- Switzerland

- /

- Tech Hardware

- /

- SWX:LOGN

Logitech International (SWX:LOGN) Elects New Chairperson And Increases Dividend To CHF 1.26

Reviewed by Simply Wall St

Logitech International (SWX:LOGN) recently undertook significant leadership changes and increased its dividend, which coincide with the company’s 17% share price increase over the last quarter. Chief among the changes was the election of Guy Gecht as the new chairperson, alongside an increase in dividends to CHF 1.26 per share. During this period, Logitech's Q1 sales and net income recorded year-over-year gains, which may have contributed positively to investor sentiment. These moves were aligned with broader market trends, as both the S&P 500 and Nasdaq reached all-time highs, reflecting robust market conditions.

Find companies with promising cash flow potential yet trading below their fair value.

The recent leadership changes at Logitech International, highlighted by the election of Guy Gecht as chairperson and the increase in dividends, could potentially bolster the company's growth narrative by reinforcing investor confidence and promoting stability. Over the last three years, Logitech's total shareholder return, including dividends and share price changes, rose by 85.71%, reflecting strong long-term performance. This robust return offers a context for the company's strategic direction amidst evolving market dynamics, while in the shorter term, the recent 17% share price increase showcases the positive reaction to these leadership and dividend moves.

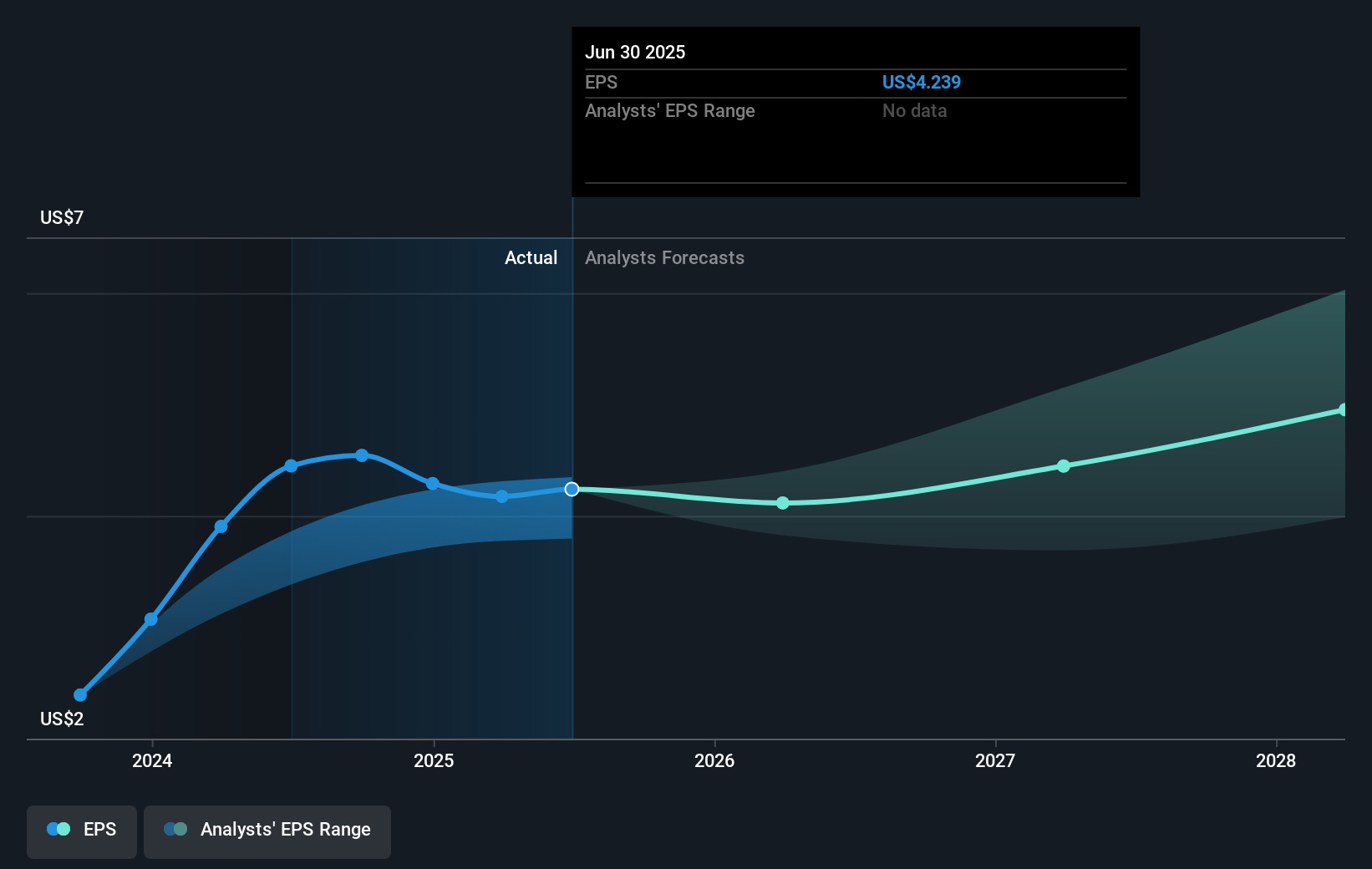

Compared to the broader Swiss market's annual performance, Logitech's return over the past year has not kept pace with the Swiss Tech industry, which returned 22.5%. The leadership change and dividend increase are expected to influence revenue and earnings forecasts positively by signaling a commitment to shareholder value, possibly encouraging sustained demand growth in key markets such as gaming and remote work. Given the current share price of CHF85.56 and the consensus analyst price target of CHF86.87, the share's movement indicates market confidence aligning closely with analyst expectations, even though the share price is slightly below the consensus target. As analysts project revenues to grow annually at 4.6%, bolstered by strategic initiatives, these developments may have a tangible impact on the company's financial outlook.

Gain insights into Logitech International's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LOGN

Logitech International

Through its subsidiaries, designs, manufactures, and markets software-enabled hardware solutions that connect people to working, creating, and gaming worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives