- India

- /

- Real Estate

- /

- NSEI:KOLTEPATIL

Here's What We Think About Kolte-Patil Developers' (NSE:KOLTEPATIL) CEO Pay

Gopal Sarda has been the CEO of Kolte-Patil Developers Limited (NSE:KOLTEPATIL) since 2017, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Kolte-Patil Developers.

See our latest analysis for Kolte-Patil Developers

Comparing Kolte-Patil Developers Limited's CEO Compensation With the industry

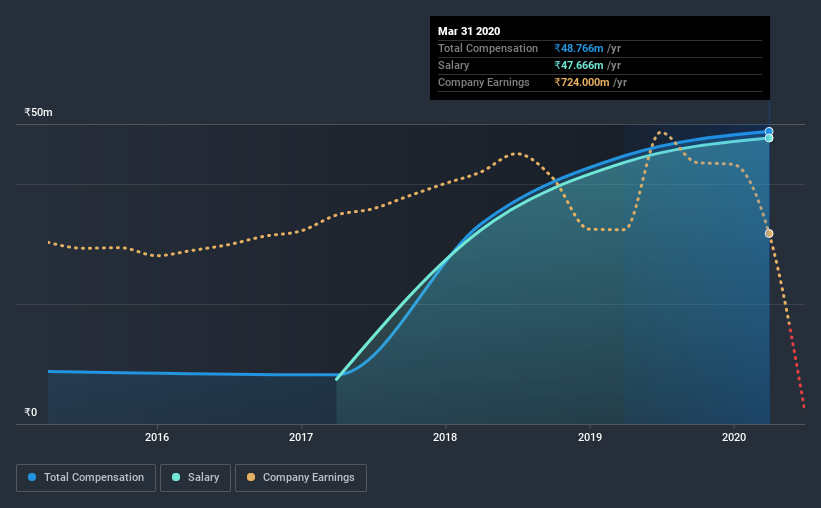

According to our data, Kolte-Patil Developers Limited has a market capitalization of ₹13b, and paid its CEO total annual compensation worth ₹49m over the year to March 2020. We note that's an increase of 9.1% above last year. In particular, the salary of ₹47.7m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from ₹7.5b to ₹30b, we found that the median CEO total compensation was ₹19m. Accordingly, our analysis reveals that Kolte-Patil Developers Limited pays Gopal Sarda north of the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹48m | ₹44m | 98% |

| Other | ₹1.1m | ₹1.1m | 2% |

| Total Compensation | ₹49m | ₹45m | 100% |

Speaking on an industry level, all of total compensation represents salary, while non-salary remuneration is completely ignored. Kolte-Patil Developers is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Kolte-Patil Developers Limited's Growth

Over the last three years, Kolte-Patil Developers Limited has shrunk its earnings per share by 22% per year. It saw its revenue drop 36% over the last year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Kolte-Patil Developers Limited Been A Good Investment?

Since shareholders would have lost about 30% over three years, some Kolte-Patil Developers Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Kolte-Patil Developers pays its CEO a majority of compensation through a salary. As we touched on above, Kolte-Patil Developers Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Unfortunately, this doesn't look great when you see shareholder returns have been negative over the last three years. To make matters worse, EPS growth has also been negative during this period. Understandably, the company's shareholders might have some questions about the CEO's remuneration, given the disappointing performance.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 1 warning sign for Kolte-Patil Developers that investors should look into moving forward.

Switching gears from Kolte-Patil Developers, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Kolte-Patil Developers, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Kolte-Patil Developers, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kolte-Patil Developers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:KOLTEPATIL

Kolte-Patil Developers

Operates as a real estate development company in India.

Very undervalued with exceptional growth potential.

Similar Companies

Market Insights

Community Narratives