- United States

- /

- Capital Markets

- /

- NYSE:GS

Goldman Sachs Group (GS) Collaborates with Elevation Point to Enhance Advisory Solutions

Reviewed by Simply Wall St

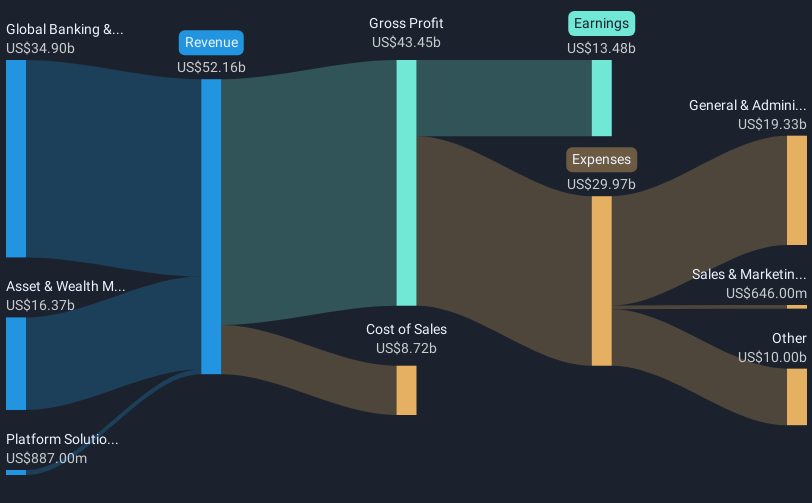

Recently, Elevation Point partnered with Goldman Sachs Group (GS) to bolster offerings for independent advisors, enhancing access across banking and capital markets. This collaboration, alongside strong Q2 earnings and a 33% dividend boost, likely added weight to Goldman Sachs’s 22% price rise last quarter. While the broader market advanced modestly with the S&P 500 up and increased Treasury yields, Goldman Sachs's strategic expansions and increased involvement in financial advisory and asset management could have amplified positive investor sentiment, reinforcing its competitive stance against a backdrop of burgeoning tech gains and interest rate speculations.

Goldman Sachs Group has 2 risks we think you should know about.

The partnership between Elevation Point and Goldman Sachs Group (GS) could bolster long-term revenue streams by enhancing offerings in banking and capital markets. This aligns well with the prior narrative's focus on stable, high-margin revenue streams driven by M&A activity and client demand. The strategic expansion into financial advisory and asset management is anticipated to positively influence GS's earnings forecasts, possibly increasing efficiency via AI and digital transformation.

Over a five-year period, Goldman Sachs's total shareholder return, including share price and dividends, was over 306.67%, a very large increase when compared to the recent one-year performance where it exceeded the US Capital Markets industry return of 33.6% and the broader US market return of 17.5%. This highlights GS's robust performance despite fluctuations in shorter-term markets.

Currently, Goldman Sachs's shares trade at US$730.85, slightly above the analysts' consensus price target of US$710.58, representing a 2.77% premium. This suggests that the company's market valuation has priced in some of the expected revenue gains and strategic advantages from recent developments. However, analysts remain cautious, with price targets ranging from US$538 to US$815, reflecting differing views on the company's future earnings growth and profit margins.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives