- India

- /

- Capital Markets

- /

- NSEI:DHANI

Investors Holding Back On Indiabulls Ventures Limited (NSE:IBVENTURES)

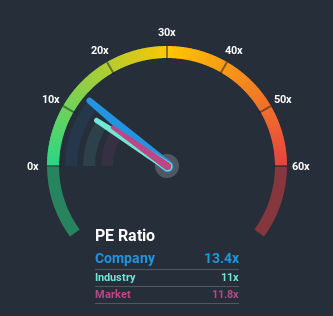

With a median price-to-earnings (or "P/E") ratio of close to 12x in India, you could be forgiven for feeling indifferent about Indiabulls Ventures Limited's (NSE:IBVENTURES) P/E ratio of 13.4x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

For example, consider that Indiabulls Ventures' financial performance has been poor lately as it's earnings have been in decline. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Indiabulls Ventures

Where Does Indiabulls Ventures' P/E Sit Within Its Industry?

It's plausible that Indiabulls Ventures' fairly average P/E ratio could be a result of tendencies within its own industry. The image below shows that the Capital Markets industry as a whole also has a P/E ratio similar to the market. So we'd say there is merit in the premise that the company's ratio being shaped by its industry at this time. In the context of the Capital Markets industry's current setting, most of its constituents' P/E's would be expected to be held back. Nevertheless, the company's P/E should be primarily influenced by its own financial performance.

Does Growth Match The P/E?

Indiabulls Ventures' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 11%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 336% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Comparing that to the market, which is predicted to shrink 2.8% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

In light of this, it's peculiar that Indiabulls Ventures' P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Indiabulls Ventures' P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Indiabulls Ventures revealed its growing earnings over the medium-term aren't contributing to its P/E as much as we would have predicted, given the market is set to shrink. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader market turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Indiabulls Ventures that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

When trading Indiabulls Ventures or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

If you're looking to trade Dhani Services, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:DHANI

Dhani Services

Engages in the real estate development, broking, financing and digital wallet services, asset reconstruction, e-commerce, and related activities through its Dhani app in India.

Flawless balance sheet very low.