- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (NYSE:JPM) Elevates David Frame to Global CEO of Private Bank

Reviewed by Simply Wall St

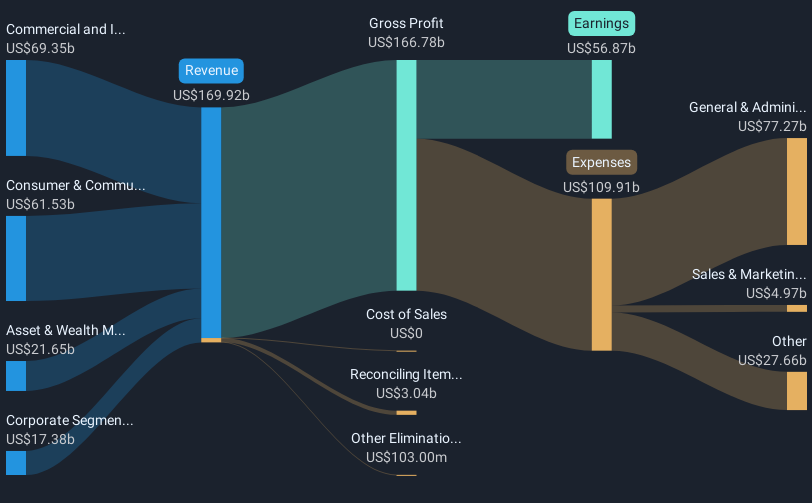

JPMorgan Chase (NYSE:JPM) recently appointed David Frame as the global CEO of its Private Bank, positioning him to enhance the bank's global presence. Over the last quarter, the company's stock price has surged by 38%, significantly outpacing the market's 1.8% increase over the past week and 14% over the year. This sharp rise in JPMorgan's stock may have been supported by strategic executive appointments, enhanced product offerings, and a substantial share repurchase program, all contributing positively relative to the broader market trends. The overall market optimism and company-specific actions likely buoyed investor confidence in JPM.

The appointment of David Frame as CEO of JPMorgan Chase's Private Bank may bolster the company's efforts at fortifying its global stance. Over the past five years, JPMorgan's shares have experienced a substantial total return of 251.62%, reflecting the company's resilience and overall growth trajectory. This performance is notably robust, especially when juxtaposed against the more recent one-year market return, which JPMorgan notably surpassed by delivering growth in excess of the market's 13.7% increase.

JPMorgan's strategic executive appointments and business actions could positively influence future revenue and earnings figures by reinforcing investor confidence and potentially enhancing operational capabilities. The recent share price movement, which is currently below the bearish target of US$195.37 from more pessimistic analysts, implies that market participants might still hold diverse views regarding the company's trajectory. This divergence reinforces the importance of evaluating new leadership roles and their potential to shape JPMorgan's earnings and operational outcomes amid shifting credit loss expectations and expense management challenges.

Review our growth performance report to gain insights into JPMorgan Chase's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives