- United States

- /

- Banks

- /

- NasdaqGM:FRST

Here's Why We Think Southern National Bancorp of Virginia (NASDAQ:SONA) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Southern National Bancorp of Virginia (NASDAQ:SONA). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Southern National Bancorp of Virginia

How Fast Is Southern National Bancorp of Virginia Growing?

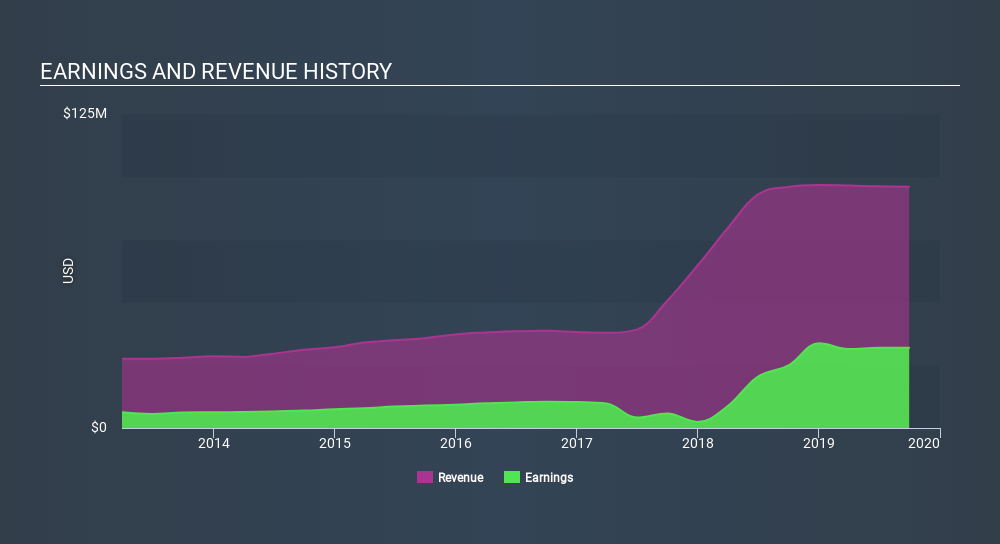

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. Southern National Bancorp of Virginia managed to grow EPS by 16% per year, over three years. That's a pretty good rate, if the company can sustain it.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Southern National Bancorp of Virginia's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. It seems Southern National Bancorp of Virginia is pretty stable, since revenue and EBIT margins are pretty flat year on year. That's not bad, but it doesn't point to ongoing future growth, either.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Southern National Bancorp of Virginia's balance sheet strength, before getting too excited.

Are Southern National Bancorp of Virginia Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see Southern National Bancorp of Virginia insiders walking the walk, by spending US$372k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. Zooming in, we can see that the biggest insider purchase was by Co-Founder & Executive Chairman Georgia Derrico for US$36k worth of shares, at about US$15.00 per share.

On top of the insider buying, it's good to see that Southern National Bancorp of Virginia insiders have a valuable investment in the business. Indeed, they hold US$18m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 4.7% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Joe Shearin, is paid less than the median for similar sized companies. For companies with market capitalizations between US$200m and US$800m, like Southern National Bancorp of Virginia, the median CEO pay is around US$1.7m.

Southern National Bancorp of Virginia offered total compensation worth US$1.1m to its CEO in the year to December 2018. That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Southern National Bancorp of Virginia Deserve A Spot On Your Watchlist?

One important encouraging feature of Southern National Bancorp of Virginia is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Southern National Bancorp of Virginia is trading on a high P/E or a low P/E, relative to its industry.

As a growth investor I do like to see insider buying. But Southern National Bancorp of Virginia isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGM:FRST

Primis Financial

Operates as the bank holding company for Primis Bank that provides various financial services to individuals, and small and medium sized businesses in the United States.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives