- India

- /

- Consumer Finance

- /

- NSEI:MUTHOOTCAP

Muthoot Capital Services (NSE:MUTHOOTCAP) Share Prices Have Dropped 32% In The Last Year

While it may not be enough for some shareholders, we think it is good to see the Muthoot Capital Services Limited (NSE:MUTHOOTCAP) share price up 26% in a single quarter. But in truth the last year hasn't been good for the share price. In fact the stock is down 32% in the last year, well below the market return.

Check out our latest analysis for Muthoot Capital Services

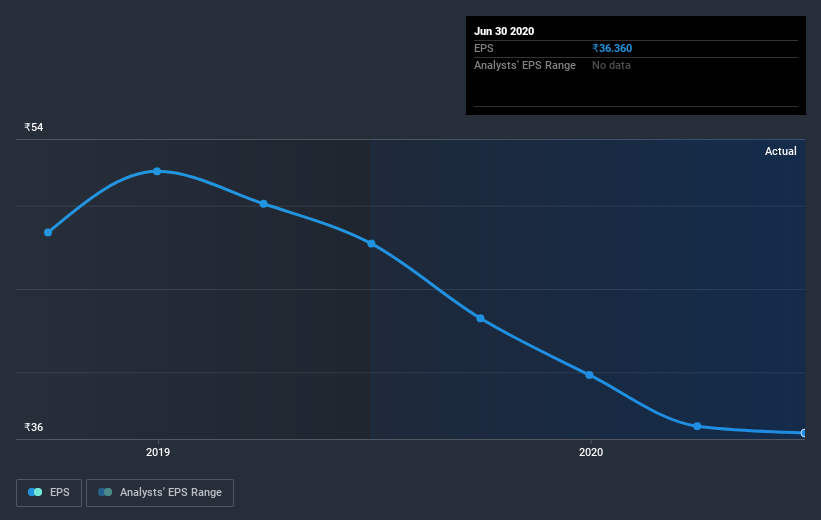

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unhappily, Muthoot Capital Services had to report a 24% decline in EPS over the last year. The share price decline of 32% is actually more than the EPS drop. So it seems the market was too confident about the business, a year ago. The P/E ratio of 10.08 also points to the negative market sentiment.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

The last twelve months weren't great for Muthoot Capital Services shares, which cost holders 32%, while the market was up about 2.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 8.8% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Muthoot Capital Services better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Muthoot Capital Services (of which 1 makes us a bit uncomfortable!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Muthoot Capital Services, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:MUTHOOTCAP

Muthoot Capital Services

A non-banking finance company, provides fund and non-fund based financial services in India.

Slight with mediocre balance sheet.