- United States

- /

- Biotech

- /

- NasdaqGS:MRNA

Moderna (NasdaqGS:MRNA) Added to Russell Midcap Indexes

Reviewed by Simply Wall St

Moderna (NasdaqGS:MRNA) recently experienced significant index changes, with the company being added to the Russell Midcap and Midcap Value indexes, while being dropped from several others. Over the last quarter, its share price recorded a notable rise of 28%, against a backdrop of a flat broader market. This performance could be partly influenced by these index adjustments, as they often affect institutional investment decisions. Additionally, developments such as expanded collaborations and clinical trials underscore the company's ongoing efforts in growth and innovation. These factors likely provided some support to Moderna's strong quarterly price performance.

Buy, Hold or Sell Moderna? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

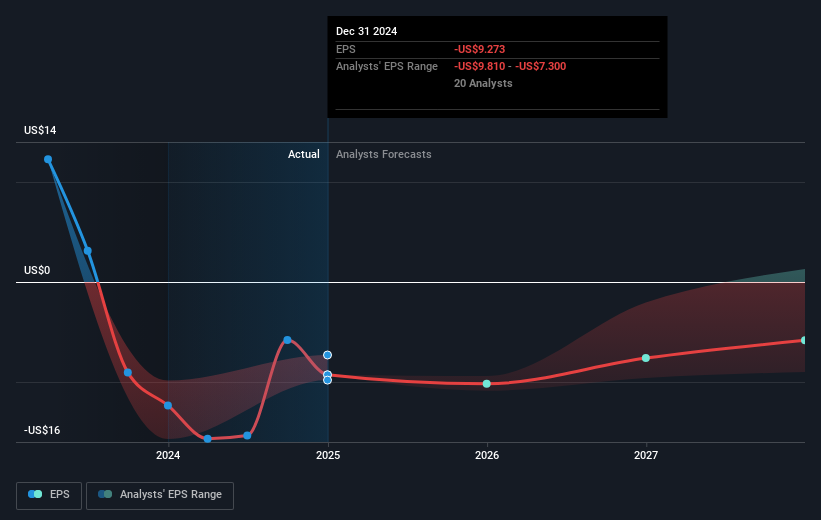

The recent inclusion of Moderna in the Russell Midcap and Midcap Value indexes may have provided a temporary uplift to its share price due to increased visibility and potential institutional interest. However, over the past five years, Moderna's total shareholder return, including dividends, amounted to a 64.53% decline, reflecting broader challenges beyond short-term fluctuations. In contrast, the company underperformed the US biotech industry over the past year, which saw a narrower 9% decline in return. This suggests that while the index changes played a role in recent movements, longer-term concerns remain.

The news of expanded collaborations and new clinical trial initiatives suggests potential for revenue growth and diversification, especially with anticipated opportunities in the international markets and oncology advancements. However, revenue challenges persist with a reported US$3.18 billion in revenue against US$3.36 billion in earnings loss, highlighting profitability concerns. The analyst consensus price target of US$47.59 stands against the current share price of US$32.54, suggesting optimism about future growth and profitability improvement. These forecasts hinge on successful execution of strategic cost reductions and achieving regulatory approvals, which remain crucial for modifying Moderna's financial trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRNA

Moderna

A biotechnology company, provides messenger RNA medicines in the United States, Europe, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives