Middle Eastern Penny Stocks Spotlight: Allmed Solutions And Two Others To Consider

Reviewed by Simply Wall St

As Middle Eastern markets experience a downturn, with most Gulf equities ending lower amid global uncertainties and anticipation of U.S. interest rate signals, investors are keenly observing potential opportunities. Penny stocks, often overlooked due to their vintage moniker, remain an intriguing area for those seeking growth in smaller or newer companies. Despite the challenges faced by broader markets, these stocks can offer substantial value when supported by strong financials and sound business models.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.84 | SAR2.18B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.72 | SAR1.49B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.52 | AED3.02B | ✅ 2 ⚠️ 3 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY3.14 | TRY3.38B | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.74 | AED776.25M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.12 | AED360.36M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.88 | AED12.16B | ✅ 3 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.833 | AED3.57B | ✅ 1 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.912 | AED556.55M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.947 | ₪219.09M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

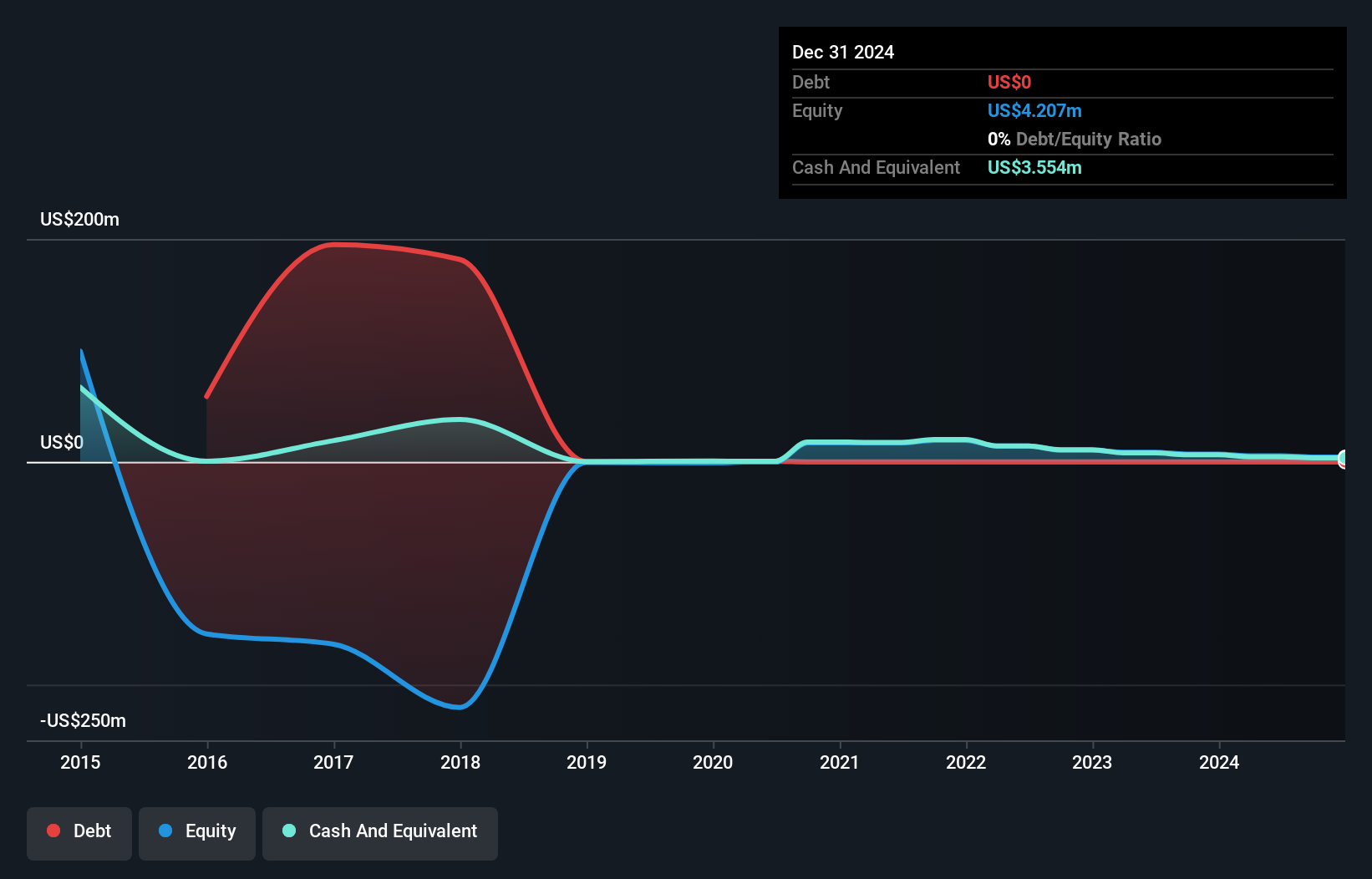

Allmed Solutions (TASE:ALMD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Allmed Solutions Ltd develops, manufactures, and markets minimally invasive medical products across various disciplines both in Israel and internationally, with a market cap of ₪29.12 million.

Operations: Allmed Solutions Ltd has not reported any specific revenue segments.

Market Cap: ₪29.12M

Allmed Solutions Ltd, with a market cap of ₪29.12 million, is currently pre-revenue and unprofitable, facing increased net losses of ₪7 million for the first half of 2025. Despite this, its short-term assets significantly surpass both its short- and long-term liabilities, indicating strong liquidity. The company benefits from an experienced board and management team with average tenures of 5.8 and 3.4 years respectively. Allmed is debt-free with a stable weekly volatility at 6%. Recent activities include filing a shelf registration for various securities to potentially raise capital in the future.

- Click to explore a detailed breakdown of our findings in Allmed Solutions' financial health report.

- Assess Allmed Solutions' previous results with our detailed historical performance reports.

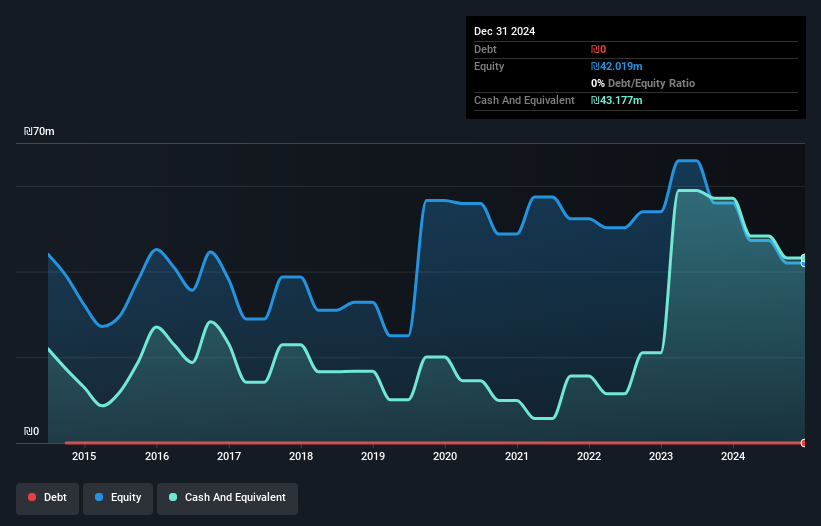

Human Xtensions (TASE:HUMX-M)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Human Xtensions Ltd. is a medical robotics company that develops, manufactures, markets, and sells modular medical devices for minimally invasive surgical operations in Israel, with a market cap of ₪6.69 million.

Operations: The company generates revenue of ₪0.67 million from its operations in developing, producing, marketing, and selling medical equipment.

Market Cap: ₪6.69M

Human Xtensions Ltd., with a market cap of ₪6.69 million, is pre-revenue, generating less than US$1 million in revenue. The company maintains strong liquidity as its short-term assets of ₪6.6 million exceed its short-term liabilities of ₪3.7 million, and it has no long-term liabilities or debt. Despite being unprofitable, Human Xtensions has reduced losses by 6.5% annually over the past five years and remains highly volatile with an 8% weekly volatility rate—higher than 75% of IL stocks. The board's average tenure is 4.5 years, indicating experienced governance amidst financial challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Human Xtensions.

- Understand Human Xtensions' track record by examining our performance history report.

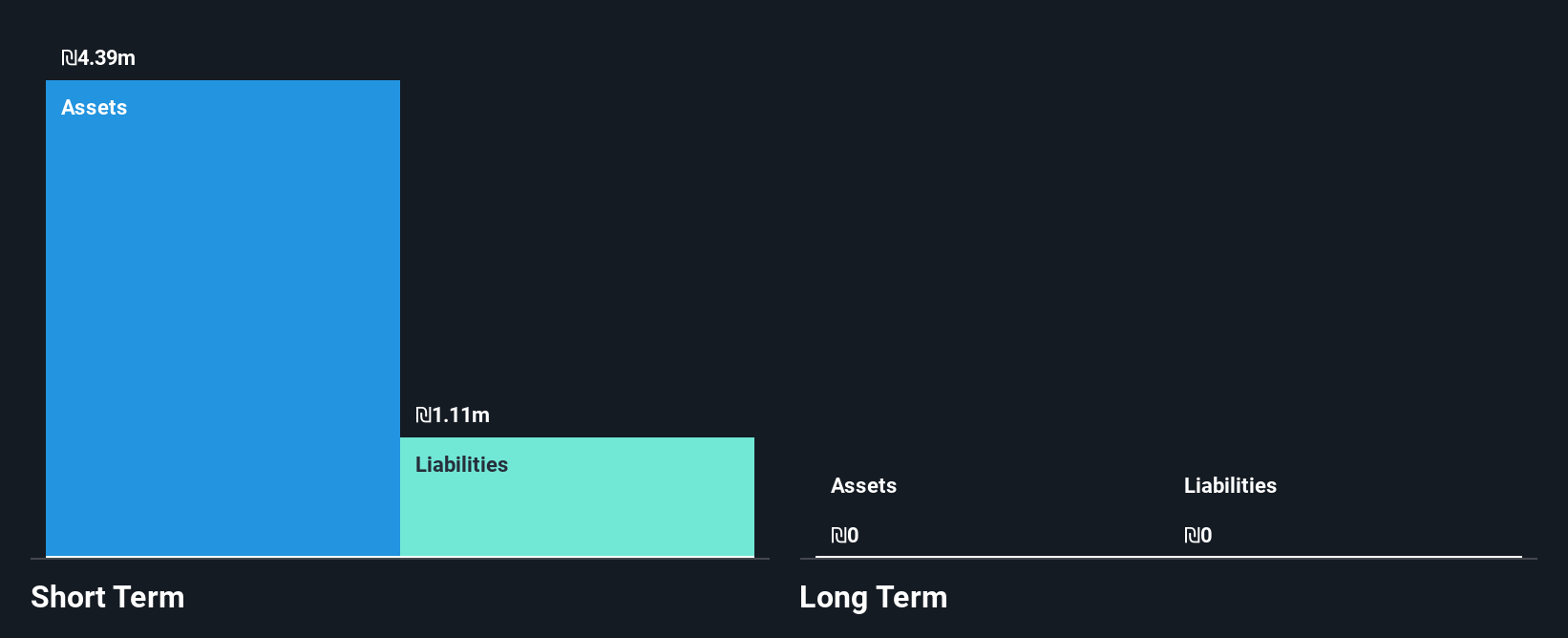

Sonovia (TASE:SONO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sonovia Ltd., with a market cap of ₪8.79 million, is an Israeli company focused on developing and producing anti-bacterial textile products.

Operations: Sonovia Ltd. has not reported any revenue segments.

Market Cap: ₪8.79M

Sonovia Ltd., with a market cap of ₪8.79 million, is pre-revenue, generating less than US$1 million in revenue. The company benefits from strong liquidity as its short-term assets of $3.7 million exceed its short-term liabilities of $332,000 and it carries no debt or long-term liabilities. However, Sonovia remains unprofitable with negative return on equity and increasing losses over the past five years at a rate of 26.3% annually. Its stock exhibits high volatility with a stable weekly rate of 14%, and despite financial hurdles, shareholders have not faced meaningful dilution recently.

- Jump into the full analysis health report here for a deeper understanding of Sonovia.

- Evaluate Sonovia's historical performance by accessing our past performance report.

Make It Happen

- Click this link to deep-dive into the 80 companies within our Middle Eastern Penny Stocks screener.

- Curious About Other Options? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:SONO

Sonovia

Engages in the development and production of anti-bacterial textile products in Israel.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives