- United States

- /

- Metals and Mining

- /

- NYSE:MP

MP Materials (NYSE:MP) Sees 51% Price Surge Over Past Month

Reviewed by Simply Wall St

Recent developments and market trends seemed to influence MP Materials (NYSE:MP) significantly as the company's stock surged 51% over the past month. This substantial rise came amid a broader market rally, with major indexes like the S&P 500 and Nasdaq reaching new heights. While the market's gains were fueled by easing geopolitical tensions and optimism surrounding potential Federal Reserve rate cuts, MP Materials' notable price movement could also be a reflection of investor sentiment aligning with these positive market conditions. Meanwhile, the tech sector's resilience and gains in related industries might have contributed additional momentum to MP Materials' recent performance.

MP Materials' substantial stock increase of 51% over the past month, amidst a favorable market backdrop, draws attention to the longer-term potential of its ongoing initiatives and strategic actions. Over a five-year period, the company's total shareholder returns reached a significant 229%. While the recent surge highlights short-term investor enthusiasm, the broader, long-term performance showcases its capacity to navigate challenges and capitalize on market conditions effectively.

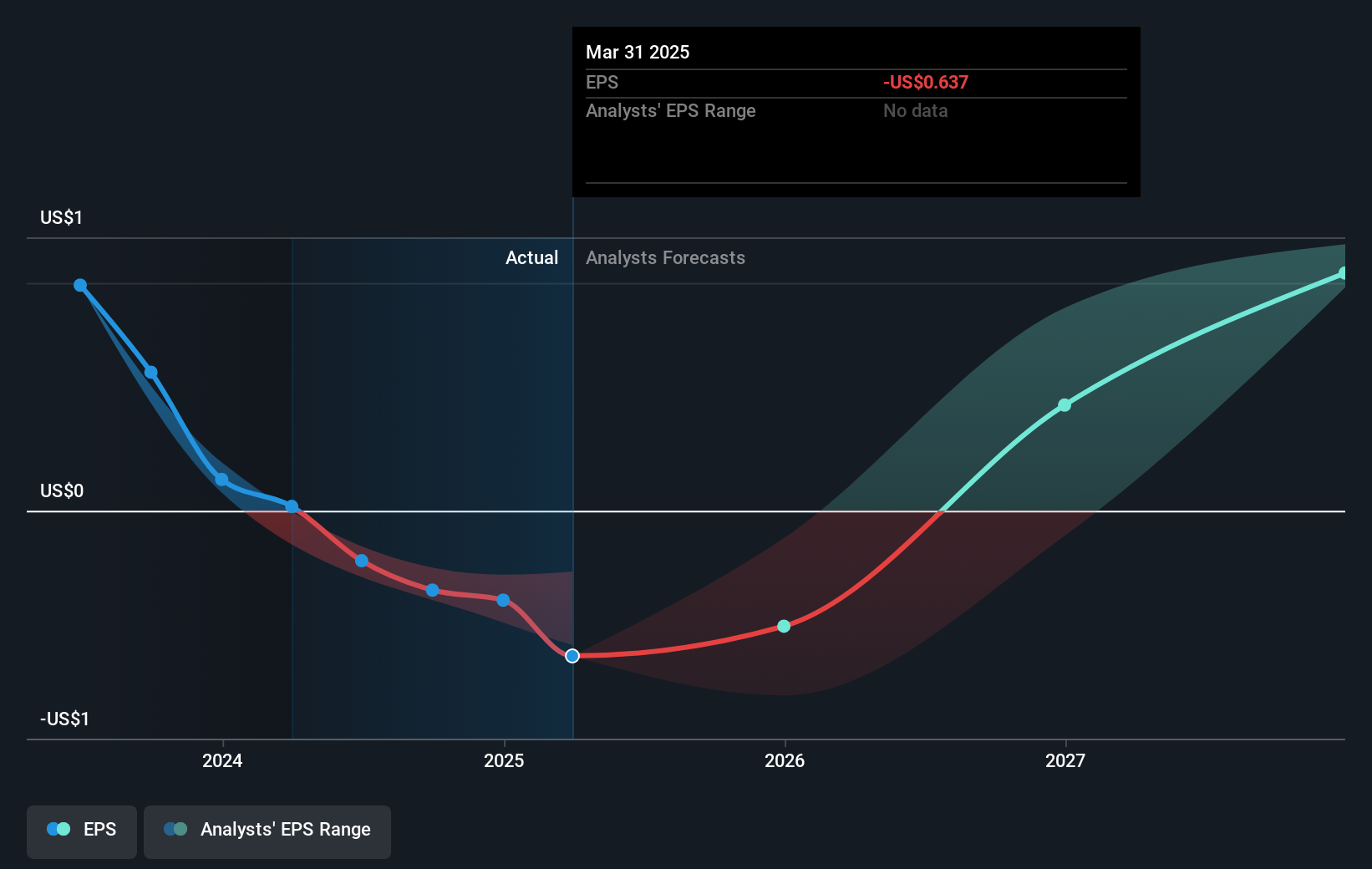

Despite the company's recent underperformance relative to the US Metals and Mining industry, which returned 10.1% over the past year, MP Materials maintains optimistic revenue and earnings forecasts. The push for production advances through new equipment and NdPr trials is viewed as a catalyst to bolster revenue and margin improvements over time. Easing geopolitical tensions and potential Federal Reserve rate cuts could further enhance growth prospects, albeit with risks associated with NdPr pricing volatility and Chinese policy shifts.

With current initiatives setting the stage for projected revenue growth of 47.6% annually over the next three years, the market's current enthusiasm may reflect expectations of this positive trajectory. However, given the current share price of US$24.58, the analyst consensus price target of US$26.69 suggests a modest upside of 7.9%, indicating cautious optimism. Investors should weigh these growth opportunities against inherent risks and the fair value estimates provided by analysts. This balanced approach allows for measured expectations amidst evolving market dynamics and company-specific developments.

Explore MP Materials' analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives