- India

- /

- Auto Components

- /

- NSEI:RICOAUTO

If You Had Bought Rico Auto Industries' (NSE:RICOAUTO) Shares Three Years Ago You Would Be Down 70%

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of Rico Auto Industries Limited (NSE:RICOAUTO) have had an unfortunate run in the last three years. Sadly for them, the share price is down 70% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 27% lower in that time. The falls have accelerated recently, with the share price down 10% in the last three months.

Check out our latest analysis for Rico Auto Industries

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

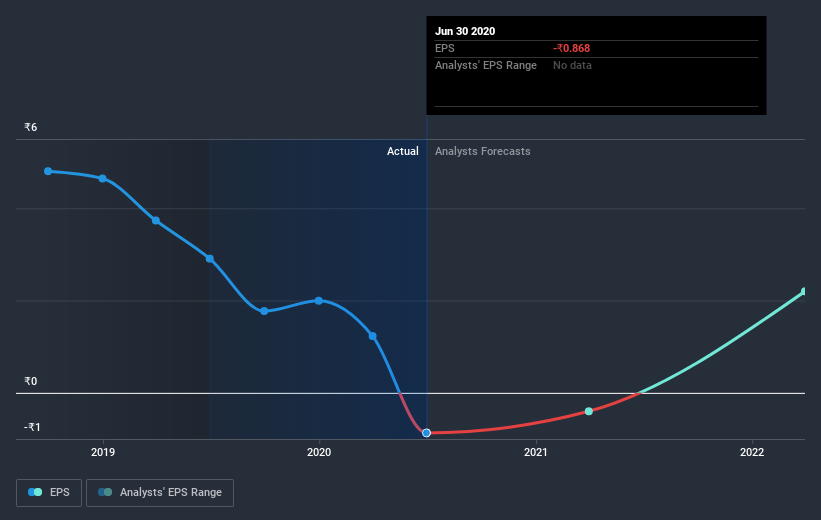

Rico Auto Industries saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Rico Auto Industries' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Rico Auto Industries shareholders are down 27% for the year (even including dividends), but the market itself is up 7.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Rico Auto Industries is showing 3 warning signs in our investment analysis , you should know about...

Of course Rico Auto Industries may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Rico Auto Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:RICOAUTO

Rico Auto Industries

An engineering company, manufactures and supplies high precision fully machined aluminum, and ferrous components and assemblies to automotive original equipment manufacturers worldwide.

Average dividend payer low.

Similar Companies

Market Insights

Community Narratives