Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Dhunseri Ventures Limited (NSE:DVL) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Dhunseri Ventures

How Much Debt Does Dhunseri Ventures Carry?

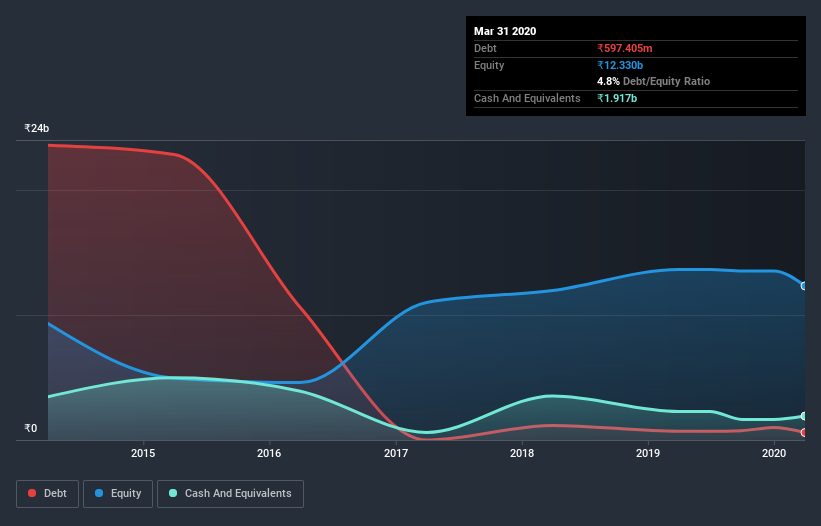

You can click the graphic below for the historical numbers, but it shows that Dhunseri Ventures had ₹597.4m of debt in March 2020, down from ₹697.6m, one year before. However, it does have ₹1.92b in cash offsetting this, leading to net cash of ₹1.32b.

How Strong Is Dhunseri Ventures's Balance Sheet?

The latest balance sheet data shows that Dhunseri Ventures had liabilities of ₹415.5m due within a year, and liabilities of ₹2.04b falling due after that. Offsetting these obligations, it had cash of ₹1.92b as well as receivables valued at ₹12.3m due within 12 months. So it has liabilities totalling ₹527.0m more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Dhunseri Ventures has a market capitalization of ₹1.82b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. Despite its noteworthy liabilities, Dhunseri Ventures boasts net cash, so it's fair to say it does not have a heavy debt load!

Shareholders should be aware that Dhunseri Ventures's EBIT was down 95% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Dhunseri Ventures's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Dhunseri Ventures may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, Dhunseri Ventures burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing up

While Dhunseri Ventures does have more liabilities than liquid assets, it also has net cash of ₹1.32b. Despite the cash, we do find Dhunseri Ventures's EBIT growth rate concerning, so we're not particularly comfortable with the stock. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 4 warning signs we've spotted with Dhunseri Ventures (including 1 which is is concerning) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Dhunseri Ventures or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:DVL

Dhunseri Ventures

Engages in the treasury operations in shares and securities in India.

Average dividend payer with mediocre balance sheet.

Market Insights

Community Narratives