- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Intuitive Machines (NasdaqGM:LUNR) Reports Turnaround In Net Income For Q1 2025

Reviewed by Simply Wall St

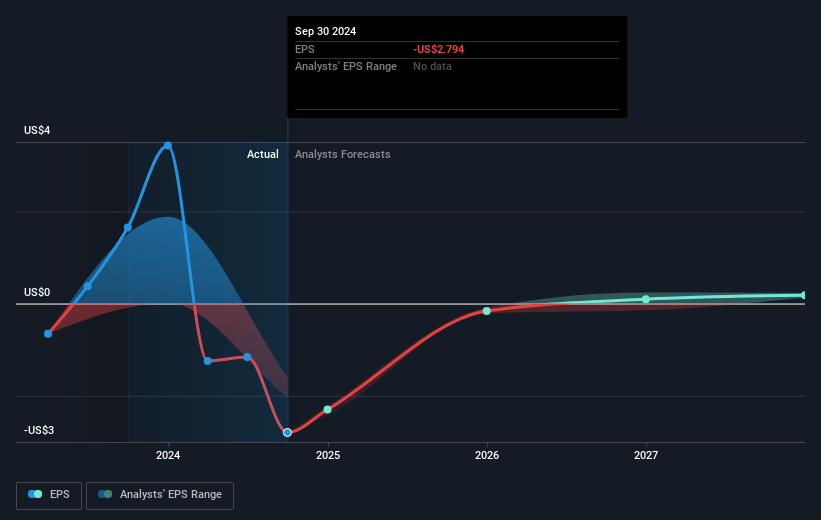

Intuitive Machines (NasdaqGM:LUNR) recently reported an 18.60% increase in its share price over the past month. Key contributions to this movement include the company's turnaround in net income for Q1 2025, which improved significantly to $0.513 million from a net loss of $119 million the previous year. Despite a decline in sales from $73.22 million to $62.52 million, the company's positive full-year revenue guidance between $250 million to $300 million supported investor optimism. These factors likely bolstered the company's share price, aligning with broader market improvements, such as the market's 2% rise over the past week.

The recent improvements in Intuitive Machines' net income and positive revenue guidance have seemingly contributed to increased investor confidence, resulting in an 18.60% surge in share price over the past month. This jump adds to the company's impressive total return of 125.10% over the last year, which is quite significant. In this longer-term context, Intuitive Machines' shares have considerably outperformed both the broader market and the US Aerospace & Defense industry, where it surpassed the market's 11.9% return and the industry's 31.1% return over the past year.

Given the company's ongoing expansion into new markets and strategic investments in high-margin revenue streams, these developments could bolster future revenue and earnings forecast. Analysts anticipate revenue growth by 24.6% annually with margins improving, though uncertainties surrounding NASA contracts and competition pose potential challenges. The current share price of US$8.6 rests below the consensus analyst price target of US$14.86, a 42.1% potential upside. For the company to achieve this target, it requires optimistic assumptions about revenue reaching US$441.2 million and earnings attaining US$15.8 million by 2028, using a high PE ratio of 247.6x. These assumptions reflect the positive sentiment driving the recent price increase, albeit paired with significant risks and variable forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives