- United States

- /

- Banks

- /

- NasdaqCM:FLIC

How Much Are The First of Long Island Corporation (NASDAQ:FLIC) Insiders Taking Off The Table?

It is not uncommon to see companies perform well in the years after insiders buy shares. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So we'll take a look at whether insiders have been buying or selling shares in The First of Long Island Corporation (NASDAQ:FLIC).

Do Insider Transactions Matter?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, rules govern insider transactions, and certain disclosures are required.

Insider transactions are not the most important thing when it comes to long-term investing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year.

See our latest analysis for First of Long Island

The Last 12 Months Of Insider Transactions At First of Long Island

The Director, Michael Vittorio, made the biggest insider sale in the last 12 months. That single transaction was for US$349k worth of shares at a price of US$23.27 each. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. The good news is that this large sale was at well above current price of US$15.17. So it is hard to draw any strong conclusion from it.

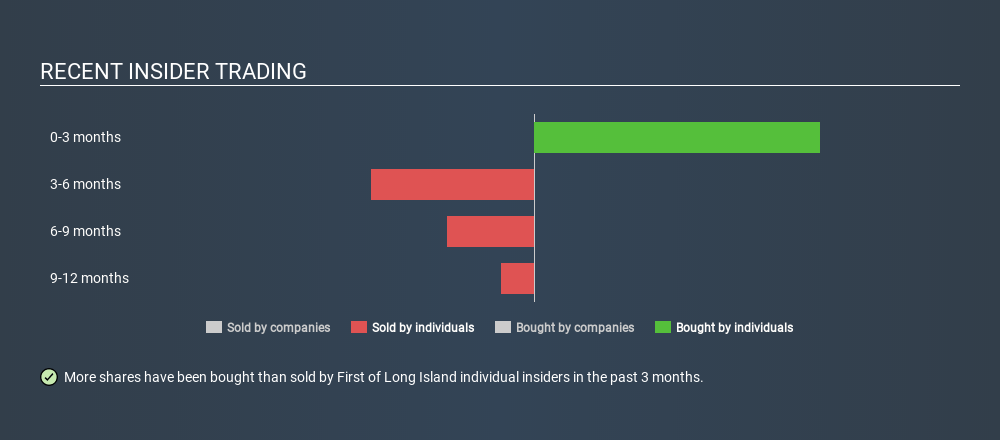

In the last twelve months insiders purchased 26.39k shares for US$416k. But they sold 26000 shares for US$603k. In total, First of Long Island insiders sold more than they bought over the last year. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insiders at First of Long Island Have Bought Stock Recently

Over the last three months, we've seen significant insider buying at First of Long Island. In total, insiders bought US$416k worth of shares in that time, and we didn't record any sales whatsoever. That shows some optimism about the company's future.

Insider Ownership of First of Long Island

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. I reckon it's a good sign if insiders own a significant number of shares in the company. First of Long Island insiders own about US$21m worth of shares. That equates to 5.8% of the company. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

So What Does This Data Suggest About First of Long Island Insiders?

The recent insider purchases are heartening. However, the longer term transactions are not so encouraging. While recent transactions indicate confidence in First of Long Island, insiders don't own enough of the company to overcome our cautiousness about the longer term transactions. So they seem pretty well aligned, overall. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. For instance, we've identified 2 warning signs for First of Long Island (1 is a bit concerning) you should be aware of.

But note: First of Long Island may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NasdaqCM:FLIC

First of Long Island

Operates as a bank holding company for The First National Bank of Long Island that provides financial services to small and medium market businesses, professional service firms, not-for-profits, municipalities, and consumers in the United States.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives