- United States

- /

- Auto Components

- /

- NasdaqGM:SYPR

Is Sypris Solutions (NASDAQ:SYPR) Weighed On By Its Debt Load?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Sypris Solutions, Inc. (NASDAQ:SYPR) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Sypris Solutions

How Much Debt Does Sypris Solutions Carry?

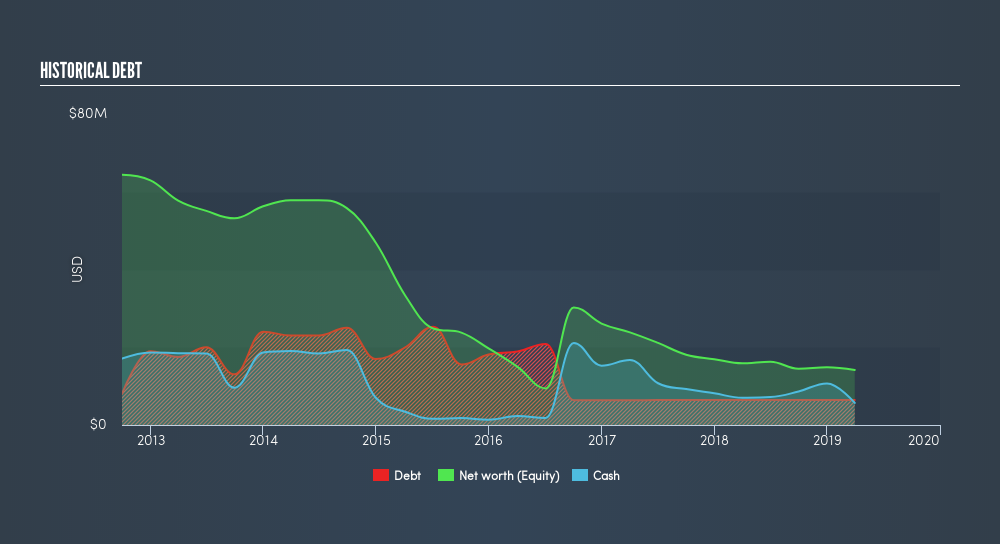

The chart below, which you can click on for greater detail, shows that Sypris Solutions had US$9.97m in debt in March 2019; about the same as the year before. On the flip side, it has US$5.69m in cash leading to net debt of about US$4.29m.

How Healthy Is Sypris Solutions's Balance Sheet?

We can see from the most recent balance sheet that Sypris Solutions had liabilities of US$28.0m falling due within a year, and liabilities of US$23.5m due beyond that. Offsetting these obligations, it had cash of US$5.69m as well as receivables valued at US$9.67m due within 12 months. So it has liabilities totalling US$36.2m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the US$20.2m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt At the end of the day, Sypris Solutions would probably need a major re-capitalization if its creditors were to demand repayment. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Sypris Solutions's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Sypris Solutions reported revenue of US$88m, which is a gain of 4.2%. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, Sypris Solutions had negative earnings before interest and tax (EBIT), over the last year. Indeed, it lost a very considerable US$4.2m at the EBIT level. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it burned through US$3.9m in negative free cash flow over the last year. That means it's on the risky side of things. For riskier companies like Sypris Solutions I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:SYPR

Sypris Solutions

Engages in the provision of truck components, oil and gas and water pipeline components, and aerospace and defense electronics primarily in North America and Mexico.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Take Two Interactive Software TTWO Valuation Analysis

Recursion Pharmaceuticals! WTH is going on?

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion