- Australia

- /

- Retail REITs

- /

- ASX:RGN

Need To Know: Shopping Centres Australasia Property Group (ASX:SCP) Insiders Have Been Selling Shares

We often see insiders buying up shares in companies that perform well over the long term. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So we'll take a look at whether insiders have been buying or selling shares in Shopping Centres Australasia Property Group (ASX:SCP).

Do Insider Transactions Matter?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, such insiders must disclose their trading activities, and not trade on inside information.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But it is perfectly logical to keep tabs on what insiders are doing. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.

Check out our latest analysis for Shopping Centres Australasia Property Group

The Last 12 Months Of Insider Transactions At Shopping Centres Australasia Property Group

Over the last year, we can see that the biggest insider sale was by the CEO & Executive Director of Shopping Centres Australasia Property Group RE Limited, Anthony Michael Mellowes, for AU$1.0m worth of shares, at about AU$2.56 per share. So we know that an insider sold shares at around the present share price of AU$2.28. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. Given that the sale took place at around current prices, it makes us a little cautious but is hardly a major concern.

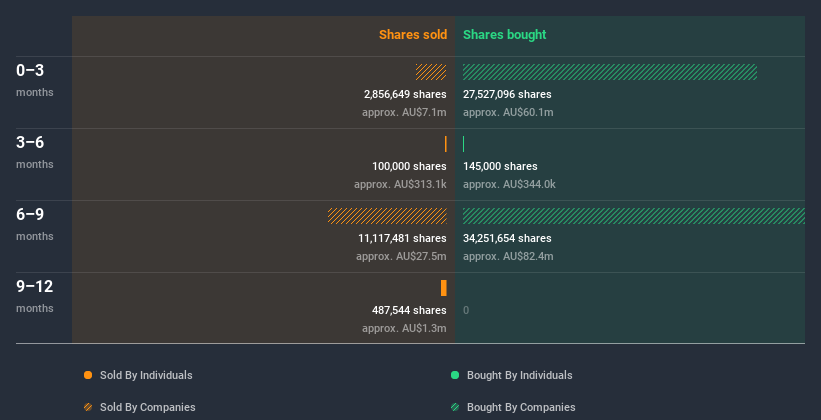

In the last twelve months insiders purchased 163.60k shares for AU$418k. On the other hand they divested 587544 shares, for AU$1.6m. All up, insiders sold more shares in Shopping Centres Australasia Property Group than they bought, over the last year. The chart below shows insider transactions (by individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Shopping Centres Australasia Property Group Insiders Bought Stock Recently

Over the last three months, we've seen a bit of insider buying at Shopping Centres Australasia Property Group. Independent Non-Executive Director of Shopping Centres Australasia Property Group RE Limited Kirstin Ferguson purchased AU$40k worth of shares in that period. We like it when there are only buyers, and no sellers. However, in this case the amount invested recently is quite small.

Insider Ownership

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. I reckon it's a good sign if insiders own a significant number of shares in the company. Based on our data, Shopping Centres Australasia Property Group insiders have about 0.3% of the stock, worth approximately AU$7.0m. We consider this fairly low insider ownership.

What Might The Insider Transactions At Shopping Centres Australasia Property Group Tell Us?

Insider purchases may have been minimal, in the last three months, but there was no selling at all. That said, the purchases were not large. We don't take much encouragement from the transactions by Shopping Centres Australasia Property Group insiders. And usually insiders own more stock in the company, according to our data. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Shopping Centres Australasia Property Group. When we did our research, we found 3 warning signs for Shopping Centres Australasia Property Group (1 can't be ignored!) that we believe deserve your full attention.

Of course Shopping Centres Australasia Property Group may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Shopping Centres Australasia Property Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:RGN

Region Group

An internally managed real estate investment trust (REIT) with 87 convenience-based retail properties, valued at $4,374 million.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026