- United States

- /

- Consumer Durables

- /

- NYSE:TOL

Need To Know: Toll Brothers, Inc. (NYSE:TOL) Insiders Have Been Selling Shares

We often see insiders buying up shares in companies that perform well over the long term. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So shareholders might well want to know whether insiders have been buying or selling shares in Toll Brothers, Inc. (NYSE:TOL).

What Is Insider Buying?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, rules govern insider transactions, and certain disclosures are required.

Insider transactions are not the most important thing when it comes to long-term investing. But equally, we would consider it foolish to ignore insider transactions altogether. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year.

Check out our latest analysis for Toll Brothers

The Last 12 Months Of Insider Transactions At Toll Brothers

The insider, Richard Hartman, made the biggest insider sale in the last 12 months. That single transaction was for US$1.6m worth of shares at a price of US$40.48 each. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. The silver lining is that this sell-down took place above the latest price (US$21.37). So it is hard to draw any strong conclusion from it.

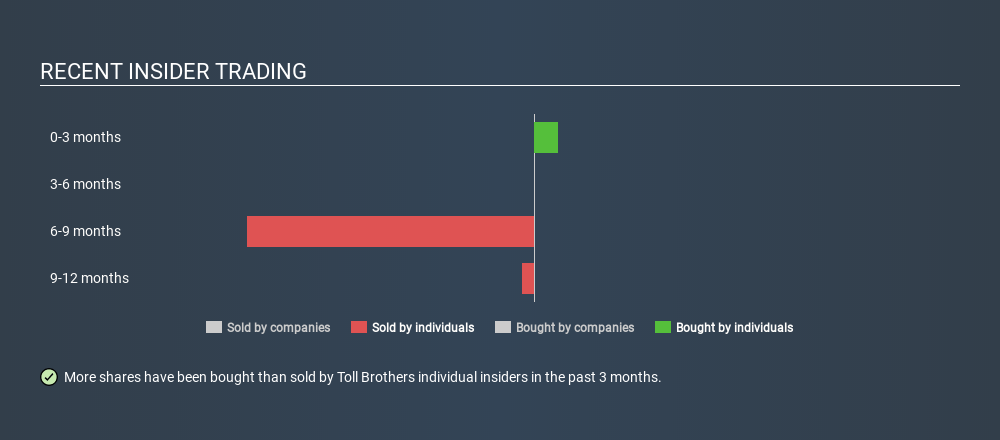

All up, insiders sold more shares in Toll Brothers than they bought, over the last year. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Toll Brothers Insiders Bought Stock Recently

Over the last quarter, Toll Brothers insiders have spent a meaningful amount on shares. Specifically, insider Stephen East bought US$99k worth of shares in that time, and we didn't record any sales whatsoever. This makes one think the business has some good points.

Does Toll Brothers Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Toll Brothers insiders own about US$253m worth of shares (which is 9.3% of the company). I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Do The Toll Brothers Insider Transactions Indicate?

It is good to see the recent insider purchase. On the other hand the transaction history, over the last year, isn't so positive. The high levels of insider ownership, and the recent buying by an insider , suggests they are well aligned and optimistic. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. At Simply Wall St, we've found that Toll Brothers has 3 warning signs (1 is concerning!) that deserve your attention before going any further with your analysis.

But note: Toll Brothers may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:TOL

Toll Brothers

Designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives