The CEO of Umanis SA (EPA:ALUMS) is Laurent Piepszownik, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Umanis.

See our latest analysis for Umanis

How Does Total Compensation For Laurent Piepszownik Compare With Other Companies In The Industry?

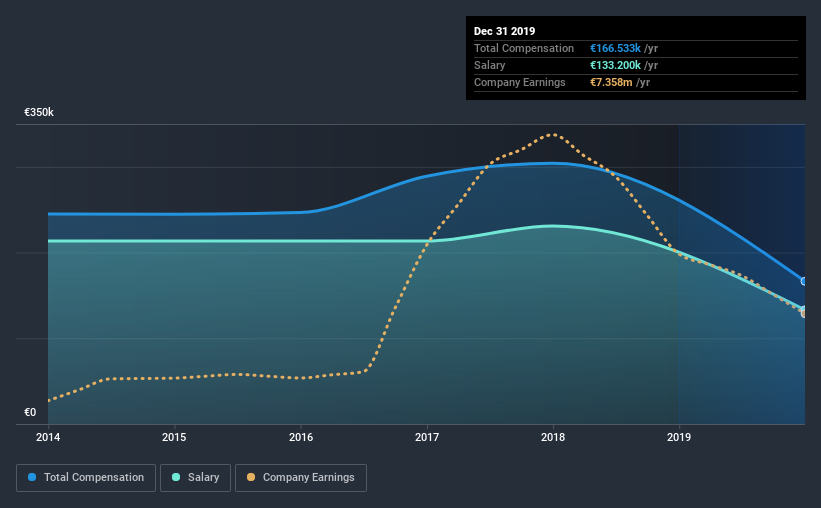

According to our data, Umanis SA has a market capitalization of €86m, and paid its CEO total annual compensation worth €167k over the year to December 2019. Notably, that's a decrease of 45% over the year before. We note that the salary portion, which stands at €133.2k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below €178m, we found that the median total CEO compensation was €313k. In other words, Umanis pays its CEO lower than the industry median.

| Component | 2019 | 2017 | Proportion (2019) |

| Salary | €133k | €231k | 80% |

| Other | €33k | €73k | 20% |

| Total Compensation | €167k | €304k | 100% |

Speaking on an industry level, nearly 56% of total compensation represents salary, while the remainder of 44% is other remuneration. Umanis pays out 80% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Umanis SA's Growth Numbers

Over the last three years, Umanis SA has shrunk its earnings per share by 15% per year. Its revenue is up 6.0% over the last year.

Overall this is not a very positive result for shareholders. The fairly low revenue growth fails to impress given that the earnings per share is down. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Umanis SA Been A Good Investment?

Given the total shareholder loss of 51% over three years, many shareholders in Umanis SA are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As previously discussed, Laurent is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. While we are quite underwhelmed with earnings growth, the shareholder returns over the past three years have also failed to impress us. We can't say the CEO compensation is high, but shareholders will be cold to a bump at this stage, considering negative investor returns.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 5 warning signs for Umanis (2 don't sit too well with us!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Umanis, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:ALUMS

Excellent balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

OPAP S.A.: Merger Momentum and Greek Gaming Resilience

A Global Powerhouse in the Making

If gold reaches $4,000 per oz

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion