- United Arab Emirates

- /

- Building

- /

- ADX:RAKCEC

Middle Eastern Dividend Stocks To Consider In November 2025

Reviewed by Simply Wall St

In recent weeks, Middle Eastern stock markets have experienced notable declines, driven by weaker oil prices and uncertainties surrounding interest rate cuts. Despite these challenges, dividend stocks remain an attractive consideration for investors seeking steady income streams in volatile times.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.22% | ★★★★★★ |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.30% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.38% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.76% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.63% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.52% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.46% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.55% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.79% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.12% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top Middle Eastern Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

R.A.K. Ceramics P.J.S.C (ADX:RAKCEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: R.A.K. Ceramics P.J.S.C. is involved in the manufacture and sale of ceramic products across the Middle East, Europe, Asia, and internationally, with a market cap of AED2.46 billion.

Operations: R.A.K. Ceramics P.J.S.C.'s revenue is primarily derived from its Ceramic Products segment, which generated AED3.26 billion, followed by the Faucets segment at AED565.93 million, and Other Industrial products contributing AED201.35 million.

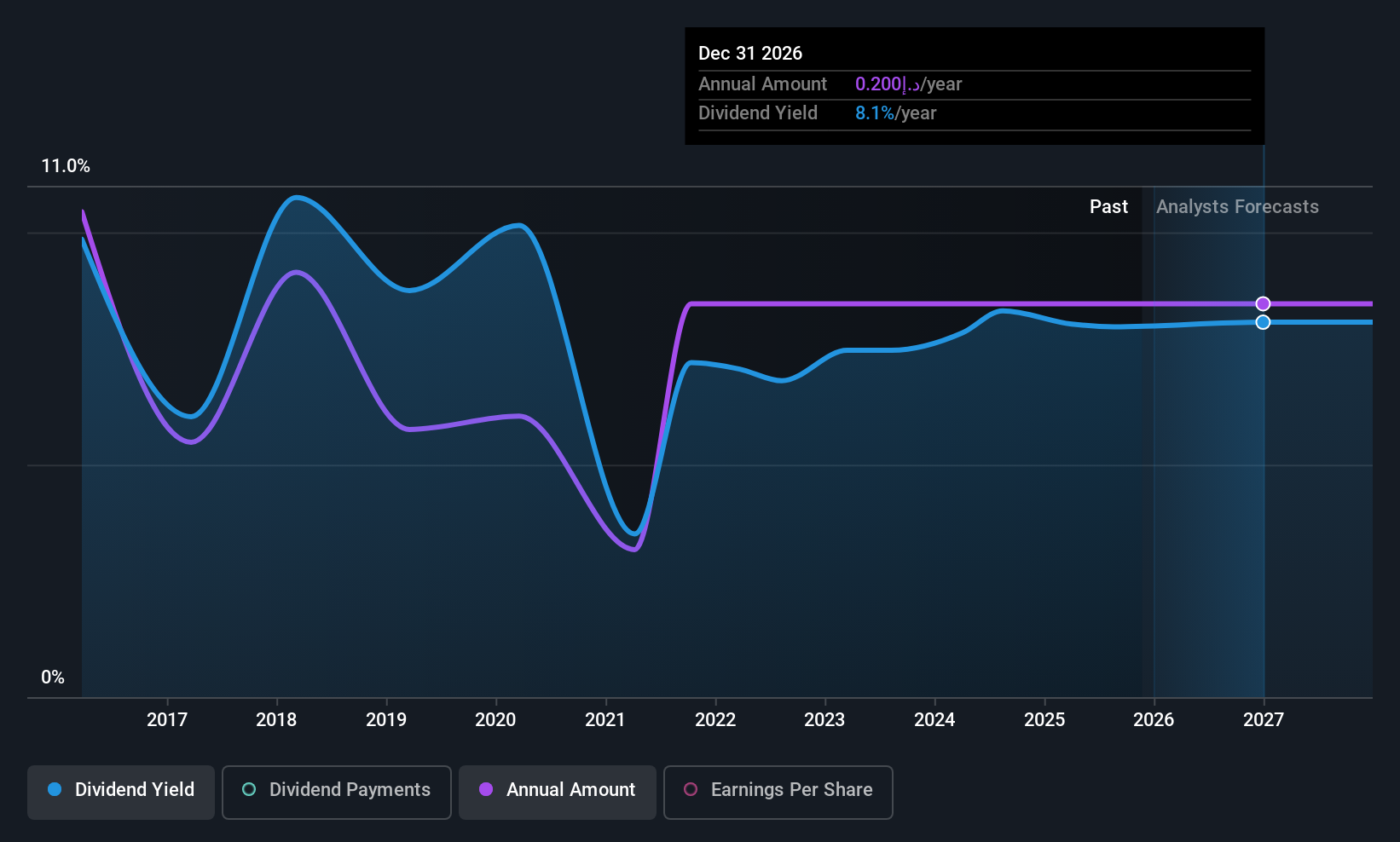

Dividend Yield: 8.1%

R.A.K. Ceramics P.J.S.C. offers an attractive dividend yield of 8.06%, placing it in the top 25% of payers in the AE market, though its dividend history is unstable with past volatility and declines over a decade. Recent earnings growth supports its payout, with a payout ratio of 83.7% covered by both earnings and cash flows despite high debt levels. The stock trades at a favorable price-to-earnings ratio compared to the AE market average, suggesting relative value among peers.

- Delve into the full analysis dividend report here for a deeper understanding of R.A.K. Ceramics P.J.S.C.

- Insights from our recent valuation report point to the potential undervaluation of R.A.K. Ceramics P.J.S.C shares in the market.

Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Göltas Göller Bölgesi Cimento Sanayi ve Ticaret A.S. operates in the cement industry and has a market capitalization of TRY5.69 billion.

Operations: Göltas Göller Bölgesi Cimento Sanayi ve Ticaret A.S. generates its revenue primarily from its operations in the cement industry.

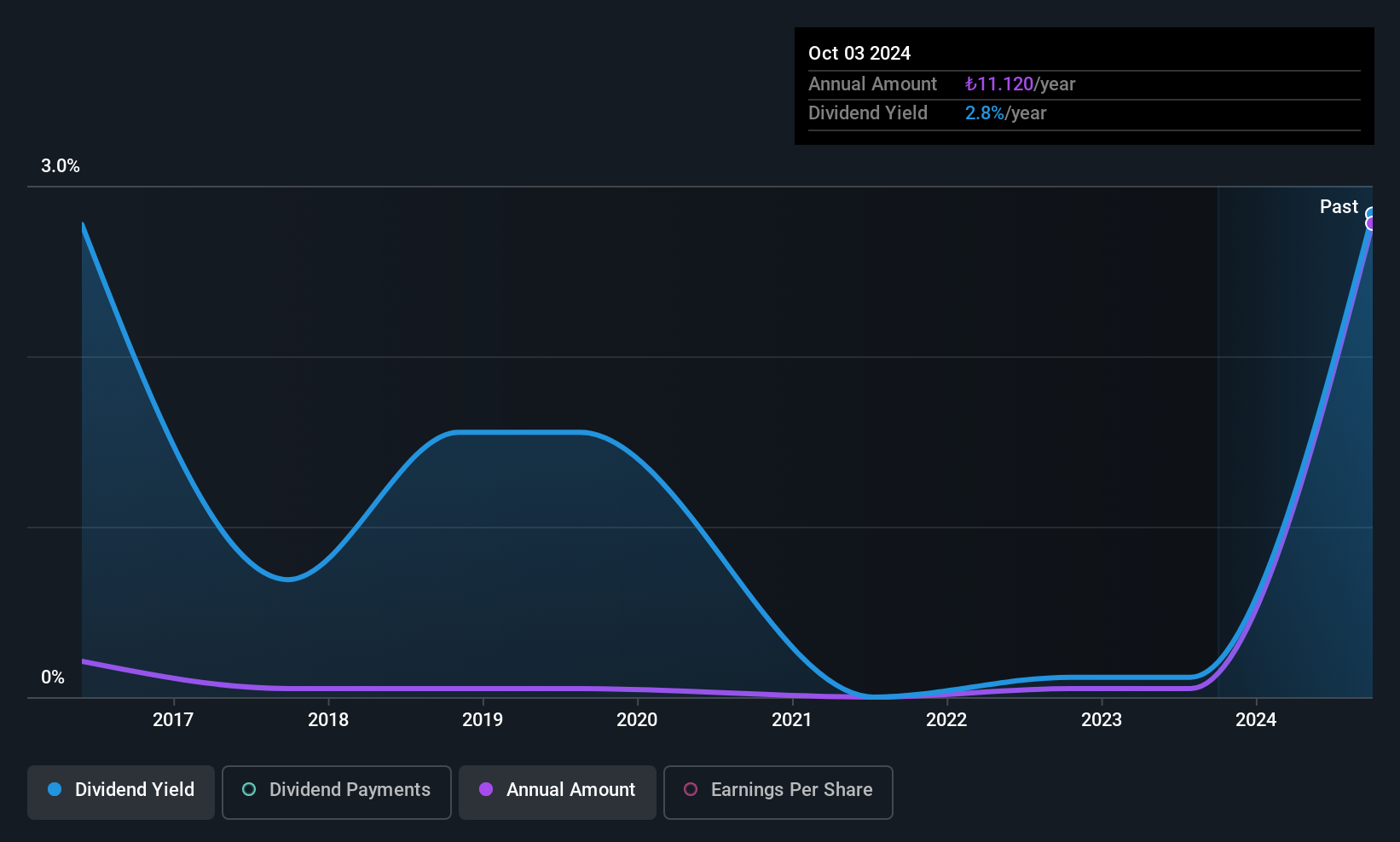

Dividend Yield: 3.5%

Göltas Göller Bölgesi Cimento Sanayi ve Ticaret's dividend yield of 3.52% ranks in the top 25% of TR market payers, supported by a low payout ratio (8%) ensuring earnings coverage. However, its dividend history is marked by volatility and unreliability over the past decade. Recent earnings showed improvement with a net income of TRY 88.64 million for Q3 2025 despite declining sales, indicating potential stability in future payouts if trends continue positively.

- Get an in-depth perspective on Göltas Göller Bölgesi Cimento Sanayi ve Ticaret's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Göltas Göller Bölgesi Cimento Sanayi ve Ticaret's share price might be too optimistic.

Alinma Bank (SASE:1150)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Alinma Bank offers banking and investment services in the Kingdom of Saudi Arabia with a market cap of SAR62 billion.

Operations: Alinma Bank's revenue is primarily derived from its Retail segment at SAR5.41 billion, followed by Corporate Banking at SAR2.16 billion, Treasury at SAR1.89 billion, and Investment and Brokerage services at SAR1.06 billion.

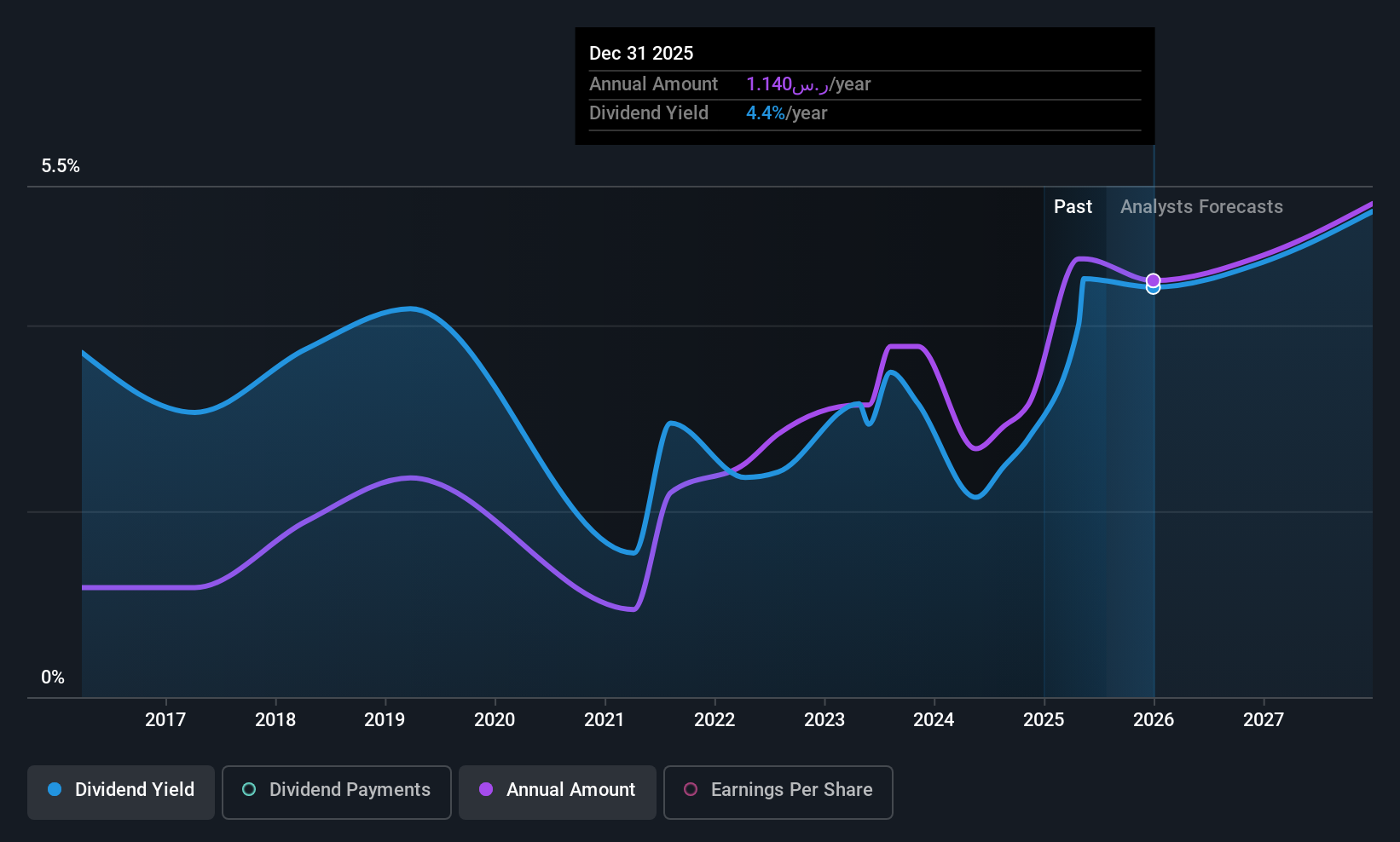

Dividend Yield: 4.8%

Alinma Bank's dividend yield of 4.84% is below the top 25% in the Saudi Arabian market, with a payout ratio of 51.8%, indicating earnings coverage. Despite increased dividend payments over the past decade, its track record remains volatile and unstable. Recent Q3 earnings showed net income growth to SAR 1.59 billion from SAR 1.57 billion last year, supporting its ongoing dividend distribution of SAR 0.30 per share payable November 18, 2025.

- Take a closer look at Alinma Bank's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Alinma Bank is trading beyond its estimated value.

Make It Happen

- Reveal the 62 hidden gems among our Top Middle Eastern Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:RAKCEC

R.A.K. Ceramics P.J.S.C

Engages in manufacture and sale of various ceramic products in the Middle East, Europe, Asian countries, and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.