How Should Investors React To Ginni Filaments Limited's (NSE:GINNIFILA) CEO Pay?

The CEO of Ginni Filaments Limited (NSE:GINNIFILA) is Shishir Jaipuria. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Next, we'll consider growth that the business demonstrates. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. The aim of all this is to consider the appropriateness of CEO pay levels.

Check out our latest analysis for Ginni Filaments

How Does Shishir Jaipuria's Compensation Compare With Similar Sized Companies?

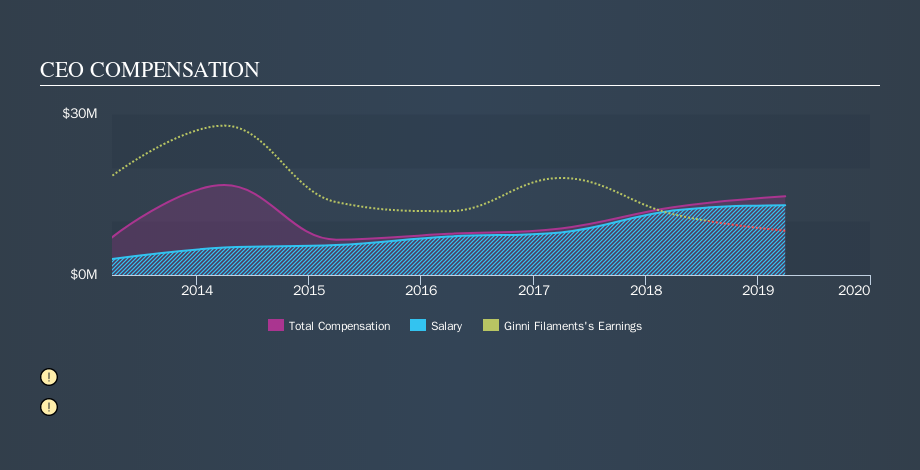

Our data indicates that Ginni Filaments Limited is worth ₹581m, and total annual CEO compensation was reported as ₹15m for the year to March 2019. While we always look at total compensation first, we note that the salary component is less, at ₹13m. We examined a group of similar sized companies, with market capitalizations of below ₹14b. The median CEO total compensation in that group is ₹2.4m.

It would therefore appear that Ginni Filaments Limited pays Shishir Jaipuria more than the median CEO remuneration at companies of a similar size, in the same market. However, this fact alone doesn't mean the remuneration is too high. We can better assess whether the pay is overly generous by looking into the underlying business performance. Although we don't have analyst forecasts you might want to assess this data-rich visualization of earnings, revenue and cash flow.

The graphic below shows how CEO compensation at Ginni Filaments has changed from year to year.

Is Ginni Filaments Limited Growing?

Ginni Filaments Limited has reduced its earnings per share by an average of 94% a year, over the last three years (measured with a line of best fit). It achieved revenue growth of 4.7% over the last year.

Sadly for shareholders, earnings per share are actually down, over three years. The fairly low revenue growth fails to impress given that the earnings per share is down. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO.

Has Ginni Filaments Limited Been A Good Investment?

Given the total loss of 58% over three years, many shareholders in Ginni Filaments Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

We compared the total CEO remuneration paid by Ginni Filaments Limited, and compared it to remuneration at a group of similar sized companies. We found that it pays well over the median amount paid in the benchmark group.

Neither earnings per share nor revenue have been growing sufficiently to impress us, over the last three years. Just as bad, share price gains for investors have failed to materialize, over the same period. This analysis suggests to us that the CEO is paid too generously! So you may want to check if insiders are buying Ginni Filaments shares with their own money (free access).

If you want to buy a stock that is better than Ginni Filaments, this free list of high return, low debt companies is a great place to look.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:GINNIFILA

Ginni Filaments

Engages in the manufacture and sale of textile products in India and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)