- China

- /

- Electrical

- /

- SHSE:688567

Global's Hidden Value: September 2025 Stocks That May Be Trading Below Their Estimated Worth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate expectations and AI-driven optimism, major indices like the Dow Jones and S&P 500 have recently reached new highs. Amidst these developments, identifying undervalued stocks can be particularly appealing as investors seek opportunities that may offer potential value in an environment of fluctuating economic indicators.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiyo Yuden (TSE:6976) | ¥3148.00 | ¥6236.19 | 49.5% |

| Q & M Dental Group (Singapore) (SGX:QC7) | SGD0.485 | SGD0.97 | 49.8% |

| Jiangxi Rimag Group (SEHK:2522) | HK$17.44 | HK$34.42 | 49.3% |

| Inspur Digital Enterprise Technology (SEHK:596) | HK$9.77 | HK$19.34 | 49.5% |

| HL Holdings (KOSE:A060980) | ₩41100.00 | ₩82081.75 | 49.9% |

| Gofore Oyj (HLSE:GOFORE) | €14.72 | €29.33 | 49.8% |

| Food Empire Holdings (SGX:F03) | SGD2.59 | SGD5.13 | 49.6% |

| Faraday Technology (TWSE:3035) | NT$150.50 | NT$300.45 | 49.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.40 | €6.76 | 49.7% |

| adidas (XTRA:ADS) | €175.75 | €350.24 | 49.8% |

Let's uncover some gems from our specialized screener.

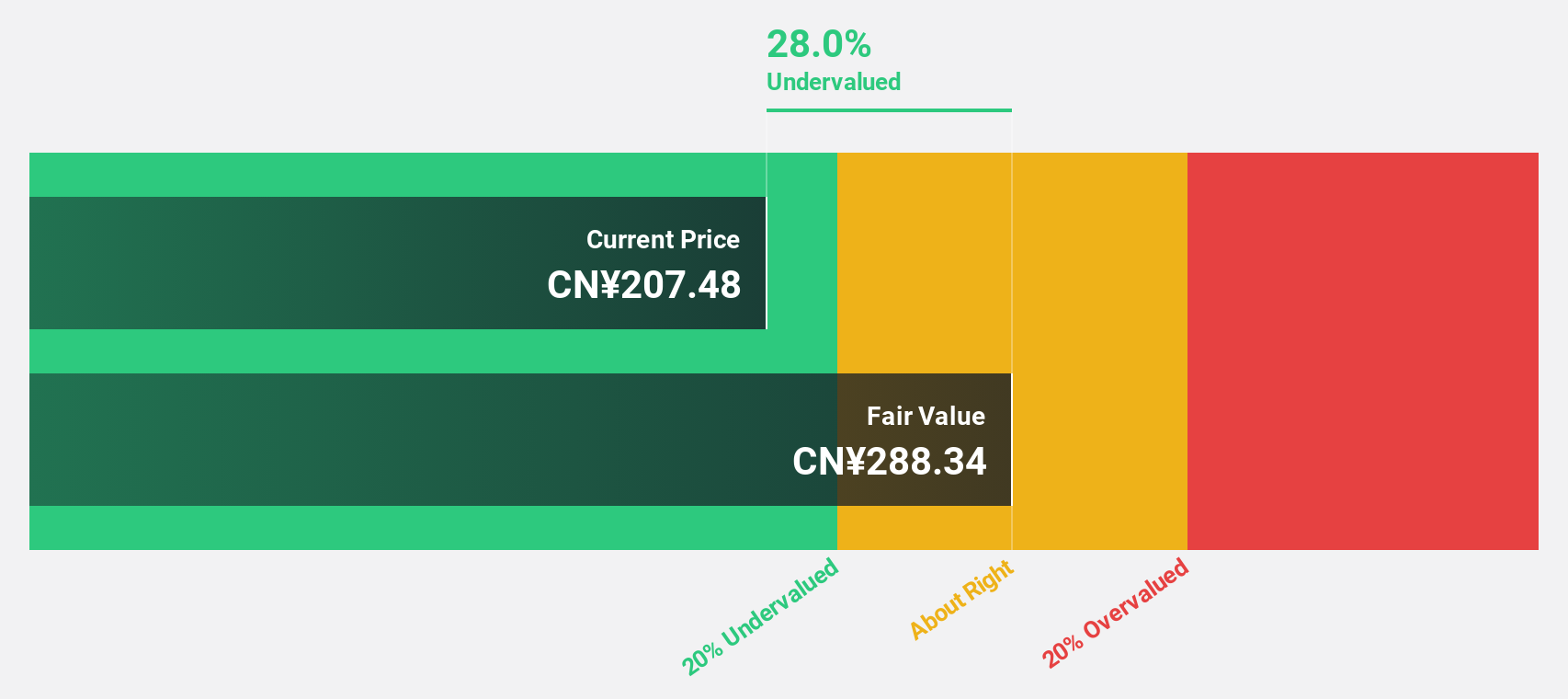

Beijing Roborock Technology (SHSE:688169)

Overview: Beijing Roborock Technology Co., Ltd. focuses on the research, development, and production of home cleaning devices in China, with a market cap of CN¥52.89 billion.

Operations: The company's revenue primarily comes from its Intelligent Cleaning Products segment, which generated CN¥15.43 billion.

Estimated Discount To Fair Value: 28.5%

Beijing Roborock Technology is trading at CN¥218, significantly below its estimated fair value of CN¥305.03, indicating undervaluation based on cash flows. Despite a decline in profit margins from 25.1% to 9.9%, revenue growth is projected at 21.1% annually, surpassing the market's average of 14%. Recent product launches and expansions into new markets highlight Roborock's commitment to innovation and potential for future growth despite current low return on equity forecasts.

- Our growth report here indicates Beijing Roborock Technology may be poised for an improving outlook.

- Dive into the specifics of Beijing Roborock Technology here with our thorough financial health report.

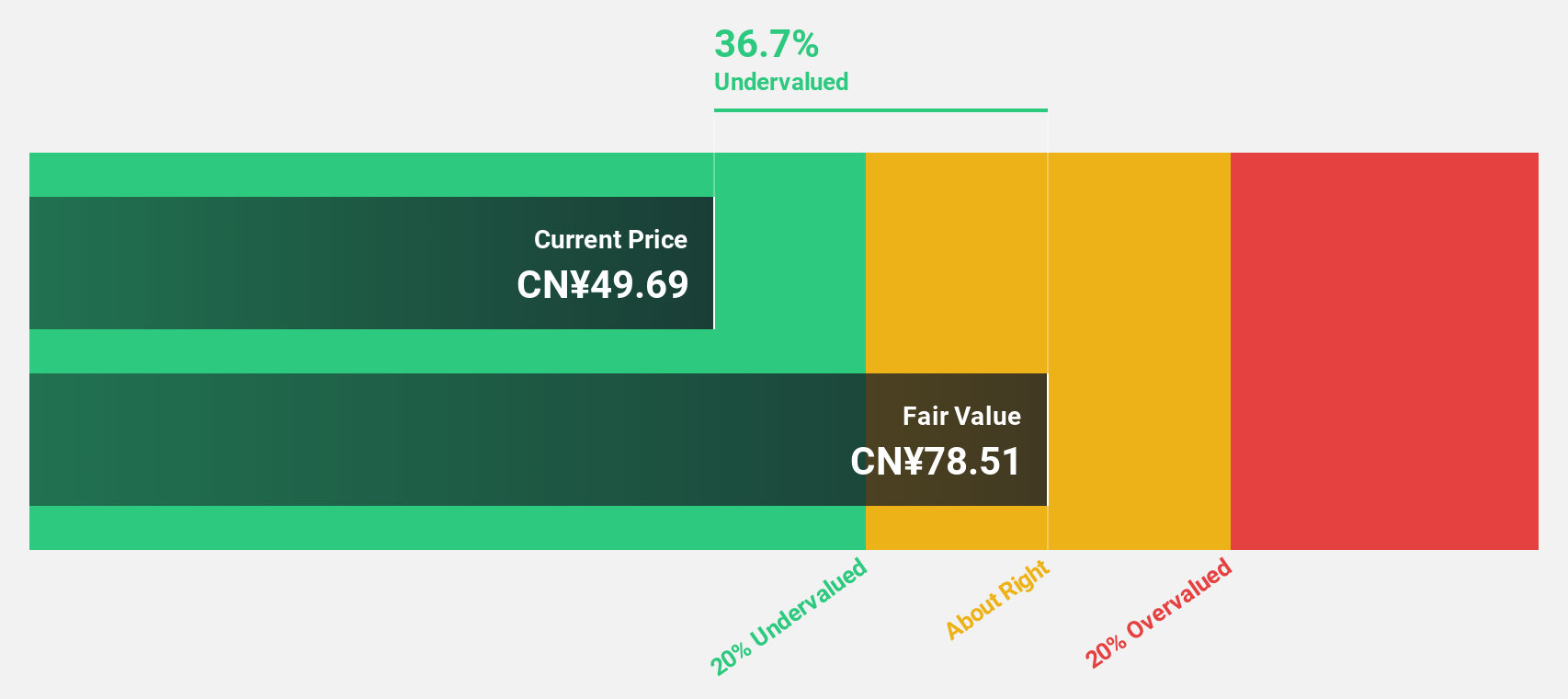

Shenzhen Newway Photomask Making (SHSE:688401)

Overview: Shenzhen Newway Photomask Making Co., Ltd is a lithography company involved in the design, development, and production of mask products in China with a market cap of CN¥8.06 billion.

Operations: The company's revenue is primarily derived from its Electronic Components & Parts segment, amounting to CN¥1.02 billion.

Estimated Discount To Fair Value: 43.2%

Shenzhen Newway Photomask Making is trading at CN¥44.81, well below its estimated fair value of CN¥78.86, demonstrating significant undervaluation based on cash flows. Recent earnings show revenue growth to CNY 544.03 million and net income increase to CNY 106.43 million for H1 2025, reflecting strong financial performance. With projected annual earnings growth of 33.9%, surpassing the market average, and robust revenue forecasts, the stock presents a compelling opportunity despite potential risks inherent in rapid expansion.

- The growth report we've compiled suggests that Shenzhen Newway Photomask Making's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Shenzhen Newway Photomask Making.

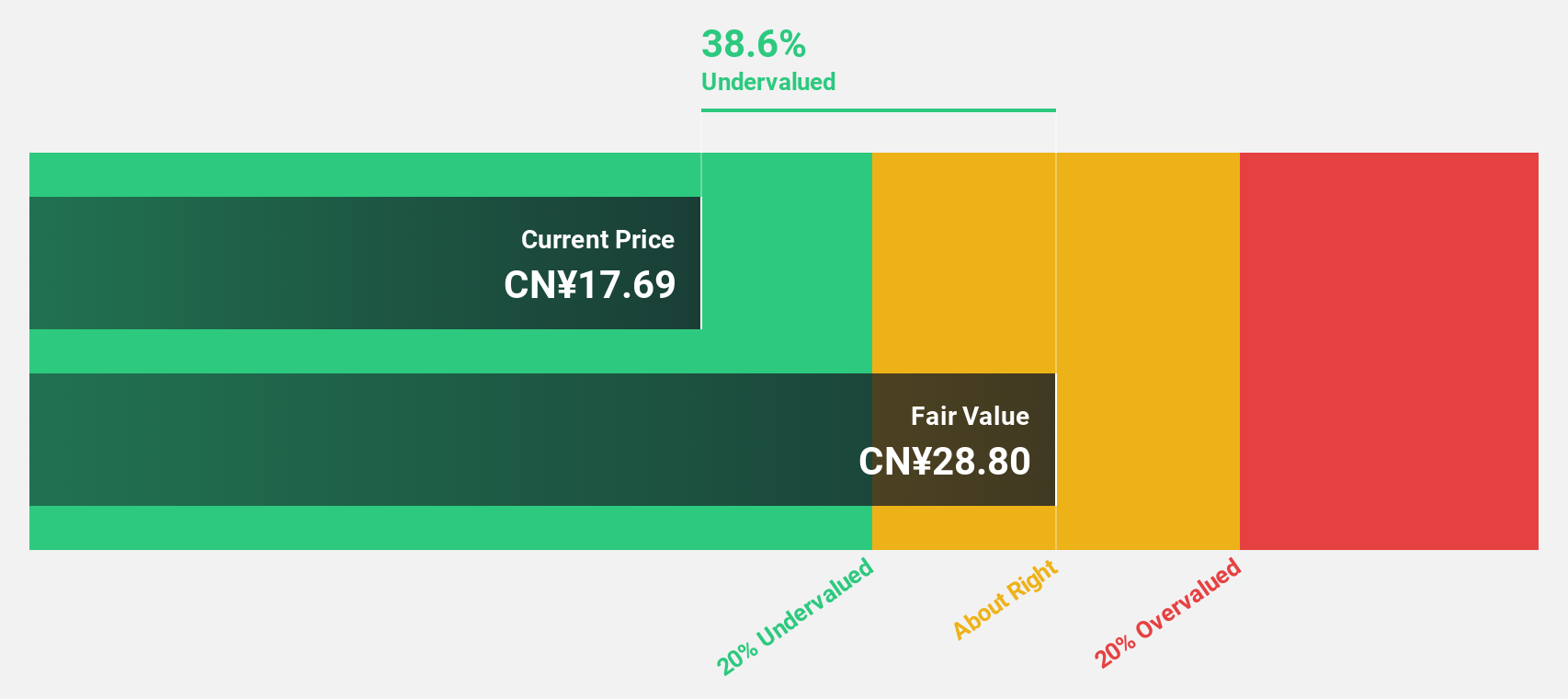

Farasis Energy (Gan Zhou) (SHSE:688567)

Overview: Farasis Energy (Gan Zhou) Co., Ltd. manufactures and sells lithium-ion pouch batteries and has a market cap of CN¥24.12 billion.

Operations: Farasis Energy (Gan Zhou) Co., Ltd. generates revenue primarily from the manufacturing and sale of lithium-ion pouch batteries.

Estimated Discount To Fair Value: 33%

Farasis Energy (Gan Zhou) is trading at CN¥20.9, significantly below its estimated fair value of CN¥31.2, indicating undervaluation based on cash flows. Despite reporting a decrease in H1 2025 revenue to CNY 4.35 billion and a net loss of CNY 161.96 million, the company is forecast to achieve profitability within three years with projected annual profit growth surpassing market averages and strong revenue growth expectations at 27.9% per year.

- Our earnings growth report unveils the potential for significant increases in Farasis Energy (Gan Zhou)'s future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Farasis Energy (Gan Zhou).

Seize The Opportunity

- Click this link to deep-dive into the 520 companies within our Undervalued Global Stocks Based On Cash Flows screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688567

Farasis Energy (Gan Zhou)

Manufactures and sells lithium-ion pouch batteries.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives