- United States

- /

- Food

- /

- NYSE:ADM

Lakeland Financial And 2 More Reliable Dividend Stocks To Consider

Reviewed by Simply Wall St

In a market environment where stocks are little changed amid ongoing trade policy uncertainties and major indexes hover near record highs, investors often seek stability through reliable dividend stocks. In this context, selecting companies with consistent dividend payouts can provide a measure of security and income, making them an attractive option for those navigating the current economic landscape.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.63% | ★★★★★☆ |

| Universal (UVV) | 5.62% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.57% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.06% | ★★★★★★ |

| Ennis (EBF) | 5.49% | ★★★★★★ |

| Dillard's (DDS) | 6.01% | ★★★★★★ |

| Credicorp (BAP) | 4.94% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.82% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.63% | ★★★★★☆ |

| Carter's (CRI) | 9.74% | ★★★★★☆ |

Click here to see the full list of 138 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

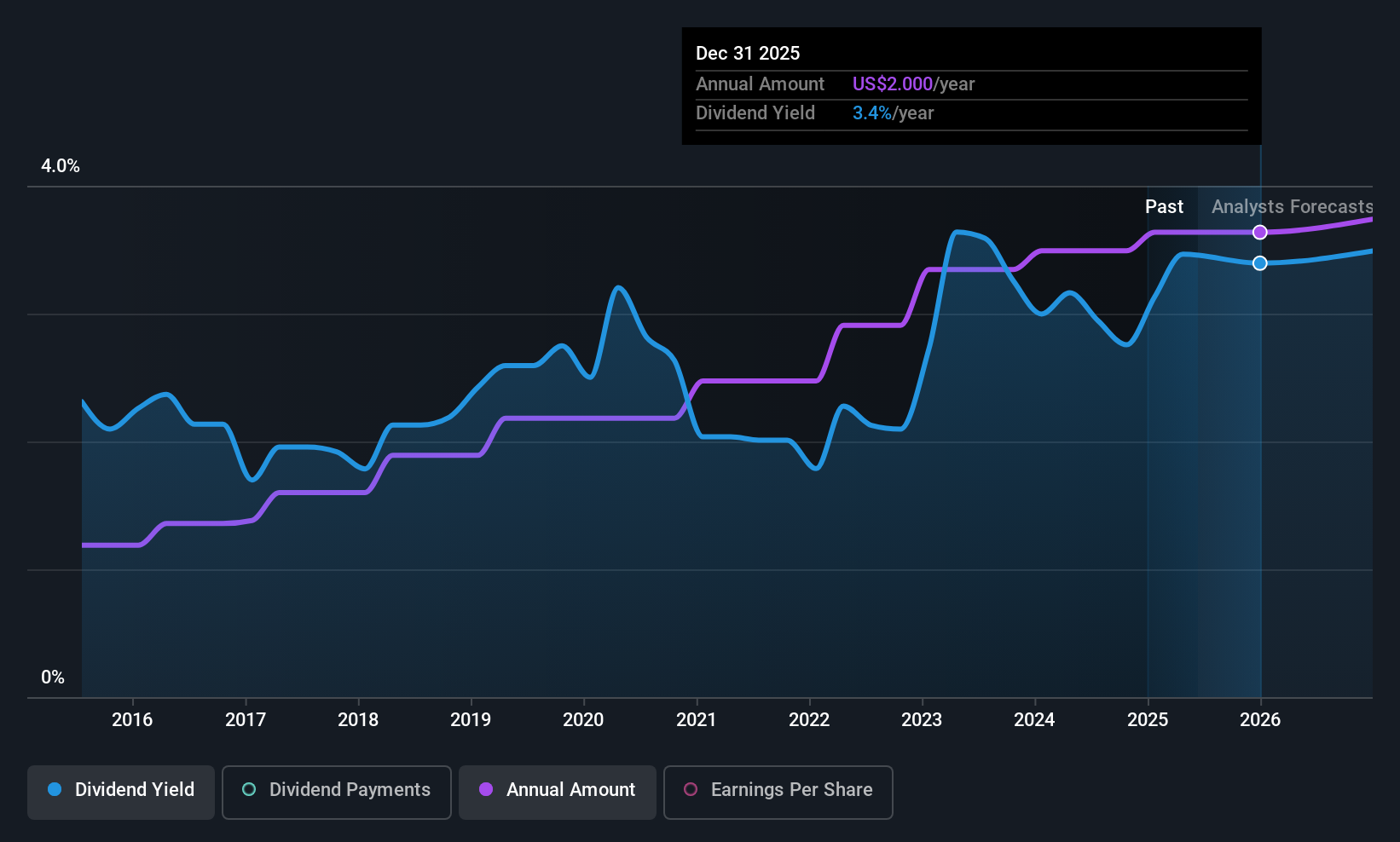

Lakeland Financial (LKFN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lakeland Financial Corporation, with a market cap of $1.66 billion, operates as the bank holding company for Lake City Bank, offering a range of banking products and services in the United States.

Operations: Lakeland Financial Corporation generates revenue of $236.27 million from its Financial Services segment.

Dividend Yield: 3.1%

Lakeland Financial Corporation offers a stable and reliable dividend, recently affirming a quarterly payout of US$0.50 per share. The dividend yield stands at 3.08%, which is below the top quartile of US dividend payers but remains covered by earnings with a payout ratio of 55.8%. Despite trading at 30% below its estimated fair value, recent board appointments may influence strategic direction, though past earnings have shown some decline.

- Take a closer look at Lakeland Financial's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Lakeland Financial shares in the market.

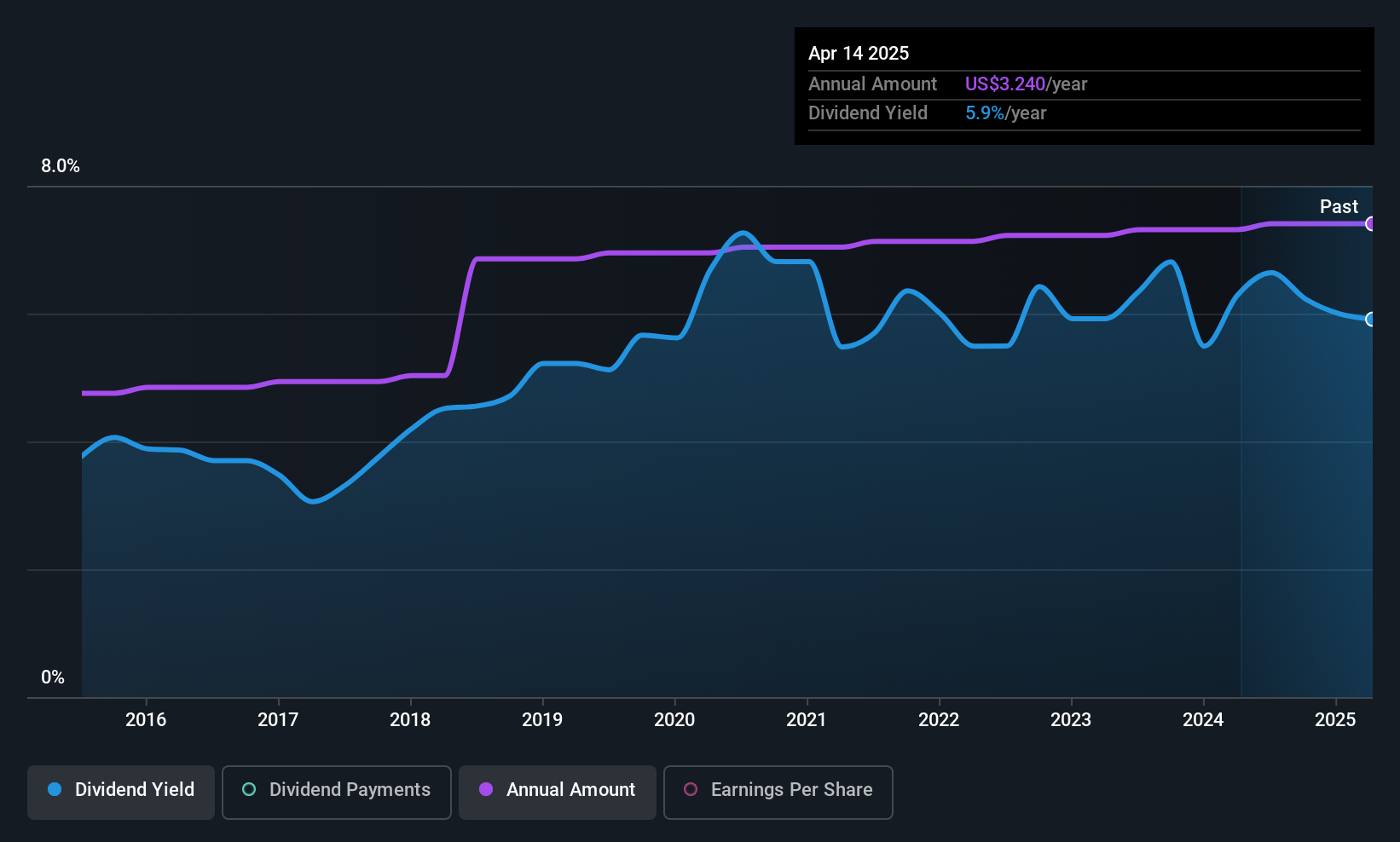

Archer-Daniels-Midland (ADM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Archer-Daniels-Midland Company operates in the procurement, transportation, storage, processing, and merchandising of agricultural commodities and related products globally with a market cap of approximately $26.40 billion.

Operations: Archer-Daniels-Midland Company's revenue is primarily derived from its AG Services and Oilseeds segment at $66.68 billion, followed by Carbohydrate Solutions at $12.00 billion, and Nutrition at $7.40 billion.

Dividend Yield: 3.7%

Archer-Daniels-Midland's dividend remains stable and reliable, recently affirming a US$0.51 per share payout. While trading below estimated fair value, its dividend yield of 3.71% is lower than the top quartile of US payers and not well covered by cash flows, evidenced by a high cash payout ratio of 441.5%. Despite this, earnings cover the dividends with a reasonable payout ratio of 71.3%, though recent profit margins have declined to 1.6%.

- Click here to discover the nuances of Archer-Daniels-Midland with our detailed analytical dividend report.

- Our expertly prepared valuation report Archer-Daniels-Midland implies its share price may be lower than expected.

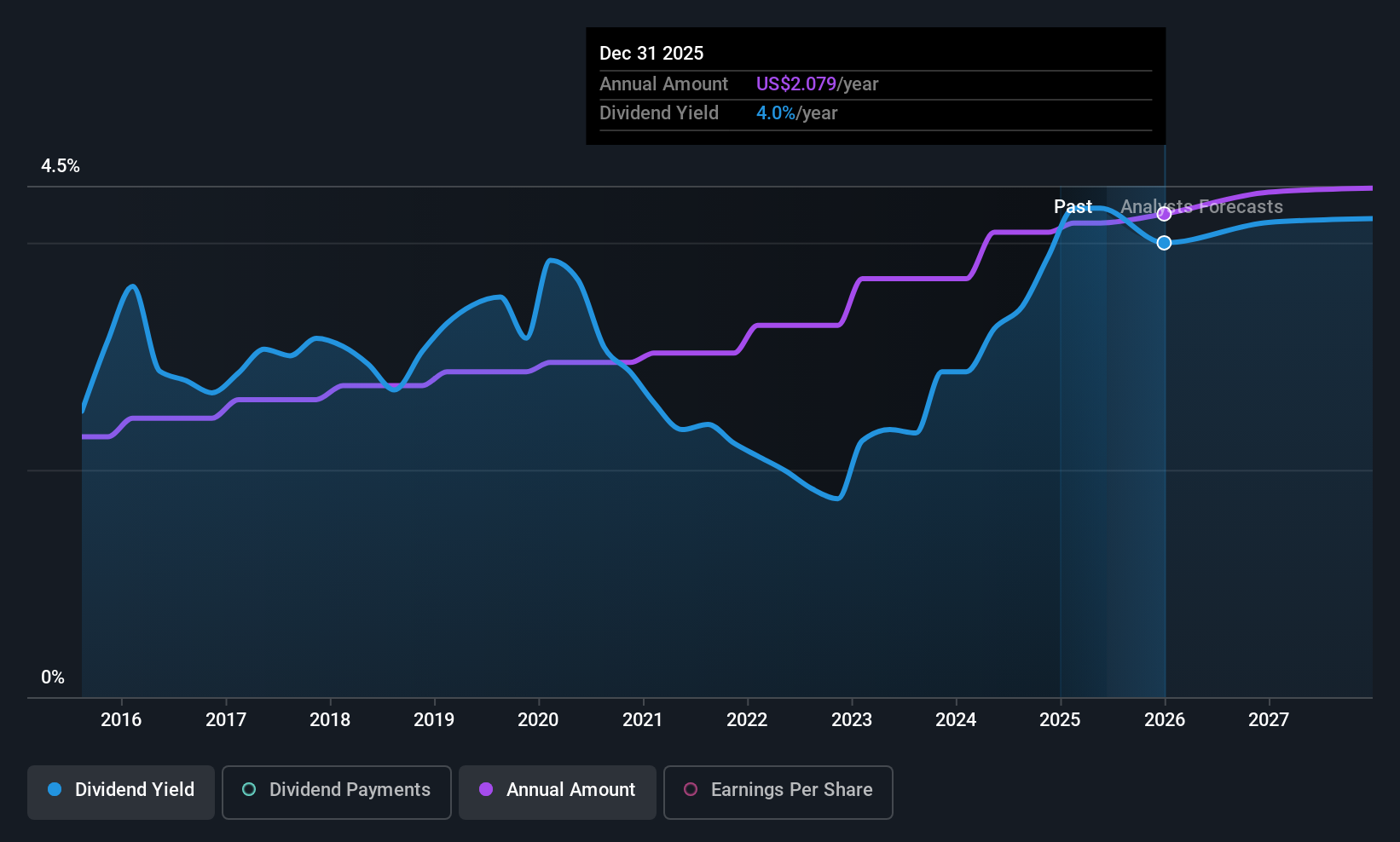

Universal (UVV)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Universal Corporation is a business-to-business agriproducts company that supplies leaf tobacco and plant-based ingredients to food and beverage markets globally, with a market cap of approximately $1.45 billion.

Operations: Universal Corporation generates revenue from its Tobacco Operations, which account for $2.61 billion, and Ingredients Operations, contributing $338.61 million.

Dividend Yield: 5.6%

Universal Corporation offers a dividend yield of 5.62%, placing it among the top 25% of US dividend payers. The company has consistently increased dividends over the past decade, supported by stable earnings coverage with an 85% payout ratio and strong cash flow coverage at 30.8%. Despite a high debt level, Universal trades significantly below its estimated fair value. Recent executive changes include Johan C. Kroner's planned retirement as CFO, ensuring continuity in leadership transition.

- Navigate through the intricacies of Universal with our comprehensive dividend report here.

- Our valuation report unveils the possibility Universal's shares may be trading at a discount.

Turning Ideas Into Actions

- Explore the 138 names from our Top US Dividend Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADM

Archer-Daniels-Midland

Engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives