- United Arab Emirates

- /

- Real Estate

- /

- DFM:EMAAR

Middle Eastern Dividend Stocks To Watch In July 2025

Reviewed by Simply Wall St

Amid concerns over U.S. tariffs and weaker oil prices, most Gulf stock markets have experienced declines, reflecting investor apprehension about global economic growth and its impact on the region's energy-dependent economies. In this environment, dividend stocks can offer a measure of stability by providing regular income streams to investors even when market volatility is high.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi National Bank (SASE:1180) | 5.57% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.23% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.55% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.62% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 3.88% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.67% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.34% | ★★★★★☆ |

| Banque Saudi Fransi (SASE:1050) | 5.79% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.28% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.74% | ★★★★★☆ |

Click here to see the full list of 77 stocks from our Top Middle Eastern Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Emaar Properties PJSC (DFM:EMAAR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Emaar Properties PJSC, along with its subsidiaries, operates in property investment, development, and management both in the United Arab Emirates and internationally, with a market capitalization of AED132.58 billion.

Operations: Emaar Properties PJSC generates revenue through its segments of Hospitality (AED2.07 billion), Real Estate (AED29.70 billion), and Leasing, Retail and Related Activities (AED7.11 billion).

Dividend Yield: 6.7%

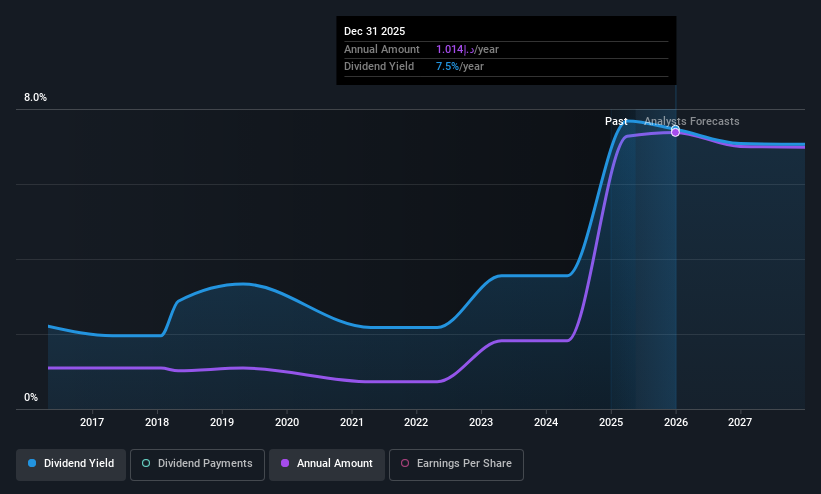

Emaar Properties PJSC offers a dividend yield of 6.67%, placing it in the top 25% of dividend payers in the AE market. Despite an unstable dividend history, recent earnings growth of 26.1% and a reasonable payout ratio (61.8%) suggest dividends are well-covered by earnings and cash flows (29.3%). The stock trades at a significant discount to its estimated fair value, presenting potential value for investors seeking income despite past volatility in payments.

- Click to explore a detailed breakdown of our findings in Emaar Properties PJSC's dividend report.

- Our expertly prepared valuation report Emaar Properties PJSC implies its share price may be lower than expected.

Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Göltas Göller Bölgesi Cimento Sanayi ve Ticaret A.S. operates in the cement industry and has a market capitalization of TRY 6.23 billion.

Operations: Göltas Göller Bölgesi Cimento Sanayi ve Ticaret A.S. generates revenue primarily from its Construction and Building Materials segment, amounting to TRY 5.49 billion, and its Energy segment, contributing TRY 469.97 million.

Dividend Yield: 3.2%

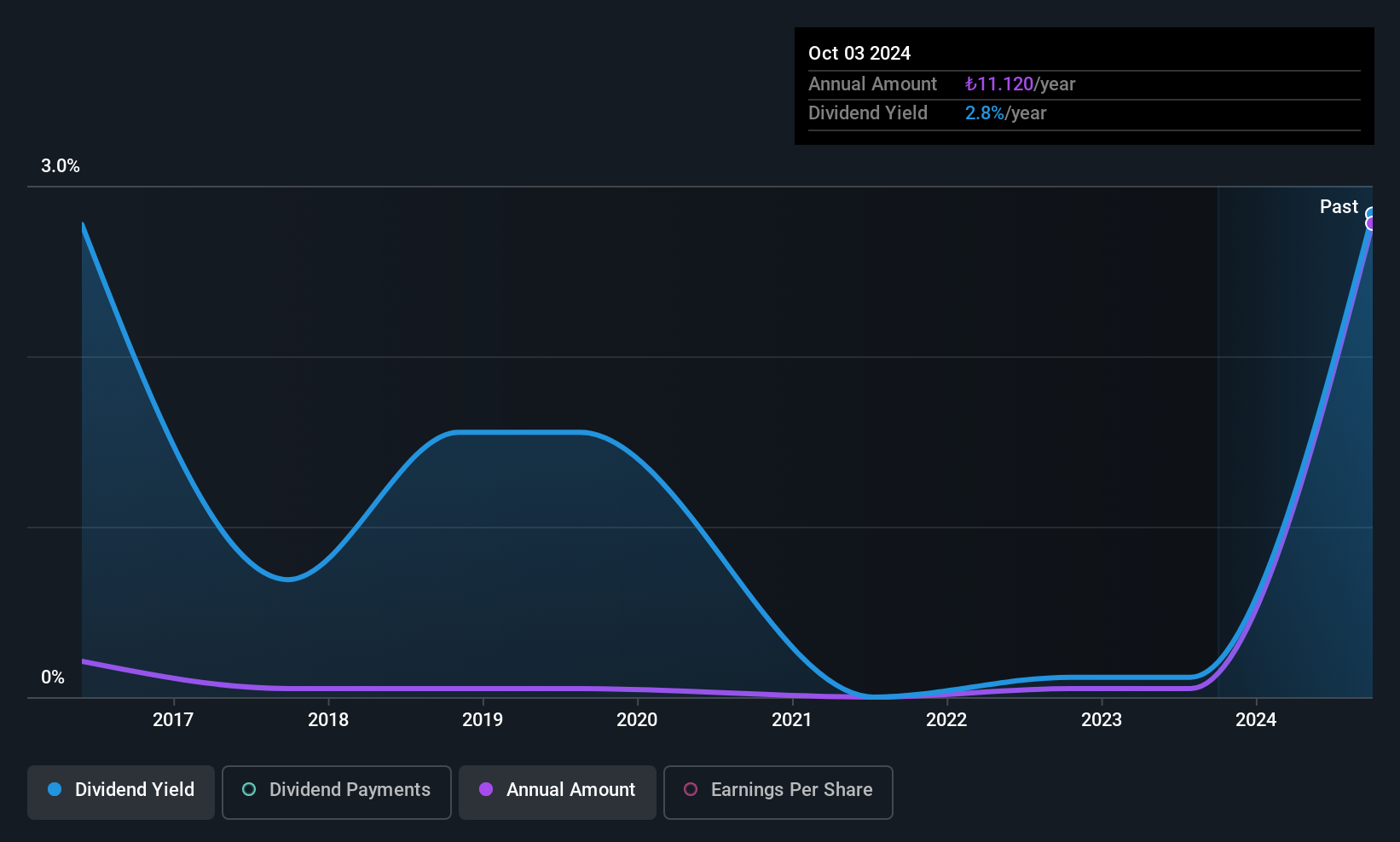

Göltas Göller Bölgesi Cimento Sanayi ve Ticaret's dividends are covered by earnings with a low payout ratio of 8.2%, but cash flow coverage is tighter at 89.6%. Despite being in the top 25% for dividend yield in Turkey, its dividend history has been volatile and unreliable over the past nine years. Recent earnings have declined significantly, with net income dropping to TRY 6.37 million from TRY 437.1 million year-on-year, raising concerns about future stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Göltas Göller Bölgesi Cimento Sanayi ve Ticaret.

- Our valuation report unveils the possibility Göltas Göller Bölgesi Cimento Sanayi ve Ticaret's shares may be trading at a premium.

Osmanli Yatirim Menkul Degerler (IBSE:OSMEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Osmanli Yatirim Menkul Degerler A.S. operates in Turkey's capital markets, offering asset management, custody services, investment consultancy, and online trading platforms with a market cap of TRY4.17 billion.

Operations: Osmanli Yatirim Menkul Degerler A.S. generates revenue primarily from its brokerage services, amounting to TRY7.76 billion.

Dividend Yield: 3.4%

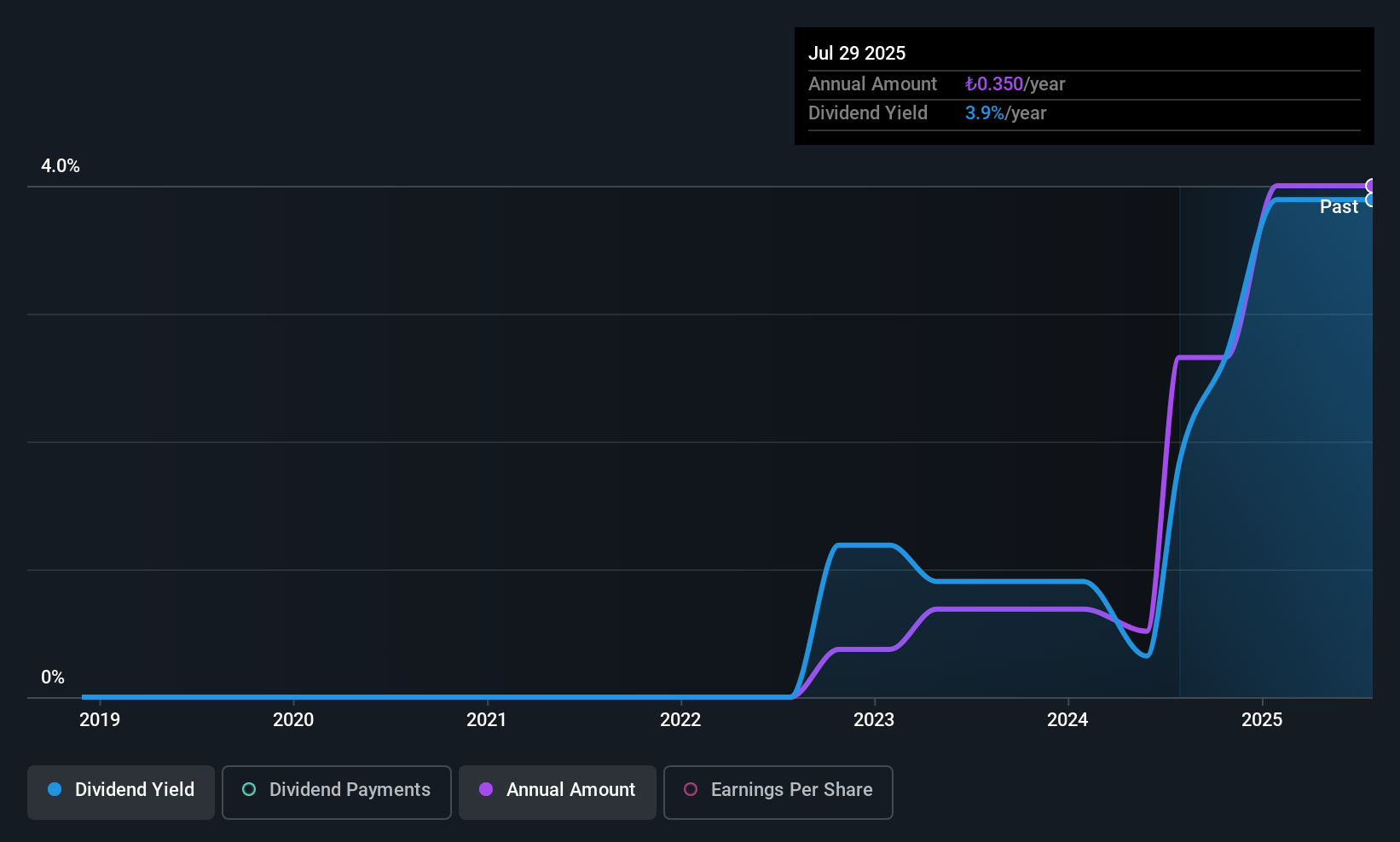

Osmanli Yatirim Menkul Degerler's dividend payments are supported by a payout ratio of 57.2% and a cash payout ratio of 21.3%, indicating strong coverage by both earnings and cash flows. Although the dividend yield is among the top in Turkey, the company's short three-year history of paying dividends has been marked by volatility and unreliability. Recent financial results show a significant decline in net income to TRY 17.82 million from TRY 122.7 million year-on-year, potentially impacting future payouts.

- Unlock comprehensive insights into our analysis of Osmanli Yatirim Menkul Degerler stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Osmanli Yatirim Menkul Degerler shares in the market.

Taking Advantage

- Click through to start exploring the rest of the 74 Top Middle Eastern Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emaar Properties PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:EMAAR

Emaar Properties PJSC

Engages in the property investment, development, and development management business in the United Arab Emirates and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives