- United States

- /

- Software

- /

- NYSE:ZEN

Is Zendesk (NYSE:ZEN) Using Debt Sensibly?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Zendesk, Inc. (NYSE:ZEN) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Zendesk

How Much Debt Does Zendesk Carry?

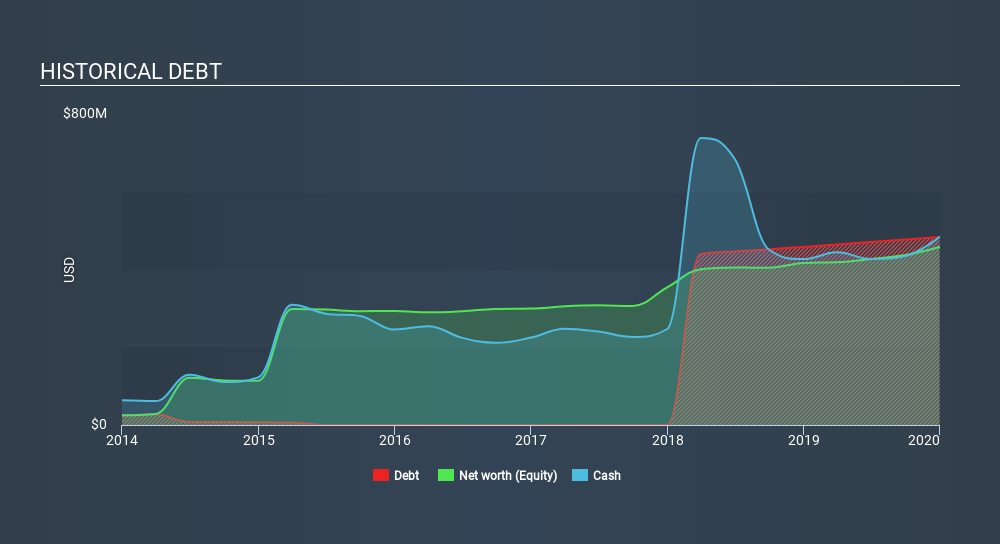

As you can see below, at the end of December 2019, Zendesk had US$483.5m of debt, up from US$458.2m a year ago. Click the image for more detail. But it also has US$483.5m in cash to offset that, meaning it has US$85.0k net cash.

How Strong Is Zendesk's Balance Sheet?

The latest balance sheet data shows that Zendesk had liabilities of US$478.7m due within a year, and liabilities of US$577.9m falling due after that. Offsetting these obligations, it had cash of US$483.5m as well as receivables valued at US$127.8m due within 12 months. So its liabilities total US$445.2m more than the combination of its cash and short-term receivables.

Given Zendesk has a market capitalization of US$8.05b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Zendesk boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Zendesk's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Zendesk reported revenue of US$816m, which is a gain of 36%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

So How Risky Is Zendesk?

Although Zendesk had negative earnings before interest and tax (EBIT) over the last twelve months, it generated positive free cash flow of US$42m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. The good news for Zendesk shareholders is that its revenue growth is strong, making it easier to raise capital if need be. But we still think it's somewhat risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for Zendesk that you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:ZEN

Zendesk

Zendesk, Inc., a software development company, provides software as a service solutions for organizations in the United States, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

VTEX - A hidden Latin American growth opportunity?

Coherent Corp. (COHR): The Silicon Photonics Powerhouse – Joining the S&P 500 Benchmark in 2026.

Vertiv Holdings Co (VRT): The Liquid Cooling Standard-Bearer – Entering the S&P 500 on March 23.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026