- United States

- /

- Personal Products

- /

- NYSE:MED

Medifast, Inc.'s (NYSE:MED) Attractive Combination: Does It Earn A Place In Your Dividend Portfolio?

Could Medifast, Inc. (NYSE:MED) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

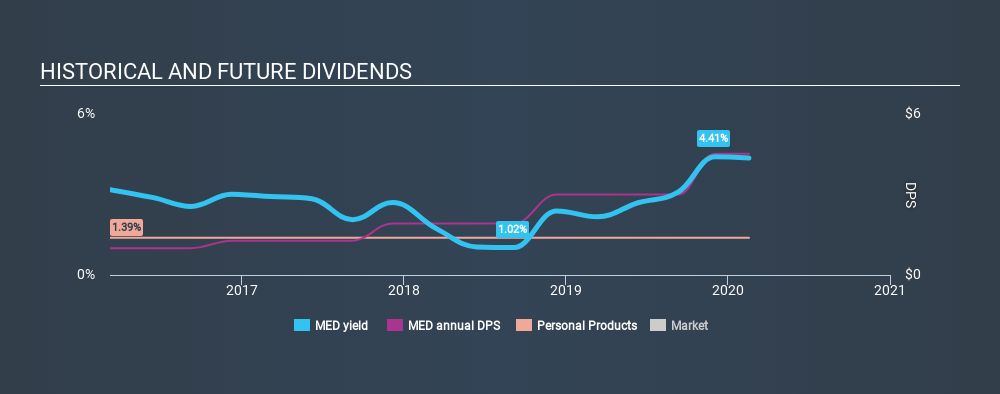

With a goodly-sized dividend yield despite a relatively short payment history, investors might be wondering if Medifast is a new dividend aristocrat in the making. It sure looks interesting on these metrics - but there's always more to the story . During the year, the company also conducted a buyback equivalent to around 3.6% of its market capitalisation. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Medifast!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Medifast paid out 48% of its profit as dividends, over the trailing twelve month period. This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Medifast's cash payout ratio in the last year was 47%, which suggests dividends were well covered by cash generated by the business. It's positive to see that Medifast's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

While the above analysis focuses on dividends relative to a company's earnings, we do note Medifast's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of Medifast's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Medifast has been paying a dividend for the past four years. The company has been paying a stable dividend for a few years now, but we'd like to see more evidence of consistency over a longer period. During the past four-year period, the first annual payment was US$1.00 in 2016, compared to US$4.52 last year. Dividends per share have grown at approximately 46% per year over this time.

The dividend has been growing pretty quickly, which could be enough to get us interested even though the dividend history is relatively short. Further research may be warranted.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Medifast has grown its earnings per share at 26% per annum over the past five years. Earnings per share have rocketed in recent times, and we like that the company is retaining more than half of its earnings to reinvest. However, always remember that very few companies can grow at double digit rates forever.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Firstly, we like that Medifast has low and conservative payout ratios. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. All things considered, Medifast looks like a strong prospect. At the right valuation, it could be something special.

Are management backing themselves to deliver performance? Check their shareholdings in Medifast in our latest insider ownership analysis.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:MED

Medifast

Through its subsidiaries, operates as a health and wellness company that provides habit-based and coach-guided lifestyle solutions to address obesity and support a healthy life in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives