- United States

- /

- Diversified Financial

- /

- NYSE:TOST

Leadership Transition at Toast (NYSE:TOST): New Interim Chief Accounting Officer Appointed

Reviewed by Simply Wall St

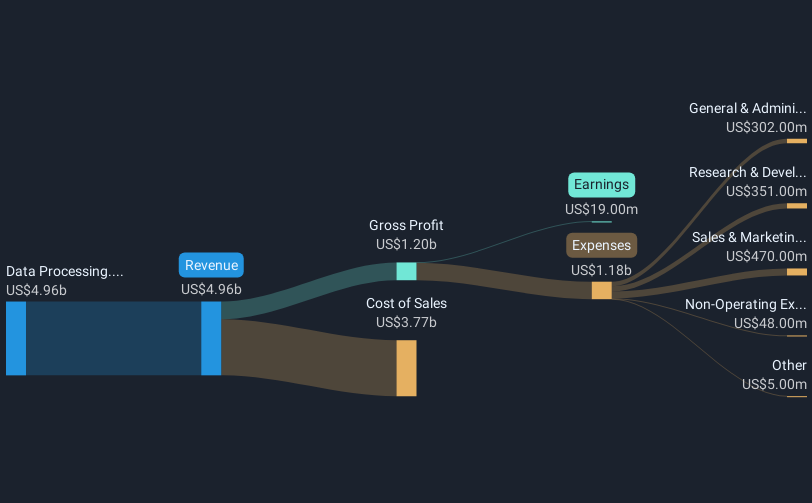

In a significant organizational shift, Toast (NYSE:TOST) announced the departure of Chief Accounting Officer Gail Miller, with Elena Gomez stepping in as Interim Chief Accounting Officer, a move that coincides with a robust 23% increase in the company's stock price in the last quarter. This upward trajectory aligns with impressive Q1 earnings, reflecting revenue growth to $1,337 million and a shift to a net income of $56 million. While the market benefited from positive economic data and easing trade concerns, Toast's launch of innovative products like Menu Price Monitor and strategic client partnerships added notable weight to its strong performance.

You should learn about the 1 weakness we've spotted with Toast.

Find companies with promising cash flow potential yet trading below their fair value.

The departure of Gail Miller and the introduction of Elena Gomez as Interim Chief Accounting Officer may signal changes in financial management at Toast. This transition, coinciding with a recent share price surge, could influence investor perception and expectations regarding the company's financial discipline and ability to meet earnings projections. With Toast reporting an impressive revenue increase to US$1.34 billion and a shift to US$56 million in net income for Q1, the impact of this news will likely be closely monitored in subsequent quarters.

Over the past three years, Toast's total shareholder return, including dividends, reached 168.63%. This remarkable performance contrasts with its one-year return, which surpassed the broader US market's 11% increase and the US Diversified Financial industry's 21.3% rise. Such long-term growth, while partly attributed to strategic shifts and market opportunities, is reinforced by the company's aggressive R&D investments and foray into AI and fintech sectors.

Analysts forecast robust revenue growth for Toast, projecting a 20% annual increase over the next three years. However, new leadership could impact the execution of strategic investments and cost optimizations, potentially influencing gross margins and profitability. Despite market optimism, the company's current share price of $36.21 falls below the consensus price target of $41.03, suggesting room for appreciation. Investors may view this as a potential opportunity, though success will depend on Toast's ability to mitigate risks associated with its heavy reliance on the US restaurant market and the challenges of international expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOST

Toast

Operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, India, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives