- United States

- /

- Metals and Mining

- /

- NYSEAM:GROY

Nano Dimension Among 3 Penny Stocks With Growth Potential

Reviewed by Simply Wall St

As of October 2025, the U.S. stock market is experiencing a notable upswing, with the S&P 500 and Nasdaq reaching record highs while investors navigate economic uncertainties like interest rate adjustments and government shutdowns. Amidst this backdrop, penny stocks—often smaller or newer companies—continue to attract attention for their potential to offer both affordability and growth opportunities. Despite their vintage label, these stocks can still hold significant value when backed by strong financials, making them an intriguing area of exploration for those seeking promising investment opportunities in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.95 | $420.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.92 | $698.01M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.14 | $196.67M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.98 | $56.61M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.89 | $23.5M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.48 | $601.5M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.955 | $6.97M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.82 | $86.55M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.43 | $10.18M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 365 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

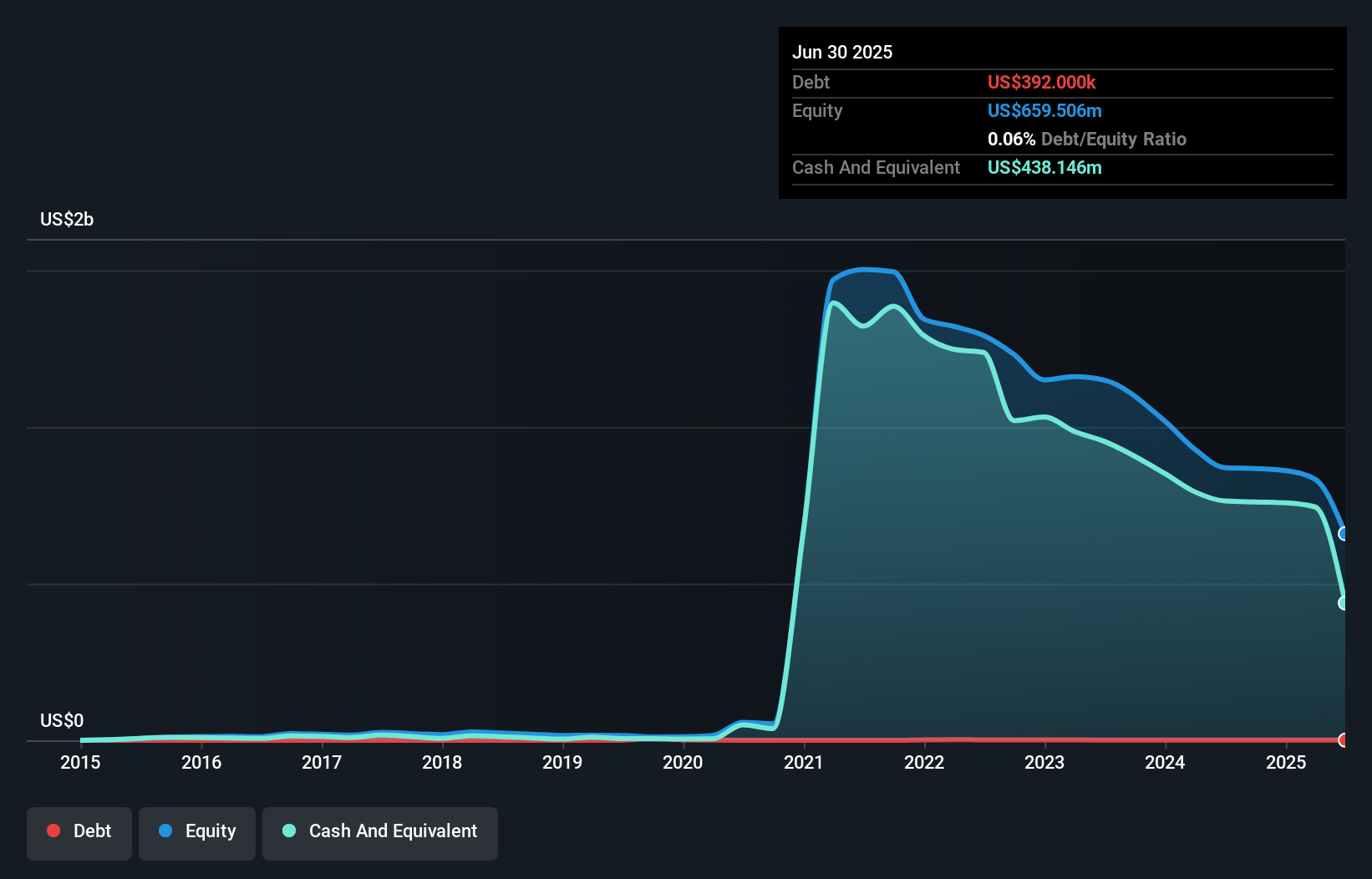

Nano Dimension (NNDM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nano Dimension Ltd. offers industrial manufacturing solutions for electronics and mechanical parts across multiple regions, with a market cap of $369.03 million.

Operations: The company's revenue segment is primarily derived from Printers & Related Products, totaling $69.66 million.

Market Cap: $369.03M

Nano Dimension Ltd. is navigating a challenging period with strategic shifts and leadership changes aimed at enhancing shareholder value. Despite being unprofitable, the company maintains strong short-term assets of US$657.3 million, exceeding both its short and long-term liabilities. Recent executive changes include the appointment of David S. Stehlin as CEO, who brings extensive technology industry expertise to guide the company through its strategic review process in collaboration with financial advisors Guggenheim Securities and Houlihan Lokey. The company's focus on fiscal responsibility and targeted growth opportunities may be pivotal in addressing operational challenges ahead.

- Take a closer look at Nano Dimension's potential here in our financial health report.

- Assess Nano Dimension's previous results with our detailed historical performance reports.

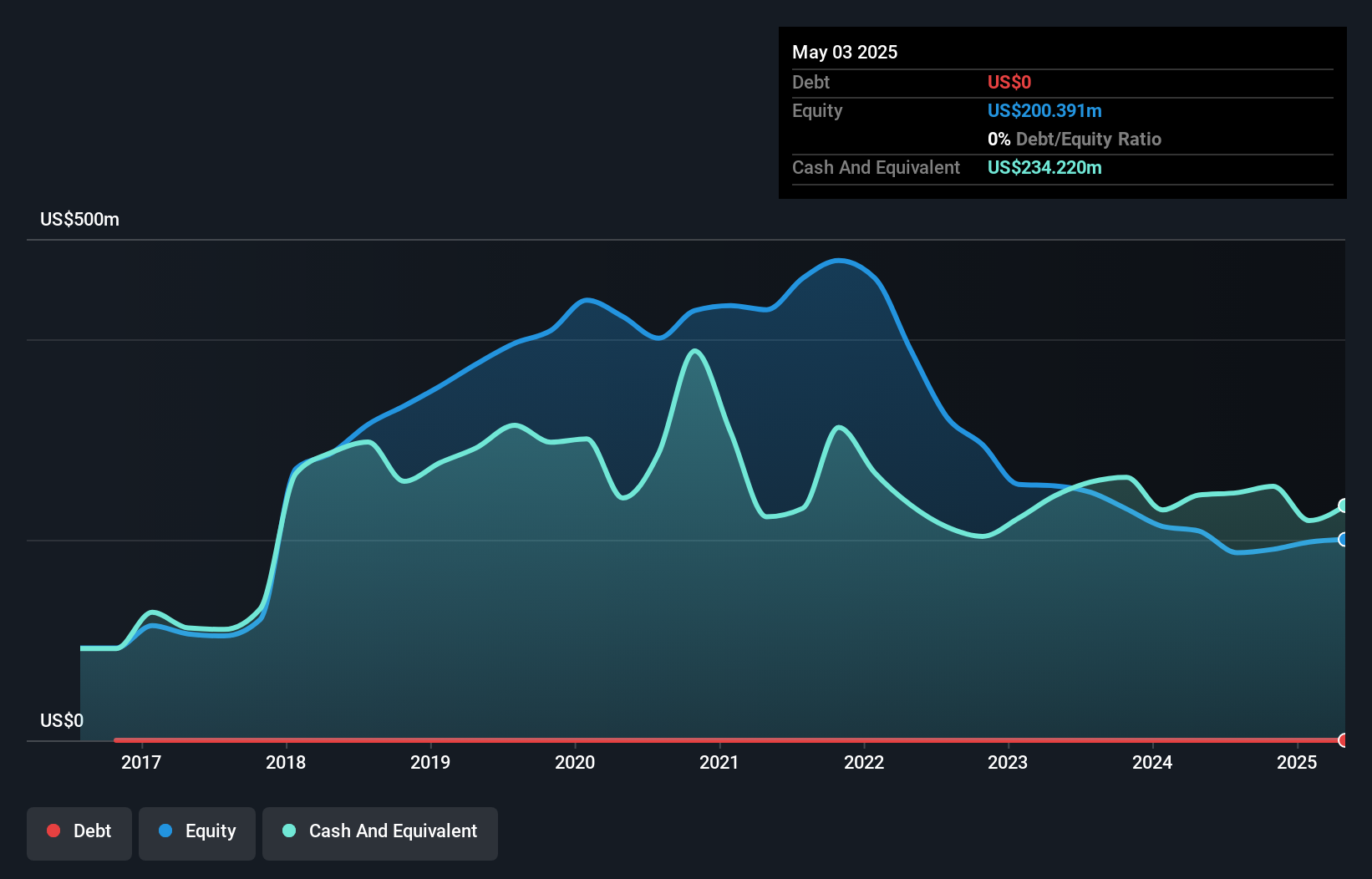

Stitch Fix (SFIX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stitch Fix, Inc. operates as a provider of clothing and accessories in the United States with a market cap of approximately $543.05 million.

Operations: The company generates revenue through its online retail operations, amounting to $1.27 billion.

Market Cap: $543.05M

Stitch Fix, Inc. is currently unprofitable but holds a solid cash runway exceeding three years, supported by positive free cash flow. The company has no debt and its short-term assets of US$373.9 million surpass both short and long-term liabilities. Despite insider selling in the last quarter, Stitch Fix's innovative product launch with Stitch Fix Vision leverages generative AI for personalized style recommendations, potentially enhancing client engagement and retention. Recent earnings show a reduced net loss compared to the previous year, indicating some financial improvement despite ongoing profitability challenges.

- Unlock comprehensive insights into our analysis of Stitch Fix stock in this financial health report.

- Assess Stitch Fix's future earnings estimates with our detailed growth reports.

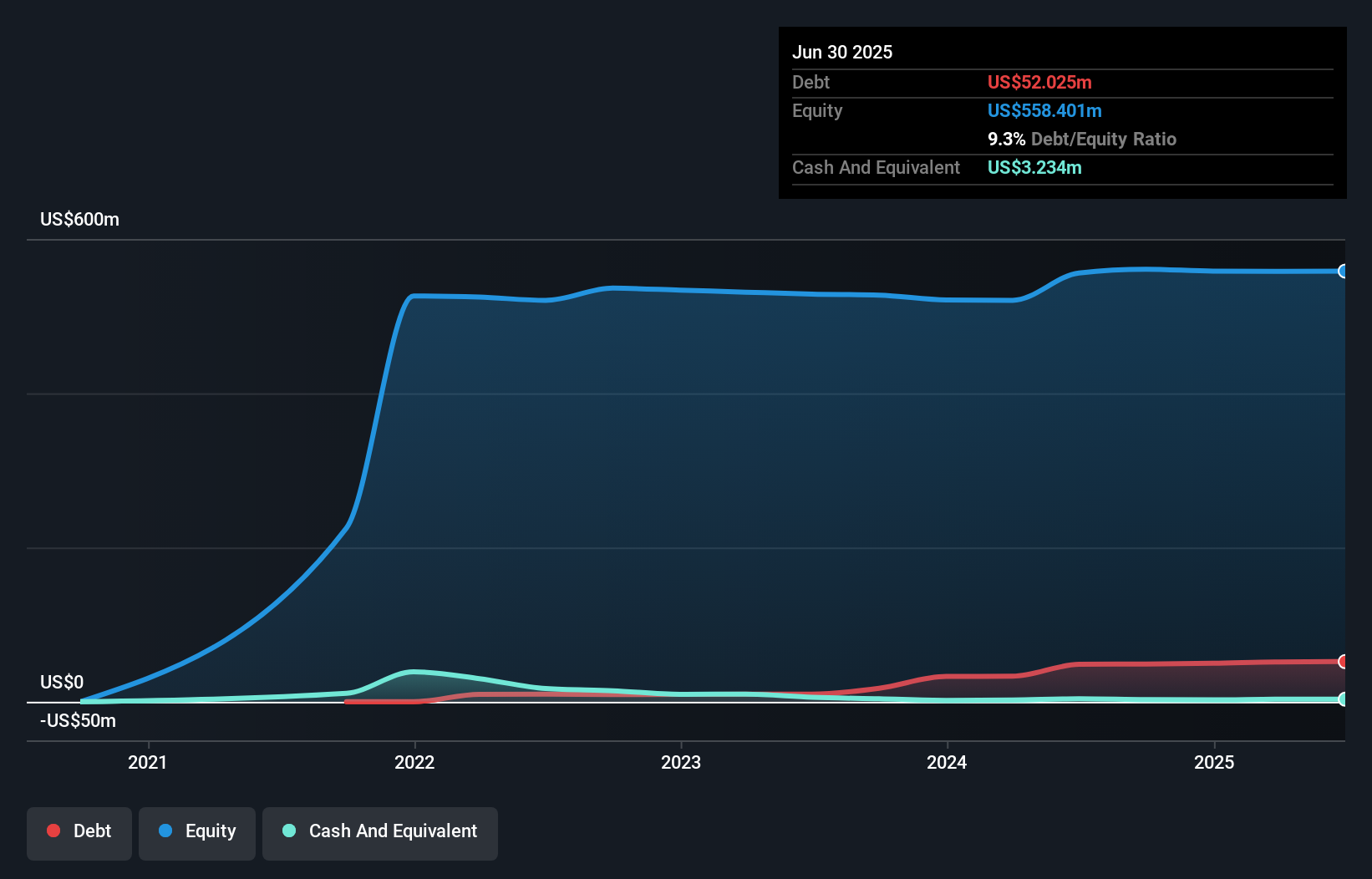

Gold Royalty (GROY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gold Royalty Corp. is a precious metals-focused royalty company that offers financing solutions to the metals and mining industry, with a market cap of approximately $648.70 million.

Operations: The company's revenue is derived from its investment in royalty and mineral stream interests, totaling $12.38 million.

Market Cap: $648.7M

Gold Royalty Corp. has shown revenue growth, with second-quarter sales reaching US$3.82 million, up from US$1.79 million the previous year, reducing its net loss to US$0.829 million from US$2.24 million a year ago. Despite being unprofitable and having long-term liabilities of US$177.2 million exceed short-term assets of US$7.2 million, it maintains a satisfactory net debt to equity ratio of 8.7%. The company has a cash runway exceeding three years even as free cash flow shrinks annually by 12.3%. Recently added to the S&P/TSX Global Mining Index, Gold Royalty continues expanding its presence in the mining sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Gold Royalty.

- Learn about Gold Royalty's future growth trajectory here.

Taking Advantage

- Explore the 365 names from our US Penny Stocks screener here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:GROY

Gold Royalty

A precious metals-focused royalty company, provides financing solutions to the metals and mining industry.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives