- United States

- /

- Medical Equipment

- /

- NYSE:MDT

Medtronic (MDT) Reports US$8,578 Million Q1 Sales and Appoints New Directors

Reviewed by Simply Wall St

Medtronic (MDT) recently reported its Q1 FY2026 earnings, showing an increase in sales to $8,578 million, while net income saw a slight decline. The company also set its guidance for organic revenue growth at 5% for the fiscal year, a detail reinforced by recent board and executive changes. Over the last quarter, MDT's shares moved up by 7.5%, a gain that contrasts with modest technological downturns affecting major indices like the S&P 500 and Nasdaq. Within this setting, Medtronic's reaffirmed growth strategy and stable dividends likely provided added assurance to investors, encouraging its outperformance relative to broader market trends.

We've discovered 1 weakness for Medtronic that you should be aware of before investing here.

The recent news of Medtronic's Q1 FY2026 earnings report and updated growth guidance implies potential shifts in revenue and earnings projections. With sales rising to US$8.58 billion and a slight dip in net income, the company's commitment to organic revenue growth of 5% highlights its focus on maintaining a steady financial trajectory. For shareholders, the stable dividends and board changes signal a reinforcing of confidence in Medtronic's capacity to deliver consistent returns, enhancing its resilience amidst broader market downturns in technology sectors.

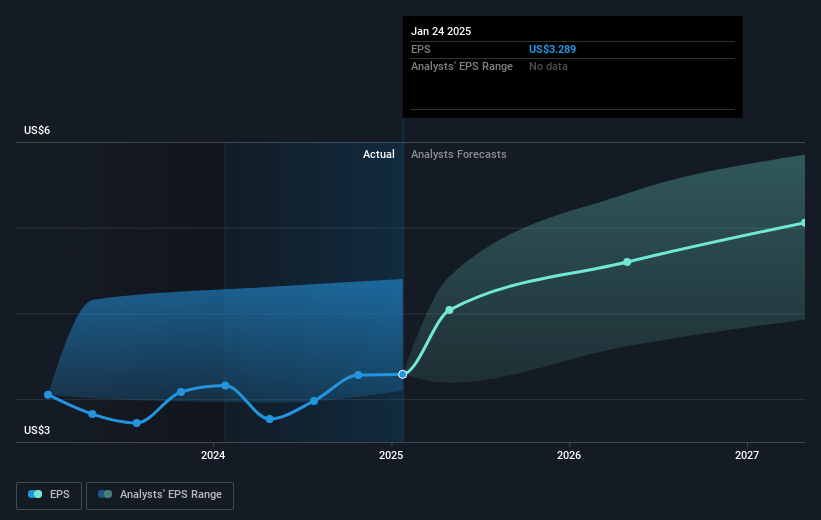

Over the previous year, Medtronic's total shareholder return, including dividends, was 13.05%. Comparatively, the company's one-year performance exceeded the US Medical Equipment industry's return of 5.1%, showcasing its relative strength. However, Medtronic's performance did not match the broader US market return of 15.8%, indicating room for further growth. As of today, Medtronic’s stock trades at US$92.81, with analysts setting a consensus price target of US$97.32. This suggests a share price discount of approximately 4.86% against the target, indicating a fair valuation aligned closely with projected earnings growth pathways. Moving forward, the integration of new technologies and expansion into emerging markets plays a crucial role in shaping future revenue and earnings, reinforcing the company's growth prospects.

Explore Medtronic's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MDT

Medtronic

Develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients in the United States, Ireland, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives