- Canada

- /

- Other Utilities

- /

- TSX:AQN

Here's What Algonquin Power & Utilities Corp.'s (TSE:AQN) P/E Ratio Is Telling Us

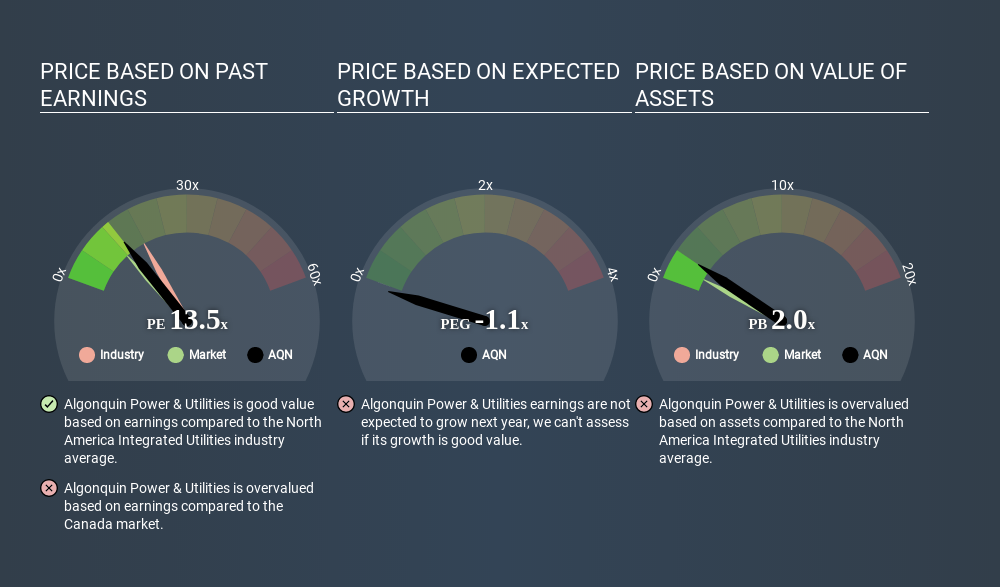

The goal of this article is to teach you how to use price to earnings ratios (P/E ratios). We'll apply a basic P/E ratio analysis to Algonquin Power & Utilities Corp.'s (TSE:AQN), to help you decide if the stock is worth further research. Algonquin Power & Utilities has a price to earnings ratio of 13.49, based on the last twelve months. That corresponds to an earnings yield of approximately 7.4%.

View our latest analysis for Algonquin Power & Utilities

How Do I Calculate Algonquin Power & Utilities's Price To Earnings Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Share Price (in reporting currency) ÷ Earnings per Share (EPS)

Or for Algonquin Power & Utilities:

P/E of 13.49 = $14.099 ÷ $1.045 (Based on the year to December 2019.)

(Note: the above calculation uses the share price in the reporting currency, namely USD and the calculation results may not be precise due to rounding.)

Is A High Price-to-Earnings Ratio Good?

The higher the P/E ratio, the higher the price tag of a business, relative to its trailing earnings. That isn't a good or a bad thing on its own, but a high P/E means that buyers have a higher opinion of the business's prospects, relative to stocks with a lower P/E.

How Does Algonquin Power & Utilities's P/E Ratio Compare To Its Peers?

One good way to get a quick read on what market participants expect of a company is to look at its P/E ratio. If you look at the image below, you can see Algonquin Power & Utilities has a lower P/E than the average (17.5) in the integrated utilities industry classification.

Algonquin Power & Utilities's P/E tells us that market participants think it will not fare as well as its peers in the same industry. Many investors like to buy stocks when the market is pessimistic about their prospects. If you consider the stock interesting, further research is recommended. For example, I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

Earnings growth rates have a big influence on P/E ratios. That's because companies that grow earnings per share quickly will rapidly increase the 'E' in the equation. That means unless the share price increases, the P/E will reduce in a few years. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

Algonquin Power & Utilities's earnings made like a rocket, taking off 173% last year. The sweetener is that the annual five year growth rate of 41% is also impressive. With that kind of growth rate we would generally expect a high P/E ratio.

Remember: P/E Ratios Don't Consider The Balance Sheet

The 'Price' in P/E reflects the market capitalization of the company. Thus, the metric does not reflect cash or debt held by the company. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

Is Debt Impacting Algonquin Power & Utilities's P/E?

Algonquin Power & Utilities's net debt is 53% of its market cap. This is enough debt that you'd have to make some adjustments before using the P/E ratio to compare it to a company with net cash.

The Verdict On Algonquin Power & Utilities's P/E Ratio

Algonquin Power & Utilities's P/E is 13.5 which is above average (11.8) in its market. Its meaningful level of debt should warrant a lower P/E ratio, but the fast EPS growth is a positive. So despite the debt it is, perhaps, not unreasonable to see a high P/E ratio.

Investors should be looking to buy stocks that the market is wrong about. If the reality for a company is better than it expects, you can make money by buying and holding for the long term. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:AQN

Algonquin Power & Utilities

Operates in the power and utility industries.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)