- India

- /

- Diversified Financial

- /

- NSEI:LTF

Investors Aren't Entirely Convinced About L&T Finance Holdings Limited's (NSE:L&TFH) Earnings

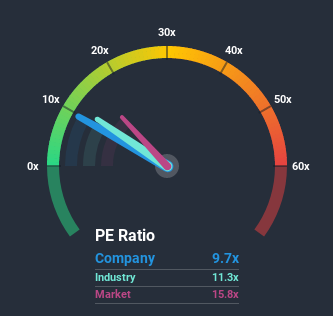

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 16x, you may consider L&T Finance Holdings Limited (NSE:L&TFH) as an attractive investment with its 9.7x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for L&T Finance Holdings as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for L&T Finance Holdings

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like L&T Finance Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 42% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 13% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 20% per year over the next three years. With the market predicted to deliver 19% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that L&T Finance Holdings' P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of L&T Finance Holdings' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for L&T Finance Holdings (1 can't be ignored!) that you need to be mindful of.

If you're unsure about the strength of L&T Finance Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you decide to trade L&T Finance Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:LTF

L&T Finance

A non-banking financial company, engages in the provision of various financial products and services in India.

High growth potential average dividend payer.