- United States

- /

- Biotech

- /

- NasdaqGS:INCY

Incyte And Two Other Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

In recent days, the U.S. stock market has experienced fluctuations as geopolitical tensions in the Middle East and volatile oil prices have influenced investor sentiment. Amid these uncertainties, identifying stocks that may be undervalued could offer potential opportunities for investors seeking to navigate these challenging conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $24.17 | $47.93 | 49.6% |

| Peoples Financial Services (PFIS) | $47.24 | $93.66 | 49.6% |

| Mid Penn Bancorp (MPB) | $26.49 | $52.26 | 49.3% |

| MetroCity Bankshares (MCBS) | $26.99 | $53.10 | 49.2% |

| Ligand Pharmaceuticals (LGND) | $115.01 | $225.70 | 49% |

| Horizon Bancorp (HBNC) | $14.61 | $29.10 | 49.8% |

| German American Bancorp (GABC) | $36.95 | $72.97 | 49.4% |

| Clearfield (CLFD) | $38.12 | $75.13 | 49.3% |

| Central Pacific Financial (CPF) | $26.01 | $51.99 | 50% |

| Arrow Financial (AROW) | $24.97 | $49.74 | 49.8% |

Here's a peek at a few of the choices from the screener.

Incyte (INCY)

Overview: Incyte Corporation is a biopharmaceutical company involved in the discovery, development, and commercialization of therapeutics across the United States, Europe, Canada, and Japan with a market cap of $13.11 billion.

Operations: The company's revenue is derived from its biotechnology segment, which generated $4.41 billion.

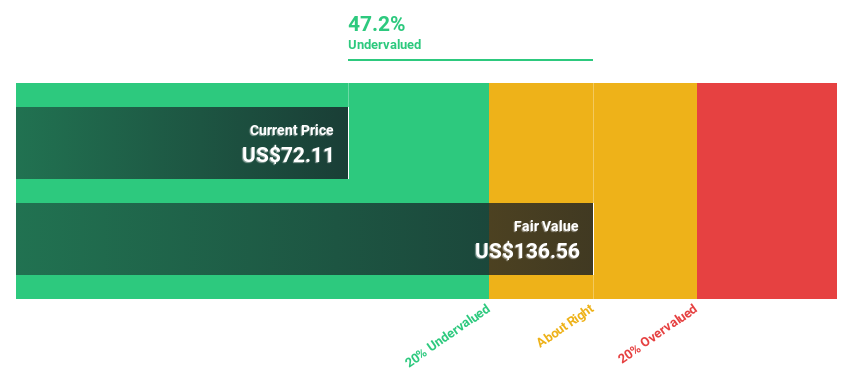

Estimated Discount To Fair Value: 49%

Incyte, trading at US$71.22, is significantly undervalued compared to its estimated fair value of US$139.73 and offers a strong earnings growth forecast of 20.4% annually, outpacing the broader U.S. market's 14.4%. Despite lower profit margins this year, recent strategic alliances and FDA approvals for key therapies bolster its innovative pipeline in oncology treatments, potentially enhancing future cash flows and supporting its valuation case as an undervalued stock based on cash flows.

- Our expertly prepared growth report on Incyte implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Incyte here with our thorough financial health report.

Bowhead Specialty Holdings (BOW)

Overview: Bowhead Specialty Holdings Inc. offers commercial specialty property and casualty insurance products in the United States, with a market cap of approximately $1.19 billion.

Operations: The company generates revenue of $457.70 million from its commercial specialty property and casualty insurance products in the United States.

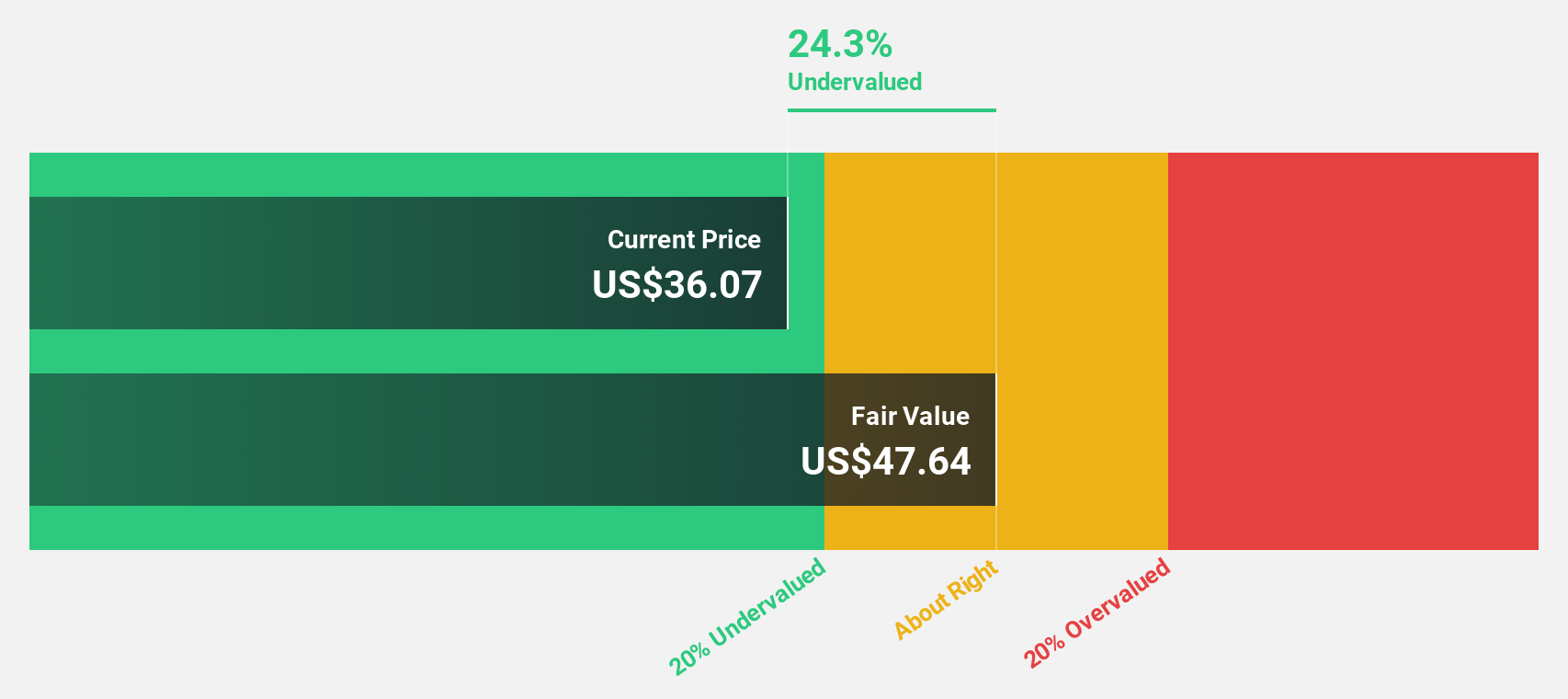

Estimated Discount To Fair Value: 22.7%

Bowhead Specialty Holdings, with a current price of US$36.84, is trading 22.7% below its estimated fair value of US$47.64, making it an attractive option for investors focusing on cash flows. The company's earnings grew by a substantial 57.6% over the past year and are projected to continue expanding at 24.5% annually, surpassing the U.S. market average growth rate of 14.4%. Recent earnings reports show strong revenue growth and improved profitability metrics, reinforcing its undervaluation status amidst recent shelf registration filings totaling nearly $948 million which could impact future financial strategies.

- Upon reviewing our latest growth report, Bowhead Specialty Holdings' projected financial performance appears quite optimistic.

- Get an in-depth perspective on Bowhead Specialty Holdings' balance sheet by reading our health report here.

Ciena (CIEN)

Overview: Ciena Corporation is a network technology company that offers hardware, software, and services to network operators across multiple regions including the Americas, Europe, the Middle East, Africa, Asia Pacific, Japan, and India; it has a market cap of approximately $10.20 billion.

Operations: Ciena's revenue is primarily derived from its Networking Platforms segment, which generated $3.25 billion, followed by Global Services at $551.93 million, Platform Software and Services at $363.38 million, and Blue Planet Automation Software and Services contributing $103.23 million.

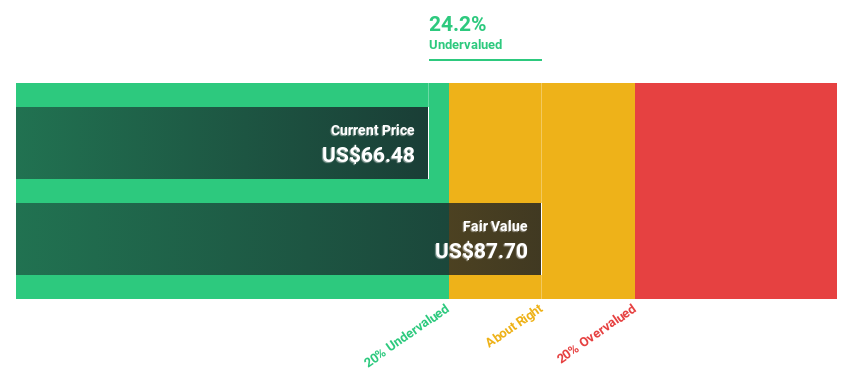

Estimated Discount To Fair Value: 29.3%

Ciena, trading at US$73.76, is significantly undervalued compared to its estimated fair value of US$104.3. The company's earnings are forecasted to grow at an impressive 35.8% annually, well above the U.S. market average of 14.4%. Recent updates include a completed share buyback program worth US$188.55 million and raised revenue guidance for fiscal year 2025, reflecting strong demand and strategic positioning in advanced optical technologies like WaveLogic 6 Extreme (WL6e).

- The analysis detailed in our Ciena growth report hints at robust future financial performance.

- Click here to discover the nuances of Ciena with our detailed financial health report.

Summing It All Up

- Dive into all 171 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INCY

Incyte

A biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics in the United States, Europe, Canada, and Japan.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives