- United States

- /

- Aerospace & Defense

- /

- NYSE:HEI

HEICO (NYSE:HEI) Reports Q2 Sales Surge to US$1,098M and Net Income Rises to US$157M

Reviewed by Simply Wall St

HEICO (NYSE:HEI) announced strong Q2 2025 earnings with a 15% increase in sales and a 27% rise in net income. This robust financial performance was accompanied by a leadership transition, with Eric and Victor Mendelson stepping in as Co-CEOs, aligning with strategic planning. During the last quarter, HEICO's shares rose 20%, a sharp contrast to the largely stable market conditions characterized by investors' anticipation of Nvidia's earnings. The company's solid earnings report, combined with a leadership shift, added notable momentum to its price movement, diverging from a broader market that remained relatively flat.

We've spotted 2 risks for HEICO you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

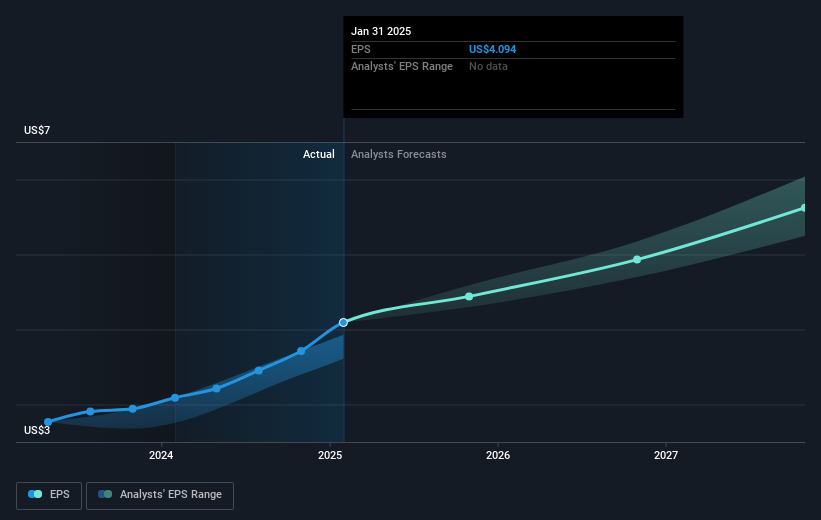

The recent announcement of strong Q2 2025 earnings, with a 15% increase in sales and a 27% rise in net income, along with the leadership transition at HEICO, has the potential to bolster investor confidence and align with analysts' expectations for the company's growth in the defense, space, and commercial aviation sectors. The leadership changes reinforce the company's strategic direction, which is anticipated to sustain earnings and revenue expansion, as projected by analysts who expect revenues to achieve $5 billion by 2028, supported by a forecasted annual growth rate of 7.9%.

Over the past five years, HEICO's total shareholder returns, which include both share price appreciation and dividends, amounted to 167.51%. This performance provides a significant long-term context compared to the one-year returns where the company's share price increased by 29%, matching the returns of the US Aerospace & Defense industry. The recent 20% quarterly share price rise also suggests a short-term positive momentum, aligning with the price target of US$268.85, which is slightly above the current share price of US$263.48. This small 2% discount to the price target indicates analysts' consensus belief in the company's fair valuation.

Despite the current economic uncertainties that could influence spending in key sectors, HEICO's resilience in strategic markets hints at steady revenue and earnings potential. The company's focus on areas favored by the pro-business agenda could benefit its positioning. However, cost pressures and potential reductions in defense budgets remain risks. Investors should consider how these developments align with HEICO's long-term goals and the analysts' assumptions about its valuation trajectory.

Learn about HEICO's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HEICO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HEI

HEICO

Through its subsidiaries, designs, manufactures, and sells aerospace, defense, and electronic related products and services in the United States and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives