- Germany

- /

- Healthtech

- /

- XTRA:NXU

Is Nexus AG's (ETR:NXU) Stock's Recent Performance Being Led By Its Attractive Financial Prospects?

Most readers would already be aware that Nexus' (ETR:NXU) stock increased significantly by 37% over the past three months. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. In this article, we decided to focus on Nexus' ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Nexus

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Nexus is:

10% = €12m ÷ €117m (Based on the trailing twelve months to March 2020).

The 'return' is the yearly profit. That means that for every €1 worth of shareholders' equity, the company generated €0.10 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learnt that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Nexus' Earnings Growth And 10% ROE

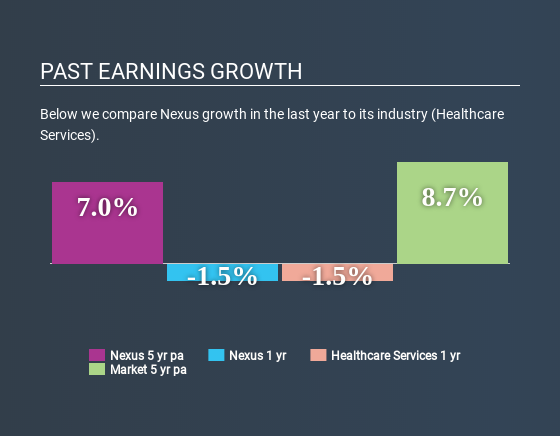

At first glance, Nexus seems to have a decent ROE. Even so, when compared with the average industry ROE of 14%, we aren't very excited. Although, we can see that Nexus saw a modest net income growth of 7.0% over the past five years. We reckon that there could be other factors at play here. For instance, the company has a low payout ratio or is being managed efficiently. Bear in mind, the company does have a respectable level of ROE. It is just that the industry ROE is higher. So this also does lend some color to the fairly high earnings growth seen by the company.

As a next step, we compared Nexus' net income growth with the industry and found that the company has a similar growth figure when compared with the industry average growth rate of 7.0% in the same period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Has the market priced in the future outlook for NXU? You can find out in our latest intrinsic value infographic research report.

Is Nexus Using Its Retained Earnings Effectively?

Nexus has a healthy combination of a moderate three-year median payout ratio of 26% (or a retention ratio of 74%) and a respectable amount of growth in earnings as we saw above, meaning that the company has been making efficient use of its profits.

Additionally, Nexus has paid dividends over a period of seven years which means that the company is pretty serious about sharing its profits with shareholders. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 16% over the next three years. Despite the lower expected payout ratio, the company's ROE is not expected to change by much.

Conclusion

On the whole, we feel that Nexus' performance has been quite good. Particularly, we like that the company is reinvesting heavily into its business at a moderate rate of return. Unsurprisingly, this has led to an impressive earnings growth. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

When trading Nexus or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nexus might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About XTRA:NXU

Nexus

Develops and sells software solutions for the healthcare market in Germany, Switzerland, Liechtenstein, the Netherlands, Poland, France, Austria, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives