- India

- /

- Consumer Finance

- /

- NSEI:MUTHOOTCAP

Investors Continue Waiting On Sidelines For Muthoot Capital Services Limited (NSE:MUTHOOTCAP)

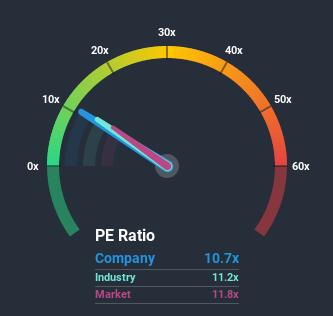

It's not a stretch to say that Muthoot Capital Services Limited's (NSE:MUTHOOTCAP) price-to-earnings (or "P/E") ratio of 10.7x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

For instance, Muthoot Capital Services' receding earnings in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Muthoot Capital Services

Where Does Muthoot Capital Services' P/E Sit Within Its Industry?

An inspection of the typical P/E's throughout Muthoot Capital Services' industry may help to explain its fairly average P/E ratio. The image below shows that the Consumer Finance industry as a whole also has a P/E ratio similar to the market. So it appears the company's ratio could be influenced considerably by these industry numbers currently. Some industry P/E's don't move around a lot and right now most companies within the Consumer Finance industry should be getting restrained. Still, the strength of the company's earnings will most likely determine where its P/E shall sit.

Is There Some Growth For Muthoot Capital Services?

In order to justify its P/E ratio, Muthoot Capital Services would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 27% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 68% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Comparing that to the market, which is predicted to shrink 2.8% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

In light of this, it's peculiar that Muthoot Capital Services' P/E sits in line with the majority of other companies. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader market.

The Key Takeaway

The price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Muthoot Capital Services currently trades on a lower than expected P/E since its recent three-year earnings growth is beating forecasts for a struggling market. When we see its superior earnings with some actual growth, we assume potential risks are what might be placing pressure on the P/E ratio. One major risk is whether its earnings trajectory can keep outperforming under these tough market conditions. It appears some are indeed anticipating earnings instability, because this relative performance should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Muthoot Capital Services (1 is a bit unpleasant) you should be aware of.

If these risks are making you reconsider your opinion on Muthoot Capital Services, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you’re looking to trade Muthoot Capital Services, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:MUTHOOTCAP

Muthoot Capital Services

A non-banking finance company, provides fund and non-fund based financial services in India.

Slight with mediocre balance sheet.