- United States

- /

- Pharma

- /

- NYSE:MRK

Merck (NYSE:MRK) To Present Promising HIV Research Data At IAS 2025 In Kigali

Reviewed by Simply Wall St

Merck (NYSE:MRK) recently announced updates on its HIV research, which are set to be unveiled at the upcoming International AIDS Society Conference. This announcement, coupled with the company's ongoing project developments and regulatory updates, such as the FDA's acceptance of a supplemental Biologics License Application for WINREVAIR, might have bolstered investor sentiment. Over the last quarter, Merck's share price increased by 2.47%. During this period, broader market movements, including trade uncertainties affecting major indices, showed mixed directions, with the overall market staying relatively flat, suggesting Merck's performance aligned with the broader market trends.

Every company has risks, and we've spotted 1 weakness for Merck you should know about.

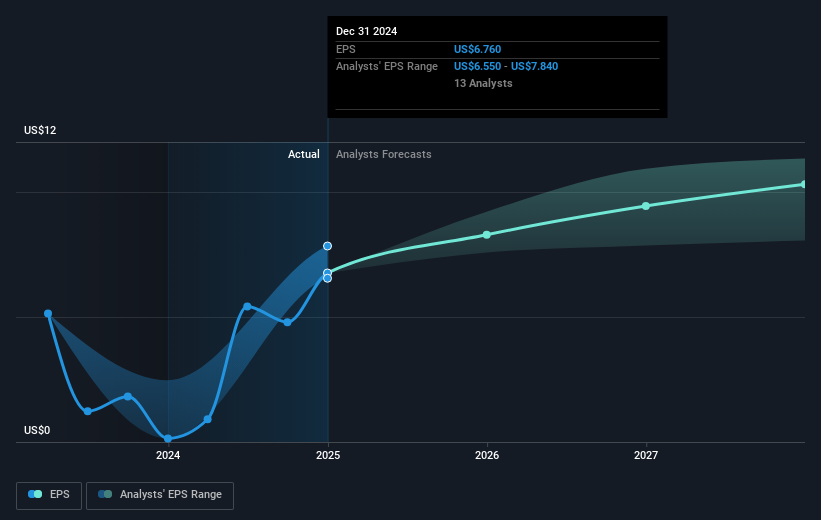

The recent updates on Merck's HIV research, paired with developments related to the supplemental Biologics License Application for WINREVAIR, hold potential implications for the company's growth narrative. These advancements might positively influence Merck's revenue by bolstering its product pipeline, which is projected to introduce over 20 new growth drivers with significant commercial potential. As a result, long-term earnings forecasts could see an upward adjustment, aligning with the company’s efforts to maintain leadership in key therapeutic areas.

Over a five-year period, Merck's total return, encompassing both share price appreciation and dividends, was 28.14%. This is noteworthy given the 12.5% return for the US market over the past year, despite the company's underperformance relative to the broader market and industry decline. Such performance over time suggests resilience and long-term growth potential, despite facing short-term market volatility and challenges from competitors within the pharmaceuticals sector.

Regarding the current share price, which sits at US$79.04, Merck's price target of US$105.02 implies a potential share price increase of 24.7%. The market's reaction to the company's recent news could be a contributing factor to bridging this gap, if the projected growth in revenue and earnings materializes effectively. Investors might consider these elements in evaluating Merck's long-term value proposition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRK

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives