- United States

- /

- Insurance

- /

- NasdaqGM:AAME

Introducing Atlantic American (NASDAQ:AAME), The Stock That Dropped 40% In The Last Five Years

Atlantic American Corporation (NASDAQ:AAME) shareholders should be happy to see the share price up 26% in the last month. But over the last half decade, the stock has not performed well. In fact, the share price is down 40%, which falls well short of the return you could get by buying an index fund.

See our latest analysis for Atlantic American

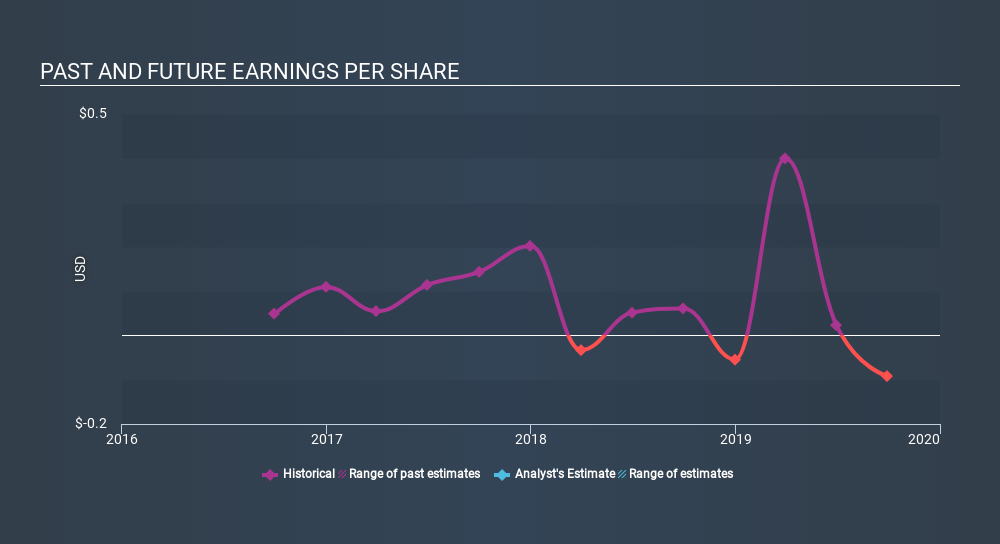

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over five years Atlantic American's earnings per share dropped significantly, falling to a loss, with the share price also lower. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Atlantic American shareholders are down 8.0% for the year (even including dividends) , but the market itself is up 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 9.3% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Be aware that Atlantic American is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

Of course Atlantic American may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGM:AAME

Atlantic American

Through its subsidiaries, provides life and health, and property and casualty insurance products in the United States.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives