- United States

- /

- Hospitality

- /

- NYSE:LVS

Las Vegas Sands (NYSE:LVS) Announces US$2 Billion Buyback Authorization Increase

Reviewed by Simply Wall St

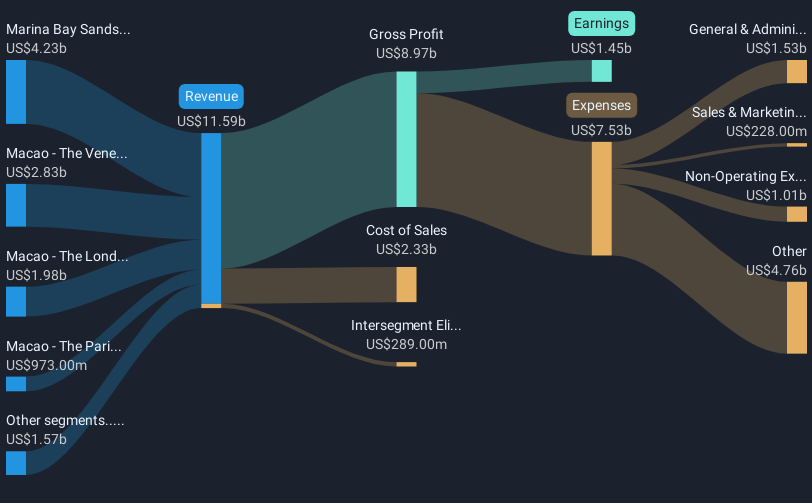

Las Vegas Sands (NYSE:LVS) experienced a notable 21% increase in its share price over the last quarter. The company's decision to repurchase over 10 million shares for nearly $450 million and the announcement of a buyback authorization increase to $2 billion likely supported this upward movement. Additionally, the declaration of a quarterly cash dividend may have provided further encouragement to investors looking for income. Although the company's earnings report showed a decline in sales and net income, these factors were seemingly counterbalanced amid broader market trends and minor gains in major indexes like the S&P 500 and Nasdaq.

We've spotted 2 risks for Las Vegas Sands you should be aware of.

The recent announcement of Las Vegas Sands' share repurchase initiative and dividend declaration correlates with a significant share price increase. Beyond short-term market reactions, these moves may positively influence the company's future revenue and earnings projections. The expanded buyback authorization to US$2 billion is intended to enhance earnings per share (EPS) and provide returns to shareholders. However, the performance needs to align with earnings growth projections for the share price to justify analysts' consensus target of US$51.15, especially since the current price of US$38.81 reflects a discount to this target.

Over a longer term, Las Vegas Sands' total shareholder return, including dividends, rose by 41.50% over three years, offering a broader context against its recent quarterly gains. While the company delivered substantial returns over this period, it lagged behind the US Hospitality industry, which posted a 23.2% return over the past year. The disparity highlights the challenges LVS faces in catching up with broader market expectations, with its annual revenue forecasted to grow at 6.1%, lower than the US market average of 8.7% per year.

Furthermore, the robust opening of The Londoner in Macao and Marina Bay Sands' positive EBITDA results suggest potential drivers for growth. However, realizing the projected revenue and earnings increases will be crucial in meeting analyst expectations. Analysts anticipate earnings of US$2.3 billion by mid-2028, but disagreements on exact outcomes persist. Consequently, it remains essential for Las Vegas Sands to capitalize on these developing opportunities while navigating market uncertainties effectively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LVS

Las Vegas Sands

Owns, develops, and operates integrated resorts in Macao and Singapore.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives