- United States

- /

- Banks

- /

- NasdaqGS:HBAN

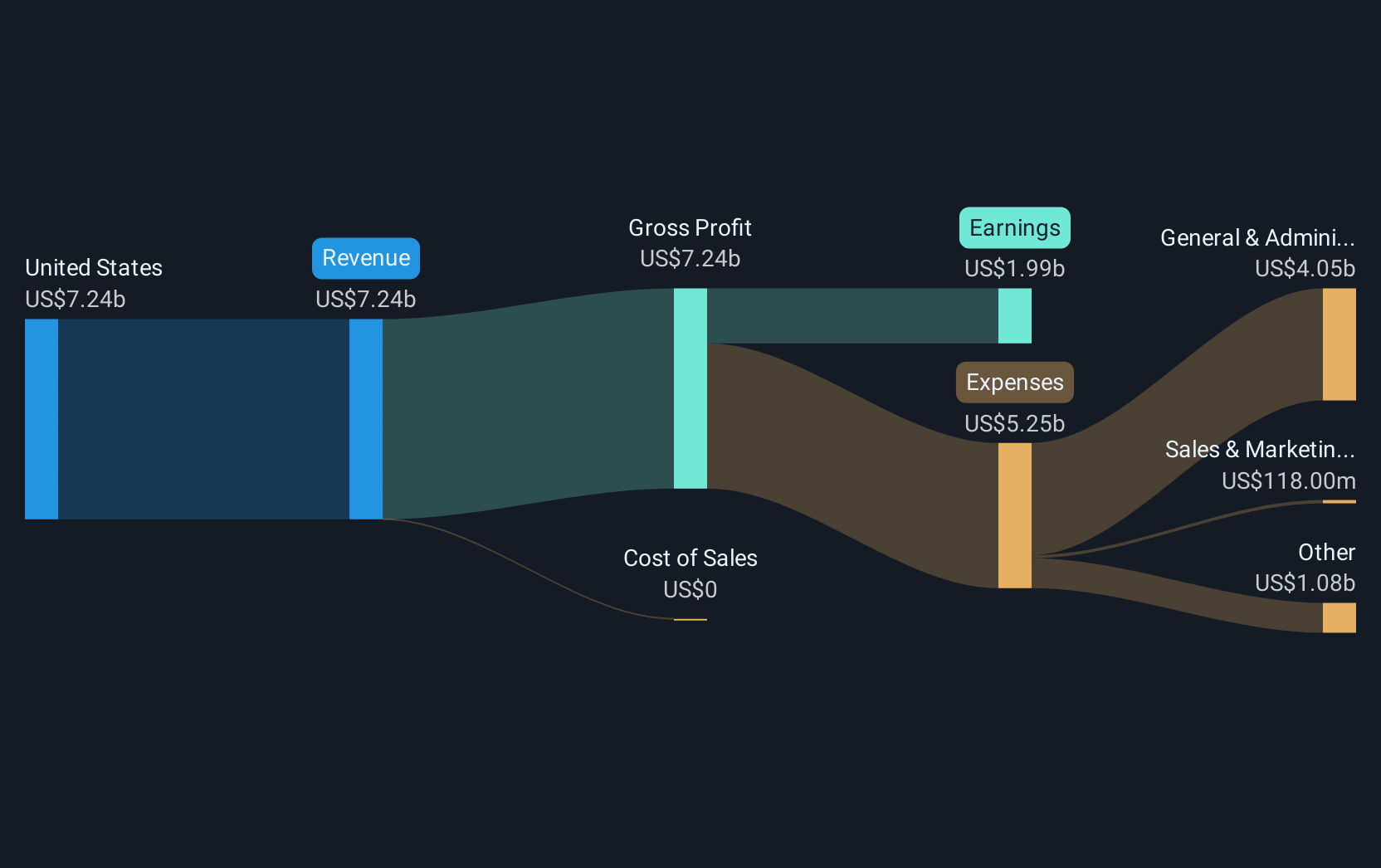

Huntington Bancshares (HBAN) Reports Higher Earnings With US$1,467 Million Net Interest Income

Reviewed by Simply Wall St

Huntington Bancshares (HBAN) recently reported increased earnings for the second quarter, with net income rising slightly from the previous year and significant growth in net interest income. During the last quarter, Huntington's stock price increased by 24%, a notable move in comparison to a flat market. The company's potential acquisition of Veritex Holdings and declared dividend on its preferred stock might have bolstered investor sentiment, aligning with strong overall market conditions despite some setbacks, such as declines in major stocks like Netflix and Amex. This favorable market climate for earnings likely contributed to Huntington's robust shareholder returns.

We've identified 1 warning sign for Huntington Bancshares that you should be aware of.

The recent rise in Huntington Bancshares' stock price by 24% in the last quarter reflects a positive shift in investor sentiment, possibly driven by increased earnings and net interest income. This change aligns well with Huntington's strategy to expand in high-fee revenue areas and manage deposits efficiently, projecting a stable earnings path despite looming economic uncertainties. The news of a potential acquisition could further bolster revenue and earnings forecasts, as it aims to enhance the company's long-term growth prospects. Analysts predict earnings to rise to US$2.3 billion by 2028, although the risks of economic uncertainties and competitive pressures could challenge these expectations. The current share price of $16.98 represents a discount to its consensus price target of approximately $19.15, suggesting room for potential upward movement, subject to realizing growth projections.

Over the past five years, Huntington's total shareholder return, including share price and dividends, reached a very large 120.59%, indicating strong performance over the long term. When contrasted with its recent 12-month performance, the stock has outpaced the broader US Market and remained on par with the US Banks Industry average of 18.4%. Notably, the board's authorization for a US$1 billion share repurchase reflects its confidence in sustaining robust shareholder returns. As the company's earnings grew 17.9% over the last year, surpassing its 5-year average of 16.5% annually, this historic growth underlines Huntington's potential to maintain an attractive total return for its shareholders moving forward.

Evaluate Huntington Bancshares' historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntington Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HBAN

Huntington Bancshares

Operates as the bank holding company for The Huntington National Bank that provides commercial, consumer, and mortgage banking services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives