How Does Sutlej Textiles and Industries' (NSE:SUTLEJTEX) CEO Salary Compare to Peers?

The CEO of Sutlej Textiles and Industries Limited (NSE:SUTLEJTEX) is Suresh Khandelia, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Sutlej Textiles and Industries pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Sutlej Textiles and Industries

Comparing Sutlej Textiles and Industries Limited's CEO Compensation With the industry

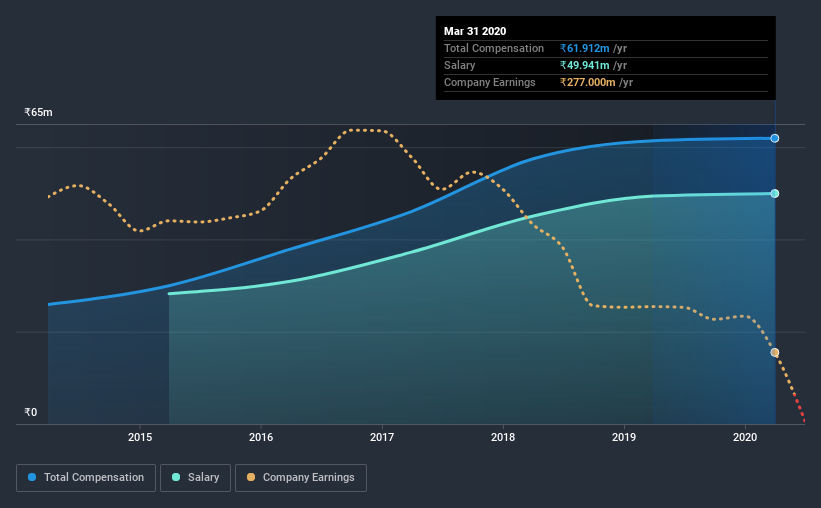

At the time of writing, our data shows that Sutlej Textiles and Industries Limited has a market capitalization of ₹4.6b, and reported total annual CEO compensation of ₹62m for the year to March 2020. That is, the compensation was roughly the same as last year. Notably, the salary which is ₹49.9m, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below ₹15b, reported a median total CEO compensation of ₹4.2m. This suggests that Suresh Khandelia is paid more than the median for the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹50m | ₹49m | 81% |

| Other | ₹12m | ₹12m | 19% |

| Total Compensation | ₹62m | ₹61m | 100% |

Talking in terms of the industry, salary represents all of total compensation among the companies we analyzed, while other remuneration is, interestingly, completely ignored. Sutlej Textiles and Industries pays a modest slice of remuneration through salary, as compared to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Sutlej Textiles and Industries Limited's Growth

Over the last three years, Sutlej Textiles and Industries Limited has shrunk its earnings per share by 60% per year. Its revenue is down 26% over the previous year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Sutlej Textiles and Industries Limited Been A Good Investment?

With a three year total loss of 69% for the shareholders, Sutlej Textiles and Industries Limited would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As we touched on above, Sutlej Textiles and Industries Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Unfortunately, this doesn't look great when you see shareholder returns have been negative over the last three years. To make matters worse, EPS growth has also been negative during this period. Considering such poor performance, we think shareholders might be concerned if the CEO's compensation were to grow.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 5 warning signs for Sutlej Textiles and Industries you should be aware of, and 2 of them can't be ignored.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Sutlej Textiles and Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:SUTLEJTEX

Sutlej Textiles and Industries

Designs, manufactures, and distributes textiles to wholesalers, manufacturers, and retailers for the home furnishing industry in India, Bangladesh, Turkey, the United States of America, Hong Kong, Singapore, and internationally.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion