- India

- /

- Metals and Mining

- /

- NSEI:GALLISPAT

If You Had Bought Gallantt Ispat (NSE:GALLISPAT) Stock A Year Ago, You Could Pocket A 41% Gain Today

If you want to compound wealth in the stock market, you can do so by buying an index fund. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Gallantt Ispat Limited (NSE:GALLISPAT) share price is 41% higher than it was a year ago, much better than the market return of around 2.5% (not including dividends) in the same period. So that should have shareholders smiling. Also impressive, the stock is up 40% over three years, making long term shareholders happy, too.

View our latest analysis for Gallantt Ispat

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year, Gallantt Ispat actually saw its earnings per share drop 65%.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Gallantt Ispat's revenue actually dropped 28% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

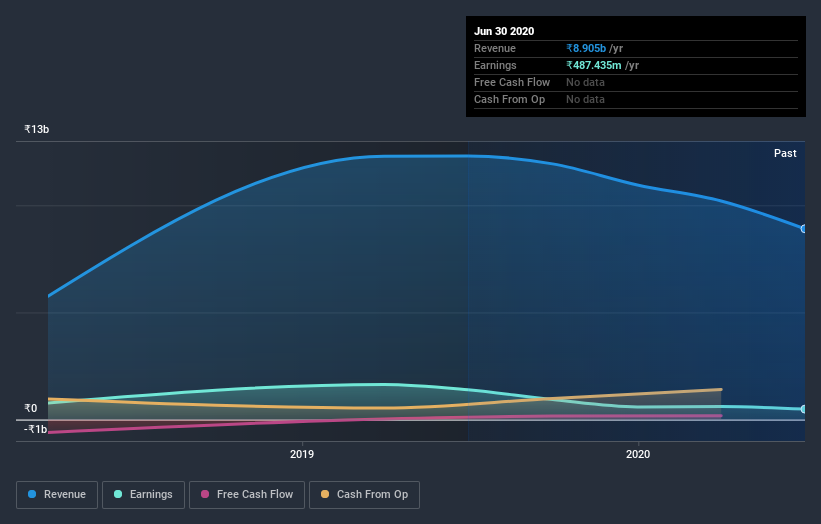

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Gallantt Ispat's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Gallantt Ispat shareholders have received a total shareholder return of 41% over one year. Notably the five-year annualised TSR loss of 6% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Gallantt Ispat better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Gallantt Ispat , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Gallantt Ispat, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:GALLISPAT

Gallantt Ispat

Gallantt Ispat Limited manufactures and sells iron and steel, and agro products under the Gallantt brand name in India.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives