Is There More To The Story Than Flügger group's (CPH:FLUG B) Earnings Growth?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. Today we'll focus on whether this year's statutory profits are a good guide to understanding Flügger group (CPH:FLUG B).

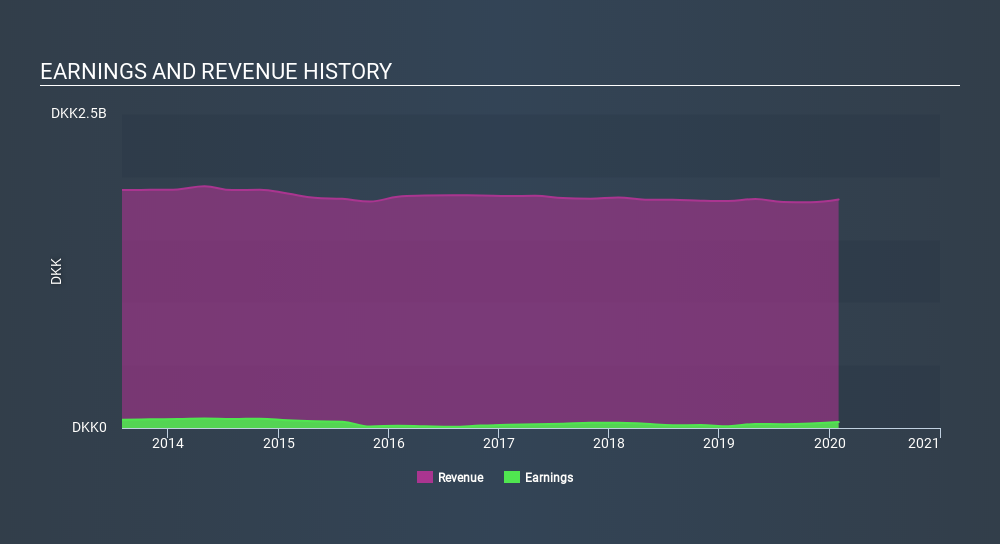

It's good to see that over the last twelve months Flügger group made a profit of ø47.1m on revenue of ø1.82b. As you can see in the chart below, it has grown its profits over the last three years, despite the fact its revenue has been steady.

View our latest analysis for Flügger group

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. Therefore, today we will consider the nature of Flügger group's statutory earnings with reference to its dilution of shareholders and the impact of unusual items. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Flügger group.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Flügger group issued 10% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Flügger group's EPS by clicking here.

How Is Dilution Impacting Flügger group's Earnings Per Share? (EPS)

Flügger group has improved its profit over the last three years, with an annualized gain of 86% in that time. And the 237% profit boost in the last year certainly seems impressive at first glance. On the other hand, earnings per share are only up 238% in that time. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if Flügger group can grow EPS persistently. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

The Impact Of Unusual Items On Profit

Alongside that dilution, it's also important to note that Flügger group's profit suffered from unusual items, which reduced profit by ø9.9m in the last twelve months. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect Flügger group to produce a higher profit next year, all else being equal.

Our Take On Flügger group's Profit Performance

To sum it all up, Flügger group took a hit from unusual items which pushed its profit down; without that, it would have made more money. But on the other hand, the company issued more shares, so without buying more shares each shareholder will end up with a smaller part of the profit. Based on these factors, it's hard to tell if Flügger group's profits are a reasonable reflection of its underlying profitability. So while earnings quality is important, it's equally important to consider the risks facing Flügger group at this point in time. To that end, you should learn about the 3 warning signs we've spotted with Flügger group (including 1 which is potentially serious).

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About CPSE:FLUG B

Flügger group

Designs, manufactures, and markets decorative paints, wood protection products, spackling pastes, and wallpaper and tools.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)