Today we are going to look at BioTelemetry, Inc. (NASDAQ:BEAT) to see whether it might be an attractive investment prospect. To be precise, we'll consider its Return On Capital Employed (ROCE), as that will inform our view of the quality of the business.

First of all, we'll work out how to calculate ROCE. Second, we'll look at its ROCE compared to similar companies. Last but not least, we'll look at what impact its current liabilities have on its ROCE.

Return On Capital Employed (ROCE): What is it?

ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. All else being equal, a better business will have a higher ROCE. Overall, it is a valuable metric that has its flaws. Author Edwin Whiting says to be careful when comparing the ROCE of different businesses, since 'No two businesses are exactly alike.'

How Do You Calculate Return On Capital Employed?

Analysts use this formula to calculate return on capital employed:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

Or for BioTelemetry:

0.12 = US$71m ÷ (US$664m - US$59m) (Based on the trailing twelve months to June 2019.)

Therefore, BioTelemetry has an ROCE of 12%.

View our latest analysis for BioTelemetry

Does BioTelemetry Have A Good ROCE?

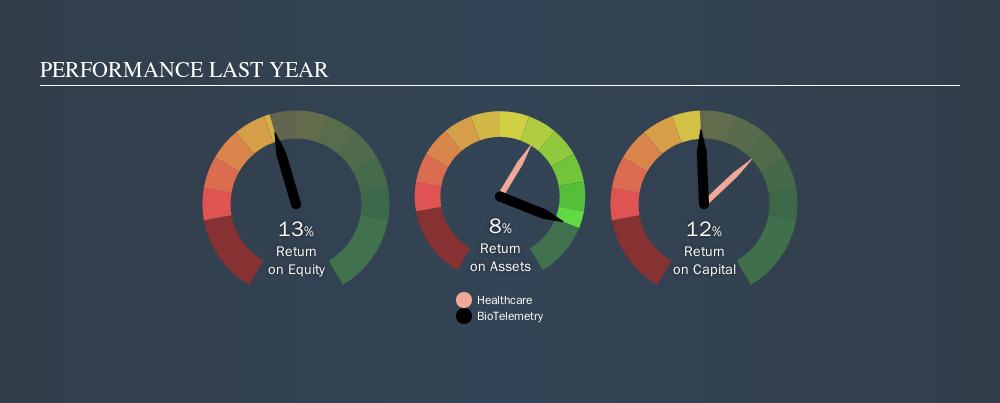

When making comparisons between similar businesses, investors may find ROCE useful. Using our data, BioTelemetry's ROCE appears to be around the 11% average of the Healthcare industry. Regardless of where BioTelemetry sits next to its industry, its ROCE in absolute terms appears satisfactory, and this company could be worth a closer look.

BioTelemetry's current ROCE of 12% is lower than its ROCE in the past, which was 18%, 3 years ago. Therefore we wonder if the company is facing new headwinds. You can see in the image below how BioTelemetry's ROCE compares to its industry.

Remember that this metric is backwards looking - it shows what has happened in the past, and does not accurately predict the future. Companies in cyclical industries can be difficult to understand using ROCE, as returns typically look high during boom times, and low during busts. ROCE is only a point-in-time measure. Future performance is what matters, and you can see analyst predictions in our free report on analyst forecasts for the company.

What Are Current Liabilities, And How Do They Affect BioTelemetry's ROCE?

Short term (or current) liabilities, are things like supplier invoices, overdrafts, or tax bills that need to be paid within 12 months. The ROCE equation subtracts current liabilities from capital employed, so a company with a lot of current liabilities appears to have less capital employed, and a higher ROCE than otherwise. To counteract this, we check if a company has high current liabilities, relative to its total assets.

BioTelemetry has total liabilities of US$59m and total assets of US$664m. As a result, its current liabilities are equal to approximately 8.9% of its total assets. Low current liabilities have only a minimal impact on BioTelemetry's ROCE, making its decent returns more credible.

The Bottom Line On BioTelemetry's ROCE

If it is able to keep this up, BioTelemetry could be attractive. BioTelemetry looks strong on this analysis, but there are plenty of other companies that could be a good opportunity . Here is a free list of companies growing earnings rapidly.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)