Ashok Chaturvedi is the CEO of Uflex Limited (NSE:UFLEX), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Uflex

Comparing Uflex Limited's CEO Compensation With the industry

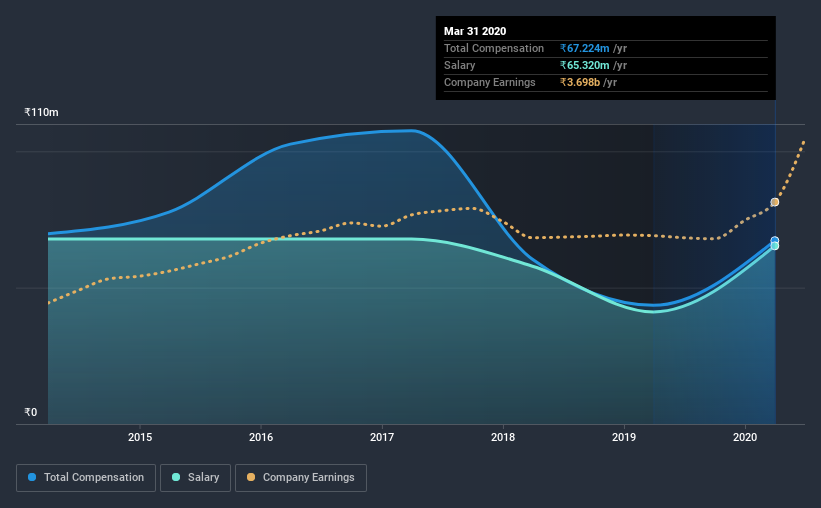

Our data indicates that Uflex Limited has a market capitalization of ₹23b, and total annual CEO compensation was reported as ₹67m for the year to March 2020. That's a notable increase of 55% on last year. Notably, the salary which is ₹65.3m, represents most of the total compensation being paid.

For comparison, other companies in the same industry with market capitalizations ranging between ₹15b and ₹59b had a median total CEO compensation of ₹17m. This suggests that Ashok Chaturvedi is paid more than the median for the industry. Furthermore, Ashok Chaturvedi directly owns ₹705m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹65m | ₹41m | 97% |

| Other | ₹1.9m | ₹2.4m | 3% |

| Total Compensation | ₹67m | ₹43m | 100% |

On an industry level, roughly 100% of total compensation represents salary and 0.1% is other remuneration. Uflex pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Uflex Limited's Growth Numbers

Uflex Limited has seen its earnings per share (EPS) increase by 10% a year over the past three years. It saw its revenue drop 6.3% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Uflex Limited Been A Good Investment?

With a three year total loss of 26% for the shareholders, Uflex Limited would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

Ashok receives almost all of their compensation through a salary. As we touched on above, Uflex Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. However, the EPS growth is certainly impressive, but it's disappointing to see negative shareholder returns over the same period. Although we'd stop short of calling it inappropriate, we think Ashok is earning a very handsome sum.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 4 warning signs for Uflex (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Uflex or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:UFLEX

Uflex

Manufactures and sells flexible packaging materials and solutions in India, the United States, Canada, Egypt, Europe, and internationally.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives