- Israel

- /

- Aerospace & Defense

- /

- TASE:FBRT

Middle Eastern Dividend Stocks To Watch In September 2025

Reviewed by Simply Wall St

As major Gulf markets experience mixed outcomes amid weak oil prices and anticipation of a U.S. Federal Reserve rate cut, investors are closely watching how these factors influence regional indices. In this climate, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those navigating the current economic landscape.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.16% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.72% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.60% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.03% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.39% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.97% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 6.78% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.80% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.21% | ★★★★★☆ |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | 6.06% | ★★★★★☆ |

Click here to see the full list of 66 stocks from our Top Middle Eastern Dividend Stocks screener.

We'll examine a selection from our screener results.

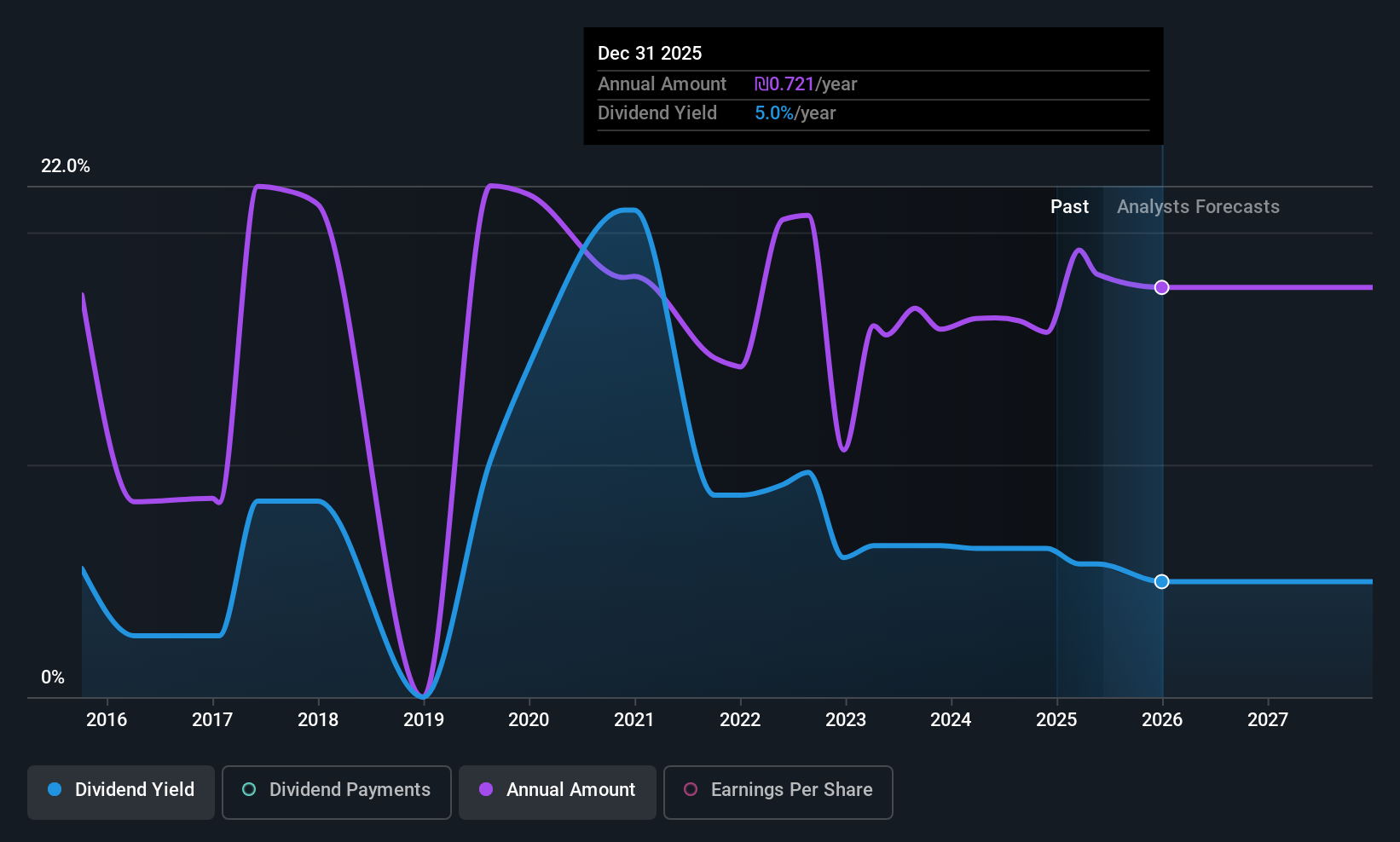

Emaar Properties PJSC (DFM:EMAAR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Emaar Properties PJSC, along with its subsidiaries, operates in property investment, development, and management both in the United Arab Emirates and internationally, with a market cap of AED126.84 billion.

Operations: Emaar Properties PJSC generates revenue through its key segments, which include Real Estate at AED31.41 billion, Leasing, Retail and Related Activities at AED7.36 billion, and Hospitality at AED2.16 billion.

Dividend Yield: 7.0%

Emaar Properties PJSC offers a compelling dividend profile, with its dividends well-covered by earnings (57.8% payout ratio) and cash flows (26.7% cash payout ratio). Despite a history of volatility, its 6.97% yield places it in the top quartile among AE market payers. Recent financials reveal robust growth, with Q2 2025 sales reaching AED 9.74 billion and net income at AED 3.37 billion, indicating strong operational performance supporting future dividend sustainability.

- Click to explore a detailed breakdown of our findings in Emaar Properties PJSC's dividend report.

- In light of our recent valuation report, it seems possible that Emaar Properties PJSC is trading behind its estimated value.

FMS Enterprises Migun (TASE:FBRT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FMS Enterprises Migun Ltd manufactures and sells ballistic protection raw materials and products globally, with a market cap of ₪1.79 billion.

Operations: FMS Enterprises Migun Ltd generates its revenue through the global sale of ballistic protection raw materials and products.

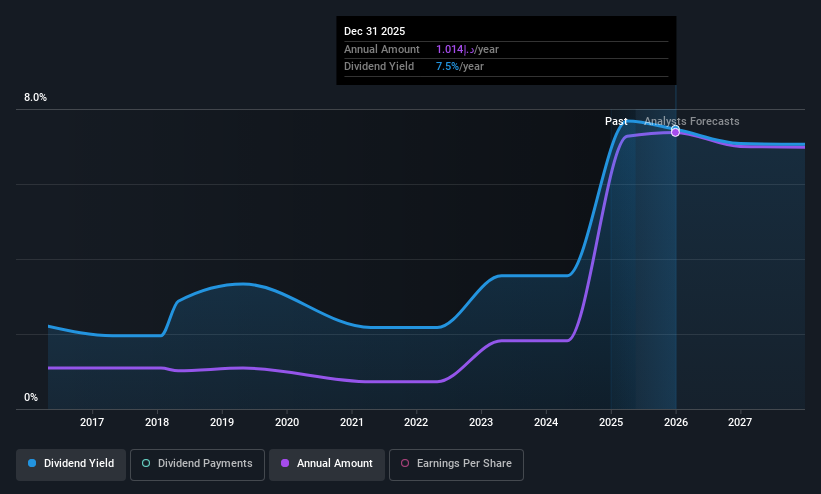

Dividend Yield: 5.6%

FMS Enterprises Migun's dividend yield of 5.6% ranks in the top 25% of IL market payers, though high non-cash earnings raise concerns about quality. The reasonable payout ratio of 70.7% suggests dividends are covered by earnings, yet a cash payout ratio of 131.4% indicates weak coverage by free cash flows. Recent Q2 results show increased sales to US$29.97 million and net income to US$11.39 million, reflecting solid operational performance despite some sustainability challenges in dividend payouts.

- Navigate through the intricacies of FMS Enterprises Migun with our comprehensive dividend report here.

- According our valuation report, there's an indication that FMS Enterprises Migun's share price might be on the expensive side.

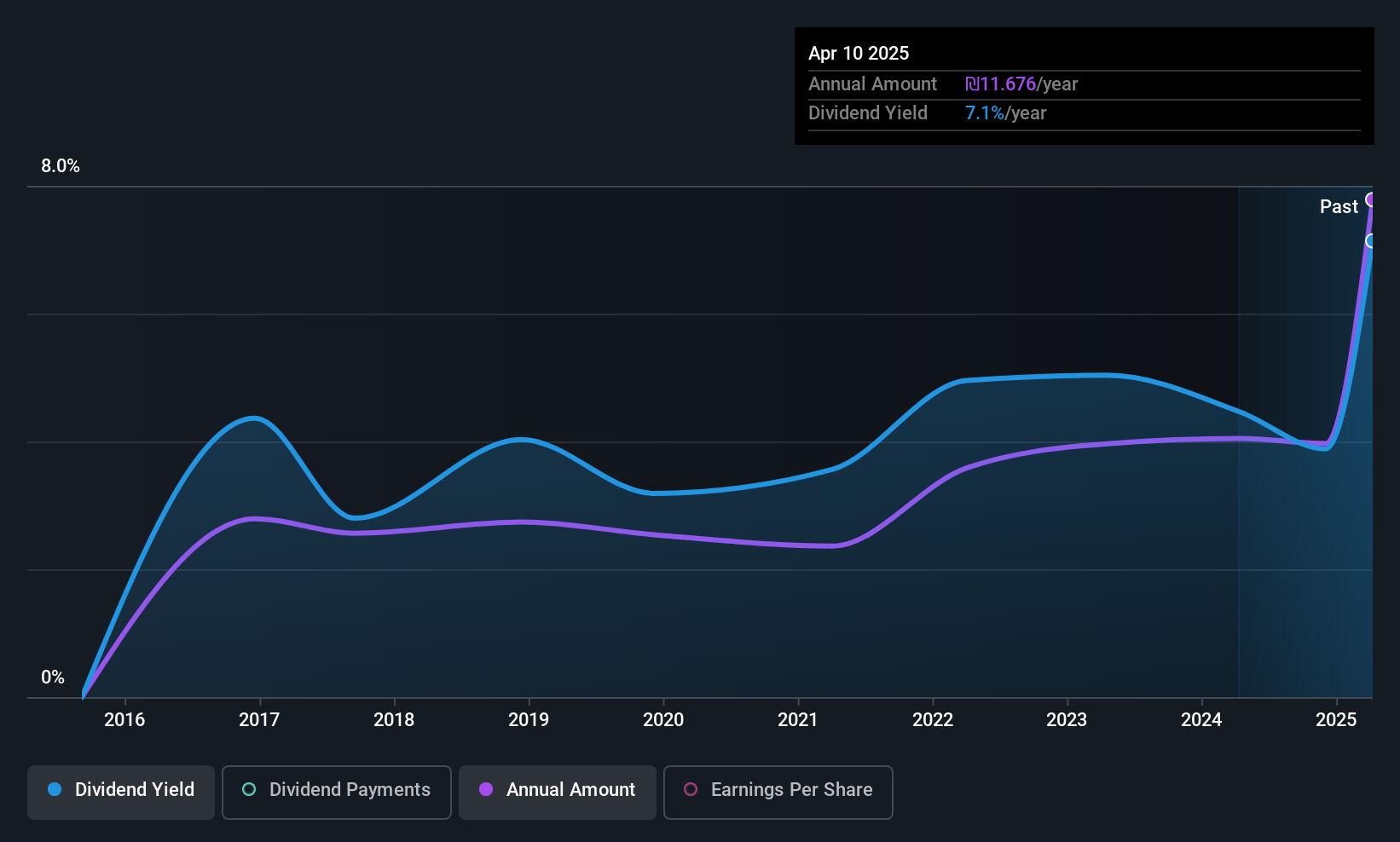

NewMed Energy - Limited Partnership (TASE:NWMD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NewMed Energy - Limited Partnership operates in the exploration, development, production, and sale of petroleum, natural gas, and condensate across Israel, Jordan, and Egypt with a market cap of ₪19.10 billion.

Operations: NewMed Energy - Limited Partnership generates revenue of $903.90 million from its Oil & Gas - Exploration & Production segment.

Dividend Yield: 4.4%

NewMed Energy's dividend yield of 4.37% is below the top 25% in the IL market, and its dividend history has been volatile over the past decade. Despite this, dividends are well covered by cash flows with a low cash payout ratio of 46.7%, though earnings coverage is higher at 79.6%. Recent Q2 results showed a decline in revenue to US$164 million and net income to US$81.2 million year-over-year, yet ongoing projects like the Leviathan gas deal could bolster future financial stability.

- Click here to discover the nuances of NewMed Energy - Limited Partnership with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, NewMed Energy - Limited Partnership's share price might be too optimistic.

Summing It All Up

- Unlock our comprehensive list of 66 Top Middle Eastern Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:FBRT

FMS Enterprises Migun

Manufactures and sells ballistic protection raw materials and products worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives