- United States

- /

- Capital Markets

- /

- NYSE:GS

Goldman Sachs Group (NYSE:GS) Appoints Raghav Maliah As Global Chairman Of Investment Banking

Reviewed by Simply Wall St

Goldman Sachs Group (NYSE:GS) experienced a 40% price surge over the last quarter, coinciding with a series of significant developments within the company and favorable overall market conditions. The appointment of Raghav Maliah as Chairman of Investment Banking is a key highlight, reflecting a strategic leadership expansion. Concurrently, strong market sentiment, marked by the S&P 500 and Nasdaq hitting record highs, may have provided an additional boost. Noteworthy developments like the firm’s share repurchase program and Goldman Sachs's addition to the Russell Top 50 bolstered investor confidence, aligning with broader market gains of 13% over the past year.

We've spotted 2 weaknesses for Goldman Sachs Group you should be aware of.

The recent leadership changes and market conditions have contributed to a strong quarter for Goldman Sachs Group, which saw a significant price surge. By appointing Raghav Maliah as Chairman of Investment Banking and introducing a share repurchase program, the company aims to enhance operational efficiency and investor confidence. The inclusion in the Russell Top 50 and achievement of record highs by major indices like the S&P 500 further spotlight investor optimism.

Over a five-year period, Goldman Sachs shares have delivered a remarkable total return of very large, signaling substantial value creation for shareholders. However, in the past year, while the company outpaced the overall US Market return of 13.2%, it exceeded the US Capital Markets industry's impressive return of 34.9%. This showcases the company’s substantial competitive positioning within its sector.

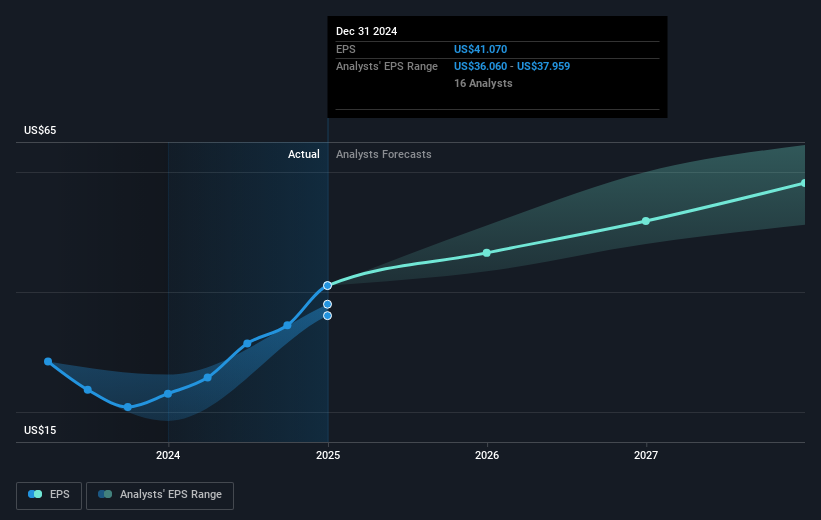

The current developments have potential implications for both revenue and earnings forecasts. Goldman Sachs's AI integration and automation efforts are projected to improve operational efficiency, likely enhancing net margins and long-term growth prospects. Positive shifts in M&A advisory backlogs suggest possible future revenue expansion. However, the current share price of US$549.36, slightly below the analyst consensus price target of US$585.58, implies limited upside according to prevailing market assessments. Nonetheless, the multiyear share repurchase plan valued at US$40 billion may offer some capital return flexibility, potentially supporting future earnings per share growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives