- United States

- /

- Auto

- /

- NasdaqGS:LCID

Lucid Group (NasdaqGS:LCID) Welcomes Douglas Grimm To Board Of Directors

Reviewed by Simply Wall St

Lucid Group (NasdaqGS:LCID) recently elected Douglas Grimm as a new board member, signaling a shift towards using his extensive automotive experience. During the last quarter, Lucid's stock price remained essentially flat. This stability came amid several positive developments such as leadership appointments and expansion efforts, including the opening of a new facility in Rutherford, N.J., all aimed at enhancing operational capabilities. However, these corporate moves were generally aligned with broader market trends, as major indexes also showed momentum, which reflects strong investor optimism initiated by solid U.S. employment data and easing concerns around tariffs.

We've identified 2 weaknesses for Lucid Group (1 shouldn't be ignored) that you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent appointment of Douglas Grimm to Lucid Group's board is poised to influence both strategic direction and investor sentiment. With the opening of a new facility in Rutherford and Grimm's automotive expertise, Lucid aims to bolster its operational capabilities. Over the last year, Lucid shares experienced a 24% decline, underperforming both the US market, which gained 11%, and the US Auto industry, which rose 47.3%. This extended downturn frames the ongoing challenges Lucid faces despite recent stable quarterly performance.

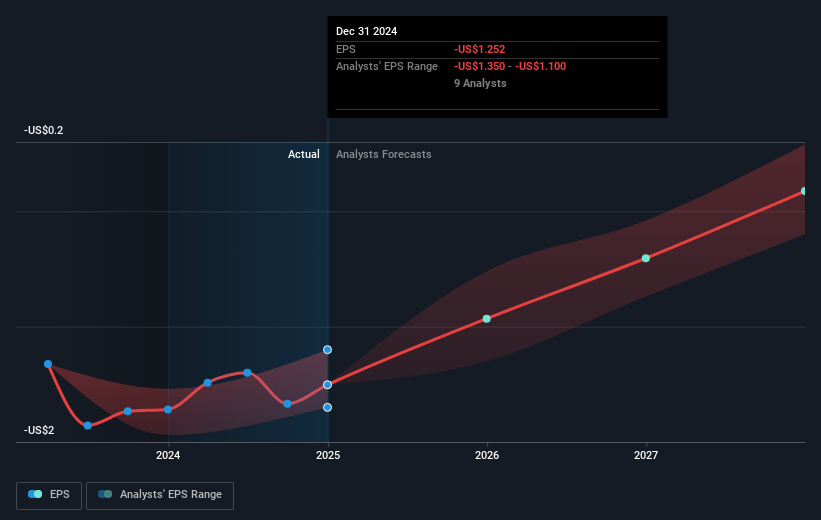

Lucid's revenue forecasts are tied to its Gravity SUV launch, expected to drive significant revenue growth. The current revenue projection shows an annual increase of 41.4%, outpacing the general market's growth forecast of 8.6%. However, challenges like production constraints and potential regulatory impacts could hinder revenue and earnings projections if not addressed efficiently. The projected revenue and earnings enhancements suggest a potential financial recovery, though profitability remains elusive in the next three years.

Despite a stable share price in the last quarter, Lucid's current price target stands slightly lower than its trading price of US$2.56, with analysts targeting US$2.53. This marginal difference suggests that on average, analysts see the company as being fairly valued at present. Investors will likely watch how Lucid navigates anticipated growth and industry challenges, which will play a critical role in achieving long-term revenue targets and aligning with the analyst price projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives