Madhav Marbles and Granites Limited's (NSE:MADHAV) Share Price Could Signal Some Risk

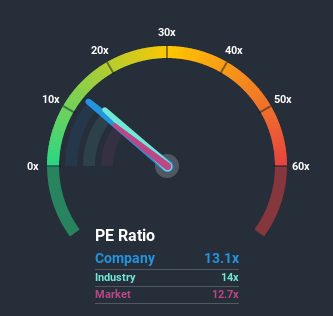

With a median price-to-earnings (or "P/E") ratio of close to 13x in India, you could be forgiven for feeling indifferent about Madhav Marbles and Granites Limited's (NSE:MADHAV) P/E ratio of 13.1x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

As an illustration, earnings have deteriorated at Madhav Marbles and Granites over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Madhav Marbles and Granites

How Does Madhav Marbles and Granites' P/E Ratio Compare To Its Industry Peers?

It's plausible that Madhav Marbles and Granites' fairly average P/E ratio could be a result of tendencies within its own industry. You'll notice in the figure below that P/E ratios in the Building industry are also similar to the market. So this certainly goes a fair way towards explaining the company's ratio right now. In the context of the Building industry's current setting, most of its constituents' P/E's would be expected to be held back. Whilst this can be a heavy component, industry factors are normally secondary to company financials and earnings.

Is There Some Growth For Madhav Marbles and Granites?

In order to justify its P/E ratio, Madhav Marbles and Granites would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 72%. This means it has also seen a slide in earnings over the longer-term as EPS is down 78% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for a contraction of 5.2% shows the market is more attractive on an annualised basis regardless.

With this information, it's perhaps strange that Madhav Marbles and Granites is trading at a fairly similar P/E in comparison. With earnings going quickly in reverse, it's not guaranteed that the P/E has found a floor yet. There's potential for the P/E to fall to lower levels if the company doesn't improve its profitability, which would be difficult to do with the current market outlook.

What We Can Learn From Madhav Marbles and Granites' P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Madhav Marbles and Granites currently trades on a higher than expected P/E since its recent three-year earnings are even worse than the forecasts for a struggling market. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough market conditions. This would place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Madhav Marbles and Granites (2 are a bit unpleasant) you should be aware of.

You might be able to find a better investment than Madhav Marbles and Granites. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

If you’re looking to trade Madhav Marbles and Granites, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:MADHAV

Madhav Marbles and Granites

Engages in the manufacture and sale of natural stones and tiles in India.

Adequate balance sheet slight.

Market Insights

Community Narratives