How Does GSS Infotech's (NSE:GSS) P/E Compare To Its Industry, After Its Big Share Price Gain?

The GSS Infotech (NSE:GSS) share price has done well in the last month, posting a gain of 34%. However, that doesn't change the fact that longer term shareholders might have been mercilessly wrecked by the 70% share price decline throughout the year.

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). So some would prefer to hold off buying when there is a lot of optimism towards a stock. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

Check out our latest analysis for GSS Infotech

Does GSS Infotech Have A Relatively High Or Low P/E For Its Industry?

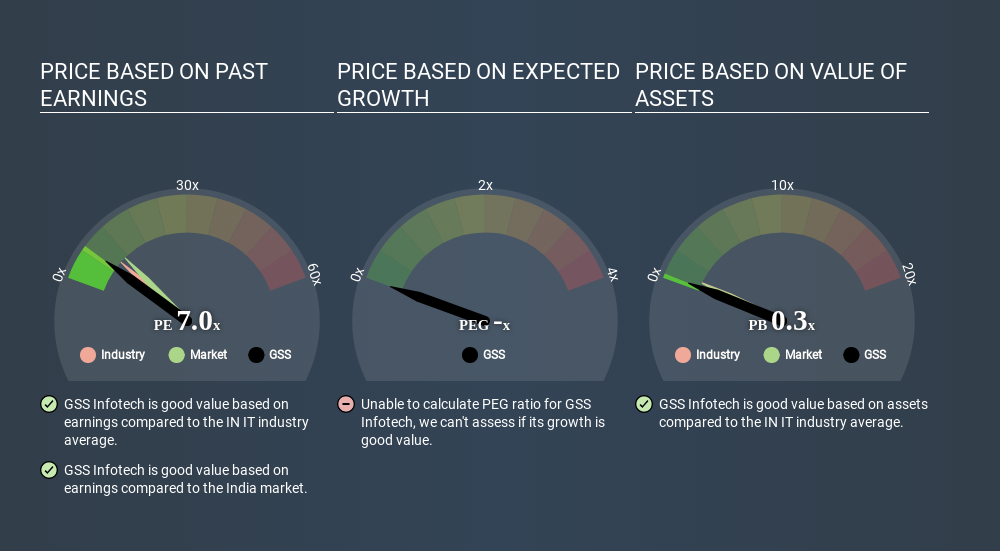

We can tell from its P/E ratio of 7.71 that sentiment around GSS Infotech isn't particularly high. We can see in the image below that the average P/E (9.3) for companies in the it industry is higher than GSS Infotech's P/E.

GSS Infotech's P/E tells us that market participants think it will not fare as well as its peers in the same industry. While current expectations are low, the stock could be undervalued if the situation is better than the market assumes. If you consider the stock interesting, further research is recommended. For example, I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. Earnings growth means that in the future the 'E' will be higher. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

GSS Infotech saw earnings per share decrease by 48% last year.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

The 'Price' in P/E reflects the market capitalization of the company. Thus, the metric does not reflect cash or debt held by the company. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

GSS Infotech's Balance Sheet

GSS Infotech has net cash of ₹33m. That should lead to a higher P/E than if it did have debt, because its strong balance sheets gives it more options.

The Bottom Line On GSS Infotech's P/E Ratio

GSS Infotech has a P/E of 7.7. That's below the average in the IN market, which is 11.3. The recent drop in earnings per share would make investors cautious, the healthy balance sheet means the company retains potential for future growth. If that occurs, the current low P/E could prove to be temporary. What is very clear is that the market has become less pessimistic about GSS Infotech over the last month, with the P/E ratio rising from 5.8 back then to 7.7 today. If you like to buy stocks that could be turnaround opportunities, then this one might be a candidate; but if you're more sensitive to price, then you may feel the opportunity has passed.

Investors should be looking to buy stocks that the market is wrong about. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. We don't have analyst forecasts, but shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

But note: GSS Infotech may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:GSS

GSS Infotech

Provides information technology (IT) services in India, Bangladesh, and the United States.

Slightly overvalued with imperfect balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion