- Germany

- /

- Commercial Services

- /

- DB:GBF

Is Bilfinger SE (FRA:GBF) Growing Too Fast?

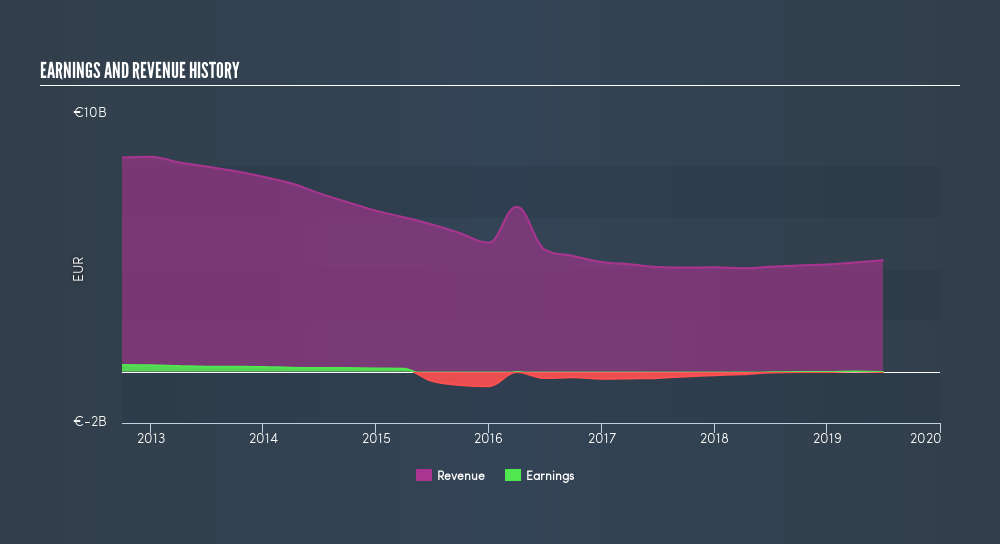

Trailing twelve-month data shows us that Bilfinger SE's (FRA:GBF) earnings loss has accumulated to -€23.1m. Although some investors expected this, their belief in the path to profitability for Bilfinger may be wavering. The single most important question to ask when you’re investing in a loss-making company is – will it need to raise cash again, and if so, when? This is because new equity from additional capital raising can thin out the value of current shareholders’ stake in the company. Given that Bilfinger is spending more money than it earns, it will need to fund its expenses via external sources of capital. Looking at Bilfinger’s latest financial data, I will estimate when the company may run out of cash and need to raise more money.

View our latest analysis for Bilfinger

What is cash burn?

With a negative free cash flow of -€83.4m, Bilfinger is chipping away at its €837m cash reserves in order to run its business. The biggest threat facing Bilfinger investors is the company going out of business when it runs out of money and cannot raise any more capital. Bilfinger operates in the diversified support services industry, which delivered positive earnings in the past year. This means, on average, its industry peers are profitable. Bilfinger runs the risk of running down its cash supply too fast, or falling behind its profitable peers by investing too little.

When will Bilfinger need to raise more cash?

We can measure Bilfinger's ongoing cash expenditure requirements by looking at free cash flow, which I define as cash flow from operations minus fixed capital investment, is a measure of how much cash a company generates/loses each year.

In the past year, free cash outflows (excluding one-offs) rose by 39%, which is high. However, given the current levels of cash holdings, it seems that Bilfinger will not need further capital soon. The company may be able to continue investing at the same rate without having to issue equity or borrow within the next three years. Although this is a relatively simplistic calculation, and Bilfinger could reduce its costs or borrow money instead of raising new equity capital, the outcome of this analysis still helps us understand how sustainable the Bilfinger operation is, and when things may have to change.

Next Steps:

Although Bilfinger’s cash burn is growing at a double-digit rate, investors can breathe easy knowing it probably won’t be raising money any time soon. This should be good news for current shareholders as there is less of a chance that their current shares will be diluted, and it also indicates the company doesn’t have an immediate cash problem on its hand. Now that we’ve accounted for cash burn growth, you should also look at expected revenue growth in order to gauge when the company may become breakeven. I admit this is a fairly basic analysis for GBF's financial health. Other important fundamentals need to be considered as well. I recommend you continue to research Bilfinger to get a more holistic view of the company by looking at:- Future Outlook: What are well-informed industry analysts predicting for GBF’s future growth? Take a look at our free research report of analyst consensus for GBF’s outlook.

- Valuation: What is GBF worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether GBF is currently mispriced by the market.

- Other High-Performing Stocks: If you believe you should cushion your portfolio with something less risky, scroll through our free list of these great stocks here.

NB: Figures in this article are calculated using data from the trailing twelve months from 30 June 2019. This may not be consistent with full year annual report figures. Operating expenses include only SG&A and one-year R&D.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About DB:GBF

Bilfinger

Provides industrial services to customers in the process industry primarily in Europe, North America, and the Middle East.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

My view on CSL Limited is positive. It’s a high-quality growth stock with strong barriers to entry through its global plasma network.

Nu holdings will continue to disrupt the South American banking market

The Transition From Automaker To AI Behemoth Is Underway, But Priced In

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion