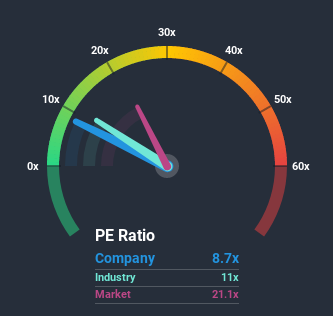

With a price-to-earnings (or "P/E") ratio of 8.7x HeidelbergCement AG (ETR:HEI) may be sending very bullish signals at the moment, given that almost half of all companies in Germany have P/E ratios greater than 22x and even P/E's higher than 36x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

The recently shrinking earnings for HeidelbergCement have been in line with the market. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

View our latest analysis for HeidelbergCement

Does HeidelbergCement Have A Relatively High Or Low P/E For Its Industry?

We'd like to see if P/E's within HeidelbergCement's industry might provide some colour around the company's particularly low P/E ratio. The image below shows that the Basic Materials industry as a whole also has a P/E ratio lower than the market. So we'd say there could be some merit in the premise that the company's ratio being shaped by its industry at this time. Some industry P/E's don't move around a lot and right now most companies within the Basic Materials industry should be getting stifled. We'd highlight though, the spotlight should be on the anticipated direction of the company's earnings.

Does Growth Match The Low P/E?

HeidelbergCement's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 2.9%. Even so, admirably EPS has lifted 66% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 2.1% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 11% each year, which is noticeably more attractive.

With this information, we can see why HeidelbergCement is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of HeidelbergCement's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for HeidelbergCement you should know about.

If you're unsure about the strength of HeidelbergCement's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

When trading HeidelbergCement or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

Valuation is complex, but we're here to simplify it.

Discover if Heidelberg Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About XTRA:HEI

Heidelberg Materials

Produces and distributes cement, aggregates, ready-mixed concrete, and asphalt worldwide.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives